AIG vs. State Farm Life Insurance in 2025 [Side-by-Side Comparison]

AIG vs. State Farm life insurance rates reveal AIG starts at $53 a month, higher than State Farm's $33 monthly. Despite this, AIG provides financial stability and diverse riders, while State Farm excels in customer satisfaction, so it’s important to compare both to find the best fit.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Ty Stewart

Licensed Life Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Licensed Life Insurance Agent

UPDATED: Mar 26, 2025

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Mar 26, 2025

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

163 reviews

163 reviewsCompany Facts

Term Policy

A.M. Best Rating

Complaint Level

Pros & Cons

163 reviews

163 reviews 18,154 reviews

18,154 reviewsCompany Facts

Term Policy

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviewsWhen comparing life insurance options, AIG vs. State Farm life insurance often comes up as a top choice for their competitive term life insurance quotes and nationwide convenience for policyholders.

It’s hard to choose between companies like AIG and State Farm. We’ll help you decide by comparing their life insurance rates, financial strength ratings, customer satisfaction, and more.

AIG vs. State Farm Life Insurance Rating

| Rating Criteria |  | |

|---|---|---|

| Overall Score | 3.6 | 4.4 |

| Business Reviews | 4.0 | 5.0 |

| Claim Processing | 3.0 | 4.3 |

| Company Reputation | 4.0 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 3.5 | 4.2 |

| Customer Satisfaction | 4.1 | 4.1 |

| Digital Experience | 4.0 | 4.5 |

| Discounts Available | 3.1 | 5.0 |

| Insurance Cost | 2.6 | 4.0 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 4.5 | 3.8 |

| Savings Potential | 2.8 | 4.3 |

| AIG | State Farm |

Before you rush to find AIG vs. State Farm life insurance quotes, you’ll want to see what other companies have to offer.

Get instant life insurance quotes from top providers using our free quote tool.

- State Farm offers lower rates at $33 a month vs. AIG’s $53 a month

- State Farm outshines AIG in financial strength

- AIG ranks lower than State Farm for customer satisfaction

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

AIG vs. State Farm Term Life Insurance Rate Comparison

Life insurance can sometimes seem like an inconvenient expense. Unlike products like AIG or State Farm auto insurance, life insurance is typically only used once.

AIG vs. State Farm Whole Life Insurance Monthly Rates by Age & Gender

| Age & Gender |  | |

|---|---|---|

| Age: 16 Female | $60 | $75 |

| Age: 16 Male | $70 | $85 |

| Age: 30 Female | $80 | $90 |

| Age: 30 Male | $100 | $110 |

| Age: 45 Female | $150 | $165 |

| Age: 45 Male | $175 | $190 |

| Age: 60 Female | $225 | $250 |

| Age: 60 Male | $300 | $325 |

This means that you might pay premiums for many years before you ever have a claim in which the insurance company pays your death benefit. In reality, you’re simply paying on behalf of your beneficiaries, so you don’t want to pay too much for life insurance.

AIG 20-Year Term Life Insurance Rates by Age, Gender, and Coverage Amount

| Gender and Coverage | Age: 16 | Age: 35 | Age: 45 | Age: 55 |

|---|---|---|---|---|

| $100,000: 20-Year Term (Male) | $11 | $11 | $18 | $37 |

| $100,000: 20-Year Term (Female) | $11 | $11 | $14 | $27 |

| $250,000: 20-Year Term (Male) | $13 | $14 | $28 | $70 |

| $250,000: 20-Year Term (Female) | $11 | $13 | $23 | $53 |

| $500,000: 20-Year Term (Male) | $20 | $21 | $49 | $125 |

| $500,000: 20-Year Term (Female) | $17 | $18 | $38 | $91 |

AIG life insurance rates are competitive with most industry providers. Starting at around $10 per month, these rates are affordable and, in many cases, cheaper than AIG’s competitors. How much does State Farm life insurance cost per month?

State Farm Average Life Insurance Monthly Rates by Age, Gender, and Policy Amount (LIFE)

| Age & Gender | $100,000 | $250,000 | $500,000 |

|---|---|---|---|

| 25-Year-Old Male | $12 | $18 | $30 |

| 25-Year-Old Female | $10 | $15 | $25 |

| 35-Year-Old Male | $15 | $22 | $37 |

| 35-Year-Old Female | $13 | $19 | $32 |

| 45-Year-Old Male | $23 | $35 | $65 |

| 45-Year-Old Female | $20 | $30 | $55 |

| 55-Year-Old Male | $43 | $80 | $150 |

| 55-Year-Old Female | $35 | $60 | $110 |

State Farm’s life insurance rates start a bit higher than AIG’s. Even the cheapest life insurance policy starts a few dollars higher with State Farm. While this might not seem like much, it can add up over time.

Comparison of AIG vs. State Farm $250,000 Life Insurance Monthly Rates by Age, Gender, and Term Length

| Age and Gender | 10-Year-Term (AIG) | 10-Year-Term (State Farm) | 20-Year-Term (AIG) | 20-Year-Term (State Farm) | 30-Year Term-(AIG) | 30-Year Term-(State Farm) |

|---|---|---|---|---|---|---|

| 25-Year-Old Male | $13 | $15 | $13 | $15 | $19 | $19 |

| 25-Year-Old Female | $11 | $15 | $11 | $15 | $15 | $19 |

| 35-Year-Old Male | $14 | $18 | $14 | $18 | $21 | $26 |

| 35-Year-Old Female | $13 | $15 | $13 | $15 | $19 | $22 |

| 45-Year-Old Male | $28 | $27 | $28 | $27 | $46 | $45 |

| 45-Year-Old Female | $23 | $23 | $23 | $23 | $39 | $37 |

| 55-Year-Old Male | $70 | $51 | $70 | $51 | $132 | $106 |

| 55-Year-Old Female | $53 | $38 | $53 | $38 | $108 | $79 |

When comparing the AIG vs. State Farm life insurance rates, you’ll notice that AIG is significantly cheaper for life insurance. AIG insurance is often about half the price of a State Farm insurance quote. You can find more details about this in our AIG life insurance review.

AIG vs. State Farm: A Comparison of Customer Reviews

When comparing AIG and State Farm, customer reviews provide valuable insights into the experiences policyholders have had with both companies.

For AIG, one user shared a frustrating experience with their 30-year term policy lapsing due to system and payment issues:

In contrast, State Farm has received positive feedback for its customer service and efficient claims handling. One user highlighted how State Farm processed a death claim within just two days of receiving the necessary documents—a process other companies reportedly took months to complete. See our guide on how to file a life insurance claim for more details.

These contrasting reviews show that while AIG may struggle with technical and service issues, State Farm excels in providing fast and reliable support, competitive pricing, and flexible policy options.

AIG vs. State Farm: Life Insurance Coverage Options

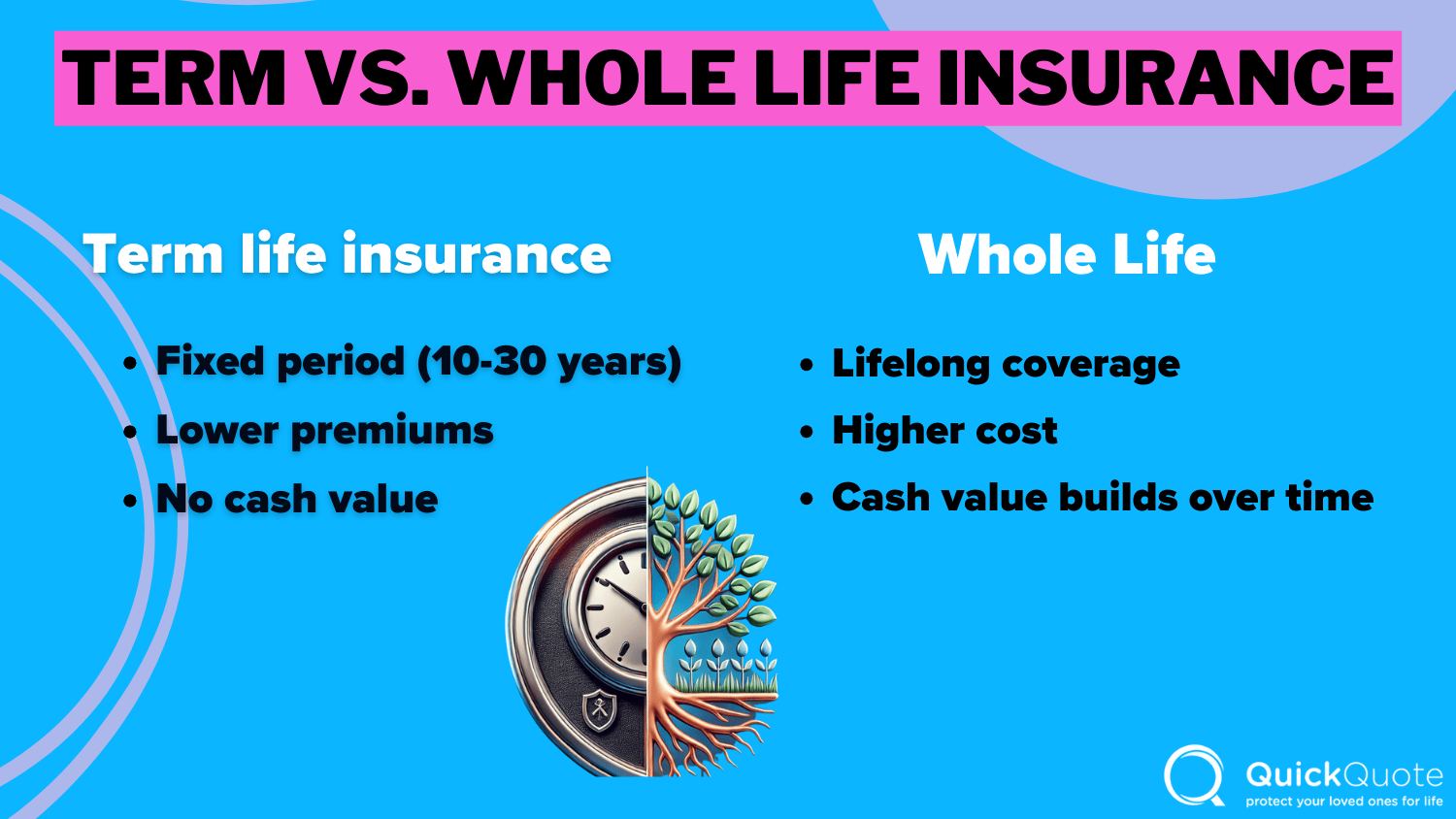

When shopping for life insurance, it’s important to understand the types of life insurance available from companies like AIG and State Farm.

AIG vs. State Farm Life Insurance: Coverage Options Compared

| Type of Life Insurance |  | |

|---|---|---|

| Term | ✅ | ✅ |

| Whole | ✅ | ✅ |

| Universal | ✅ | ✅ |

| Indexed | ✅ | ❌ |

| Variable | ✅ | ❌ |

| Final Expense | ✅ | ✅ |

| Group | ✅ | ✅ |

| No Medical Exam | ✅ | ❌ |

| Accidental Death & Dismemberment (AD&D) | ✅ | ✅ |

| Guaranteed Issue | ✅ | ❌ |

Both brands are well-established, but they each have different strengths regarding the types of policies they provide. Here’s a closer look at what each company offers:

AIG Life Insurance Coverage Options

AIG offers various life insurance products designed to fit your financial goals and life stage. Here’s a look at the main options you can choose from:

- Guaranteed Issue Whole Life Insurance: Available for ages 50–80 with no medical exam. Coverage ranges from $10,000 to $25,000, ideal for final expenses like funeral costs.

- Universal Life Insurance: Options like Secure Lifetime GUL 3 provide guaranteed premiums, while Value+ Protector ties cash value growth to market indices.

- Term Life Insurance: Flexible terms from 10 to 30 years, with premiums starting at $10 per month. The Select-a-Term option allows you to tailor coverage for specific goals like mortgage payments or education savings.

- Accidental Death & Dismemberment Insurance (AD&D): Designed for unexpected events, offering payouts up to $500,000 for accidental death or partial payouts for severe injuries like loss of a limb.

AIG’s life insurance offerings provide flexibility and affordability, making them a strong choice for diverse coverage needs.

State Farm Life Insurance Coverage Options

State Farm focuses on simple, user-friendly policies emphasizing customer service. Here are the key life insurance options offered by State Farm:

- Term Life Insurance: Available in 10-, 20-, and 30-year terms, with conversion options for permanent coverage. Features include a Return of Premium Term Life plan that refunds premiums if the policyholder outlives the term (Read More: Types of Term Life Insurance).

- Whole Life Insurance: Offers lifetime coverage with guaranteed cash value growth. Limited Pay Whole Life allows premiums to be fully paid in 10, 15, or 20 years.

- Universal Life Insurance: Provides flexible premiums and death benefits, ideal for those needing adaptable coverage.

- Final Expense Insurance: Up to $10,000 coverage for funeral costs, starting at $20 per month.

State Farm’s policies are ideal if you want flexible coverage with options to adjust as your needs change.

Their Return of Premium Term Life policy is especially appealing if you’d like a refund on premiums after your term ends.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

AIG vs. State Farm Discounts and Riders

So far, we’ve noted that State Farm offers cheaper life insurance rates, while AIG stands out for its financial strength and broader policy customization options. The final step is to see if either company offers any additional benefits that could help you as a policyholder.

Life insurance discounts aren’t as common as those for other types of insurance, but both AIG and State Farm provide ways to save. AIG offers savings through multi-policy bundling, while State Farm provides similar discounts for policyholders with multiple types of coverage.

Both AIG and State Farm also have standard life insurance riders that could help make your life insurance policy more flexible. Each company offers:

- Waiver of Premium Life Insurance Rider

- Children’s Term Rider

- Select Term Riders

These are just a few common life insurance riders you’ll find with AIG and State Farm.

AIG vs. State Farm Business Ratings

Unsurprisingly, most customers will start looking for affordable AIG vs. State Farm life insurance rates before looking into other details about each company. The cost of life insurance premiums is important for most people.

Don’t forget that cheap life insurance isn’t the only important factor to consider when you look to buy AIG vs. State Farm life insurance. You also want to evaluate ratings, customer reviews, and policy details or discounts. State Farm insurance rating?

Insurance Business Ratings & Consumer Reviews: AIG vs. State Farm

| Agency |  | |

|---|---|---|

| Score: 835 / 1,000 Avg. Satisfaction | Score: 710 / 1,000 Above Avg. Satisfaction |

|

| Score: A Good Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 77/100 Good Customer Feedback | Score: 75/100 Positive Customer Feedback |

|

| Score: 0.98 Fewer Complaints Than Avg. | Score: 0.78 Fewer Complaints Than Avg. |

|

| Score: A Excellent Financial Strength | Score: B Fair Financial Strength |

AIG is stronger in terms of financial stability and business practices. Its “A” rating from A.M. Best reflects excellent financial strength, reassuring policyholders that the company can pay out claims. Plus, State Farm life insurance reviews from BBB show an “A” rating, which means it has strong business ethics and reliable practices.

State Farm, however, doesn’t do as well in some of these areas. It has a “B” rating from A.M. Best, meaning its financial strength is okay but not great. But its A+ rating from the BBB shows it runs a trustworthy business and keeps customers happy, putting it on par with AIG in this area.

State Farm also excels in customer satisfaction. With a J.D. Power score of 710/1,000, it outperforms AIG’s score of 835/1,000, reflecting more positive customer experiences. That said, State Farm has a higher complaint ratio (0.78) with the NAIC, suggesting more reported complaints relative to its market share than AIG’s average score of 0.98.

State Farm commands a bigger slice of the market at 8.30%, while AIG trails with 2.5%. This broader coverage shows how State Farm reaches more clients because of its high customer approval scores and vast network of agents.

AIG, though smaller, stands out for its financial strength and reliable business practices. Its focus seems to be on offering stability and trust, even without the broad reach of State Farm. For customers, this means choosing between scale and accessibility with State Farm or financial security with AIG.

AIG vs. State Farm: Other Insurance Products

AIG and State Farm aren’t just big names in life insurance; they offer other coverage options too. AIG has policies for travel, health, investments, and even retirement (Read More: Life Insurance Retirement Plans). State Farm, on the other hand, covers home, auto, business, and disability insurance.

Both companies have a long history and plenty of options to fit different coverage needs. But when it comes to life insurance, which one is better? Next, we’ll go over the pros and cons of each to help you decide which one suits you best.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

AIG Pros and Cons

Choosing the right life insurance is important (Read More: How to Buy Life Insurance). You’ll want affordable rates but good protection so you know that your beneficiaries will be covered when the time comes.

Pros

- Strong Financial Stability: A.M. Best gives AIG an A rating, ensuring solid financial backing for its policyholders.

- BBB Rating: AIG holds an A rating from the Better Business Bureau (BBB), reflecting good business practices and reliable service.

- Variety of Riders: AIG provides different add-ons (called riders) for life insurance, so you can adjust your policy to fit your personal needs.

Cons

- Pricier Plans: AIG costs more than some other companies. Their plans start at around $53 a month, while State Farm, for example, starts at $33 a month.

- Customer Service Issues: Some users have experienced delays and challenges with claims processing.

If personalized service is important to you, AIG’s range of riders and financial strength could be a good fit.

State Farm Pros and Cons

Is life insurance with State Farm worth it? Let’s go over the pros and cons so you can see if it’s the right fit for you.

Pros

- Cheaper Rates: State Farm’s life insurance starts at $33 a month, which is more affordable compared to AIG’s $53 per month.

- Wider Agent Network: State Farm has agents across the U.S. who provide personalized support and services.

- Top Customer Satisfaction: State Farm ranks higher than AIG in customer satisfaction. Find out what customers have to say in our State Farm life insurance review.

Cons

- Limited Premium Options: While State Farm’s rates are competitive, some policies might start a bit higher compared to other providers like AIG.

- Fewer Rider Options: State Farm provides fewer rider options than AIG.

State Farm offers a good balance of affordability and personalized support for life insurance.

AIG vs. State Farm Life Insurance: Choose Your Provider Now

Our AIG vs. State Farm life insurance review highlights why these popular companies have earned their strong reputations.

We’re honored! State Farm has been ranked #1 in Customer Satisfaction among Life Insurance Providers 3 years in a row and Best in Product Offerings by J.D. Power. Call your agent or click to get a quote today. https://t.co/qWy8GXkArU pic.twitter.com/ug4MT7a43r

— State Farm (@StateFarm) January 16, 2023

While AIG offers a variety of policy options and riders, its plans are pricier, starting at $53 per month compared to State Farm’s more affordable $33 per month. State Farm also excels in customer satisfaction, making it a top choice for many.

Price is important, but don’t forget to look at the company’s financial strength, how they handle claims, and their customer service. That’s what makes a good provider.Chris Abrams Licensed Life Insurance Agent

Still having trouble deciding if AIG vs. State Farm life insurance is right for you? Get personalized quotes from other top companies in just a few clicks using our free quote tool below (Read More: How To Get Life Insurance Quotes Without Sharing Personal Information).

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Frequently Asked Questions

What insurance products does AIG offer?

AIG offers life insurance, auto insurance, home insurance, and more.

Does State Farm offer life insurance?

Does State Farm have life insurance? Yes, it offers a variety of options to meet different needs and preferences.

What is a State Farm life insurance policy?

A State Farm life insurance policy provides various options, including term, whole, and universal life insurance. These policies are designed to offer financial security for your loved ones, with coverage that can fit different needs and budgets. Whether you’re looking for affordable short-term protection or lifetime coverage with cash value, State Farm has a range of policies to choose from. See our article, “Whole Life Insurance vs. Universal Life Insurance,” to learn how they differ.

What insurance products does State Farm offer?

State Farm offers life insurance, auto insurance, home insurance, and more.

Which company has cheaper term life insurance, AIG or State Farm?

AIG generally has cheaper rates for term life insurance than State Farm.

Which company has better ratings, AIG or State Farm?

State Farm has stronger ratings for financial strength and customer satisfaction compared to AIG.

What are AIG’s term life insurance rates?

AIG’s term life insurance rates start at $15 per month for healthy, young applicants seeking low coverage. For older applicants or those requiring higher coverage, rates may exceed $40 per month. AIG’s term life insurance provides flexible and affordable protection for most budgets. Compare life insurance rates by age and gender.

What discounts and riders are offered by AIG and State Farm?

AIG and State Farm offer standard life insurance riders. Contact their agents for more details.

Can I manage my AIG insurance policy online?

Yes, AIG offers online policy management through its website and mobile app. These platforms allow customers to pay premiums, view coverage details, and file claims. Managing an AIG insurance policy online is convenient and accessible for tech-savvy users.

What are the benefits of term life insurance with State Farm?

Term life insurance with State Farm provides affordable coverage for a set period, such as 10, 20, or 30 years. It’s an excellent option for those who need protection during critical life stages, like paying off a mortgage or raising a family.

Are AIG’s whole life insurance rates competitive?

AIG’s whole life insurance rates are higher than those of term policies because they provide lifetime coverage and cash value growth. For instance, while term life insurance with AIG may start at $20–$30 per month, whole life policies often exceed $100 monthly, depending on age and coverage (Read More: Cheapest Life Insurance Companies).

Does State Farm offer life insurance without a medical exam?

If you are wondering if you can get State Farm life insurance with no medical exam. The answer is yes. State Farm’s Instant Answers policy provides up to $50,000 in term life coverage for applicants under 50 or for at least 10 years, whichever lasts longer.

You can get approved in minutes at a State Farm office, but approval is based on your answers to health questions in the application and other eligibility factors. You don’t need a physical exam.

Is State Farm Life Insurance Company reliable?

You may wonder, “Is State Farm life insurance good?” State Farm ratings from A.M. Best and J.D. Power are pretty strong, which means it’s financially stable and trustworthy. A lot of people rely on State Farm for life insurance because of its great reputation and good customer service.

How do I get a life insurance quote from State Farm visiting a physical office?

You don’t have to visit a physical office to get a quote from State Farm. Just head to their website or reach out to a local agent to check out your options. They have online tools that make it easy to compare term and whole life policies. If you already have a policy, you can use the State Farm life insurance policy lookup to check your coverage details.

How does State Farm compare to Nationwide for life insurance?

Both companies offer competitive life insurance options in the State Farm vs Nationwide comparison, but their strengths differ. State Farm life insurance policies are often more affordable, with rates starting at $33 per month, while Nationwide provides additional flexibility in customizing coverage with riders. Learn more about Nationwide in our Nationwide life insurance review.

How does the State Farm whole life insurance calculator work?

The State Farm whole life insurance calculator is a handy tool to help you figure out how much coverage you might need. You just fill in details like your total debt, how many years of income you want to replace, estimated final expenses, and any future education costs. The calculator then gives you a rough estimate of your coverage amount. Just keep in mind that it’s just an estimate and not a guarantee of coverage. For a more accurate quote, it’s best to speak with a State Farm agent.

What is AIG direct life insurance?

AIG Direct is the company’s platform for purchasing life insurance directly, offering convenience and flexibility. With AIG Direct life insurance quotes, customers can easily compare prices and coverage options online or by phone. It’s especially useful for those seeking AIG Direct term life insurance, which provides customizable coverage lengths and competitive rates. This streamlined service removes the need for an agent, making it ideal for people who prefer a quicker, more independent purchasing process.

How can I get State Farm quotes for life insurance?

Many people ask, “Can I get a quick quote for life insurance with State Farm?” The answer is yes. You can easily get State Farm quotes for life insurance online through their website, by contacting a local agent, or by using their mobile app. These quotes are personalized based on factors like age, your job, health, and the type of policy you’re considering, such as term, whole, or universal life insurance.

Read More: Does your job affect your life insurance?

Comparing quotes helps you find a policy that fits your budget and coverage needs. Enter your ZIP code into our free quote comparison tool to get started.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Ty Stewart

Licensed Life Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Licensed Life Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.