AIG vs. North American Life Insurance in 2025 (Find Out Who’s Cheaper)

AIG and North American life insurance offer policies with monthly term coverage starting at $20 and $18, respectively. AIG vs. North American life insurance shows that AIG’s universal life plans provide cash value growth, while North American’s final expense policies lock in fixed rates.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Jan 29, 2025

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 29, 2025

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

0 reviews

0 reviewsCompany Facts

Term Policy

A.M. Best Rating

Complaint Level

0 reviews

0 reviewsAIG vs. North American life insurance displays different program offerings for satisfying diverse coverage necessities.

AIG offers different forms of life insurance, such as term, whole, and universal. It also gives annuities and services related to retirement. This wide range makes the product flexible for all kinds of financial objectives.

In comparison, North American has its concentration on total life insurance and policies for final expenses which focus is mainly on steady growth over a longer duration. Get started by comparing top providers’ term life insurance quotes.

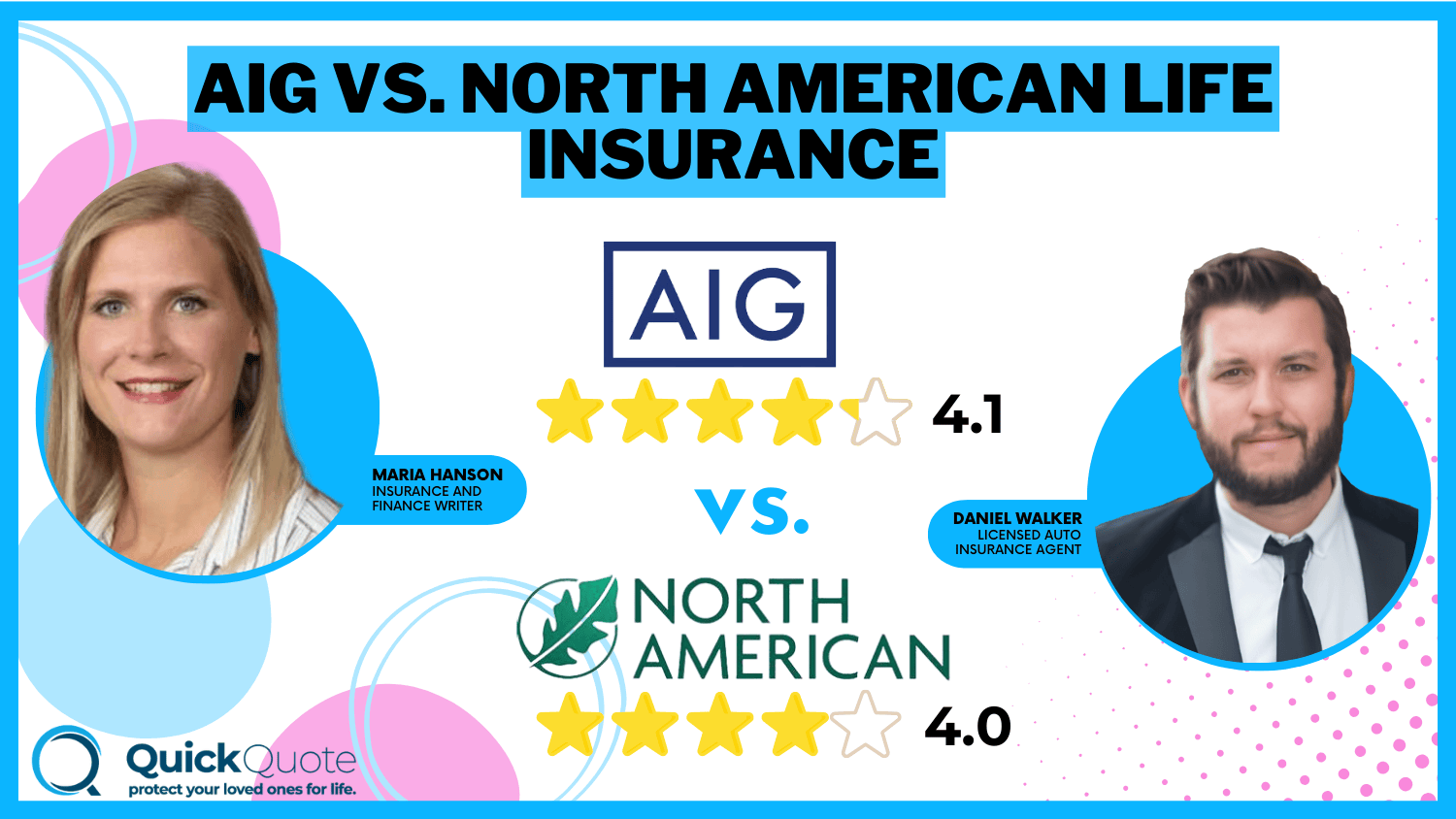

AIG vs. North American Life Insurance Rating

| Rating Criteria |  | |

|---|---|---|

| Overall Score | 4.1 | 4.0 |

| Business Reviews | 4.0 | 4.2 |

| Claim Processing | 3.9 | 4.1 |

| Company Reputation | 4.3 | 4.4 |

| Coverage Availability | 4.2 | 4.0 |

| Coverage Value | 4.1 | 4.3 |

| Customer Satisfaction | 3.8 | 4.0 |

| Digital Experience | 4.0 | 3.5 |

| Discounts Available | 3.5 | 3.7 |

| Insurance Cost | 3.9 | 4.0 |

| Plan Personalization | 4.2 | 4.1 |

| Policy Options | 4.3 | 4.5 |

| Savings Potential | 4.0 | 4.1 |

| AIG Review | North America Review |

The piece discusses how these firms vary in their range of products, monetary ratings, and customer satisfaction. It compares their advantages for you to discover the supplier that meets your particular insurance requirements. Enter your ZIP code now to see life insurance quotes from multiple companies near you.

- AIG and North American rates start at $20 and $18 monthly

- AIG offers term, universal, and whole life insurance options

- North American focuses on whole life and final expense coverage

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Comparing AIG vs. North American Monthly Life Insurance Rates

This table makes a comparison of the monthly rates for term and whole-life policies from AIG, North American, and other top companies. It brings attention to differences in affordability so that you can find out which company has the most cost-effective option for your needed coverage.

AIG vs. North American Monthly Life Insurance Rates by Coverage Type and Provider

| Insurance Company | Term Policy | Whole Policy |

|---|---|---|

| $20 | $25 |

| $18 | $28 | |

| $18 | $30 | |

| $17 | $27 | |

| $19 | $29 |

AIG’s life insurance cost for term insurance is $20 every month. This rate is a little bit more expensive compared to North American and American National which both charge $18 monthly.

On the other hand, when it comes to whole policy costs, North American has the most expensive price at $30 per month whereas AIG offers a lower one with only $25 per month.

Pacific Life gives the cheapest rates for term policies at $17 and a medium price of $27 for complete policies. These variations show how the kind of coverage and its supplier affect cost, assisting you to choose the most economical choice that suits your requirements.

The table below shows the monthly charges for entire life policies provided by AIG and North America across varied ages and genders. By placing rates next to each other, you can notice how age and gender influence premium prices. for every supplier.

AIG vs. North American Life Whole Policy Life Insurance Monthly Rates by Age & Gender

| Age & Gender |  | |

|---|---|---|

| Age: 16 Female | $65 | $70 |

| Age: 16 Male | $70 | $75 |

| Age: 30 Female | $90 | $95 |

| Age: 30 Male | $95 | $105 |

| Age: 45 Female | $120 | $130 |

| Age: 45 Male | $130 | $145 |

| Age: 60 Female | $200 | $210 |

| Age: 60 Male | $220 | $235 |

From the table, we can see that AIG is providing a bit less cost for many categories. The tiniest difference is seen in young women ($65 from AIG compared to $70 from North American at 16 years of age).

With an increase in age, this gap becomes larger and it’s especially noticeable for men where AIG continues with cheaper premiums.

For instance, a 60-year-old man pays $220 with AIG while he would pay $235 with North American. These differences underline the significance of comparing rates that are based on your demographic to find the best bargain.

Discover more by reading our guide: Calculate Your Term Life Insurance Needs

AIG vs. North American Ratings and Review Comparisons

This table compiles the business ratings and customer feedback for AIG and North American. It gives an overview of satisfaction, financial stability, and amount of complaints. The chart underscores the performance of each provider in important industry measurements to assist consumers in making well-informed decisions.

Insurance Business Ratings & Consumer Reviews: AIG vs. North American

| Agency |  | |

|---|---|---|

| Score: 835 / 1,000 Avg. Satisfaction | Score: 750 / 1,000 Avg. Satisfaction |

|

| Score: A Good Business Practices | Score: B+ Good Business Practices |

|

| Score: 77/100 Good Customer Feedback | Score: 70/100 Good Customer Service |

|

| Score: 0.98 Avg. Complaints | Score: 1.1 Avg. Complaints |

|

| Score: A Excellent Financial Stability | Score: A Excellent Financial Stability |

AIG achieves 835 out of 1,000 in J.D. Power rankings, showing higher satisfaction when compared to North American’s score of 750 out of 1,000. Consumer Reports also rates AIG slightly better at 77 out of a hundred when compared to North American’s rating which is 70 over hundred – this highlights more positive customer response.

Consumers may find better complaint resolution with North American, but AIG scores higher in customer satisfaction.Jimmy McMillan Licensed Life Insurance Agent

Despite this, the complaint ratio for North American is smaller (0.98) in comparison to AIG’s average of 1.1, which indicates that they resolve issues better. Both organizations keep strong financial ratings with an A grade from A.M. Best and assure dependability for individuals who hold their policies.

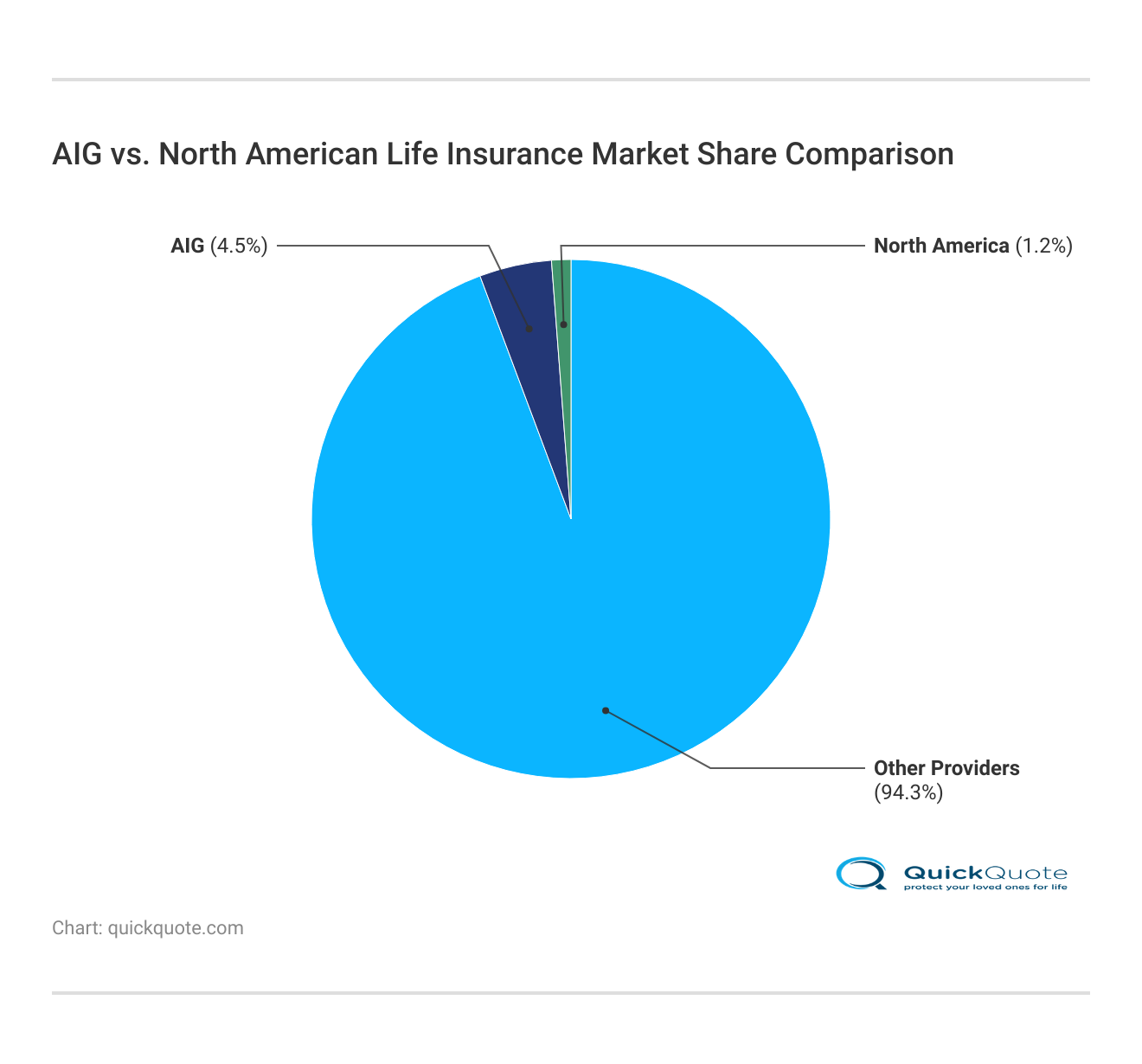

AIG has a noticeable 4.5% share in the life insurance market, this points to its solid hold when compared with North America’s smaller share of 1.2%. Most part of the market, which is about 94.3%, includes other providers and it shows there is strong competition and diverse choices for customers.

Though North American has a lesser portion of the market, it concentrates on specific offerings and attracts particular groups. AIG’s bigger share shows that its product variety is wider and indicates its established name in this field.

Comment

byu/Away-Bus-377 from discussion

inLifeInsurance

One user on Reddit has highlighted the advantages of North American Life Insurance and pointed out benefits beyond just living benefits. They expressed that while price is important, if there is less than a $10 difference monthly, it favors choosing North American.

This comment shows how many consumers believe in the worthiness of policies from North American. This insight reinforces the significance of balancing expense with the quality of being covered.

Read more:

- AIG vs. Fidelity Life Insurance

- AIG vs. MassMutual Life Insurance

- AIG vs. Mutual of Omaha Life Insurance

- AIG vs. SBLI Life Insurance

- AIG vs. State Farm Life Insurance

Evaluating Life Insurance Options From AIG and North American

Choosing the correct life insurance supplier finally depends on your personal needs, budget, and what type of coverage you prefer.

AIG offers good, versatile policy options at rates that compete well in the market, making it attractive for people who look for adaptable solutions. Discover tips on how to buy term life insurance tailored to your needs.

On the other hand, North American emphasizes value over a longer period through whole life and final expense policies. By comparing rates, advantages, and monetary stability, you can determine which firm best fits your objectives for fiscal safety.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Understanding AIG Life Insurance

When evaluating AIG Insurance Company for your life insurance needs, you might consider their various offerings. AIG Life Insurance provides options such as AIG Direct Term Life Insurance, which includes the AIG term life insurance policy.

To determine if this policy suits you, review AIG term life insurance quotes and compare AIG term life insurance rates. Additionally, look into the AIG term life Insurance Rating and read AIG term life insurance reviews to gauge overall satisfaction.

For a more tailored assessment, get an AIG term life quote to see how term life insurance at AIG aligns with your requirements. To learn more, read our AIG life insurance review.

AIG term life insurance rates are known for being competitive and flexible, catering to various financial needs. For an accurate comparison and to find the best fit for your situation, explore AIG term life insurance rates and see how they stack up against other providers.

AIG term life insurance offers flexible policy terms and competitive rates, making it a solid option for those seeking affordable coverage. For a detailed assessment, check out our AIG term life insurance review, which highlights the benefits and features of AIG’s term life policies.

North American Life Insurance Insights

When considering North American Life Insurance Company, it’s crucial to review its overall reputation and offerings. North American Company rating is notable for its high marks, holding an A rating from A.M. Best and the Better Business Bureau, reflecting strong financial stability and customer satisfaction.

Check the North American Company for Life and Health Insurance rating and read the North American Company for Life and Health Insurance reviews for a comprehensive assessment. The North American Company Life Insurance review will provide detailed insights into their policies and services.

Additionally, look at North American Company ratings and North American Life Insurance Reviews to gauge customer satisfaction.

For more specific information, visit the North American Life Insurance Company website and explore North American Company reviews to make an informed decision. Compare policies using North American company life and health insurance reviews.

Frequently Asked Questions

How does AIG compare to North American?

AIG offers term, whole, and universal life policies, while North American focuses on whole life and final expense coverage. AIG’s term life rates start at $20/month, while North American offers similar term policies at $18/month. Learn how to calculate your life insurance age to find accurate policy rates.

What do AIG Direct life insurance reviews say?

AIG Direct life insurance reviews highlight its competitive monthly rates for term policies and ease of online application. Customers often praise the variety of coverage options but note that premiums may increase with age or additional riders.

How do AIG and Pacific Life compare?

AIG excels with flexible term, whole, and universal life policies, while Pacific Life is known for competitive term rates and strong retirement-focused products. Your choice depends on your coverage needs and budget.

What is the AIG life insurance rating?

AIG life insurance has an A rating from A.M. Best, reflecting strong financial stability and reliability. Its high ratings make it a trusted provider in the life insurance industry. Enter your ZIP code today for customized AIG vs. North American Life Insurance quotes.

How does Protective compare to AIG in terms of life insurance?

Protective life insurance offers lower monthly rates for term life insurance, while AIG provides more comprehensive options, including universal and annuities. Both are financially strong, but AIG’s product variety appeals to broader needs.

How much is AIG’s life insurance rate?

AIG life insurance quotes start at $20 per month for term life coverage, with whole-life policies beginning at around $25 per month. Rates vary based on age, gender, and policy type.

Is AIG a good life insurance company?

Is AIG Life Insurance reliable? AIG is a reputable life insurance company with strong financial ratings, diverse policy options, and competitive rates. It is well-suited for various financial goals and coverage needs.

Does AIG offer affordable life insurance?

Yes, AIG provides affordable life insurance, with term life policies starting at $20 monthly. The company also offers flexible payment options and coverage levels to suit different budgets.

What are the differences between AIG and Northwestern Mutual?

AIG provides affordable term life insurance starting at $20/month with flexible options. Northwestern Mutual emphasizes whole-life policies with cash value growth, suitable for long-term planning.

What do AIG’s whole life insurance reviews say?

AIG’s whole life insurance reviews highlight its guaranteed death benefits, cash value accumulation, and flexible premium options. However, some customers note higher costs compared to term-life policies.

Is American General Life Insurance the same as AIG?

Yes, American General Life Insurance is a subsidiary of AIG, providing similar life insurance products under the AIG umbrella.

How does AIG compare to Lincoln Life Insurance?

AIG stands out for its variety of term, whole, and universal life options, with rates starting at $20/month. Lincoln Life Insurance is known for competitive rates and robust retirement-focused products.

How does AIG differ from New York Life?

AIG excels with flexible term life insurance starting at $20/month, while New York Life is renowned for its whole life and financial planning services, catering to those seeking lifetime coverage.

What sets AIG apart from the National Life Group?

AIG offers a broader range of life insurance products, including term life at $20/month, whereas National Life Group specializes in indexed universal life and annuities for long-term growth. Explore AIG vs. North American Life Insurance rates using our free ZIP code comparison tool.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.