Best Life Insurance for Children in 2025 (Your Guide to the Top 10 Companies)

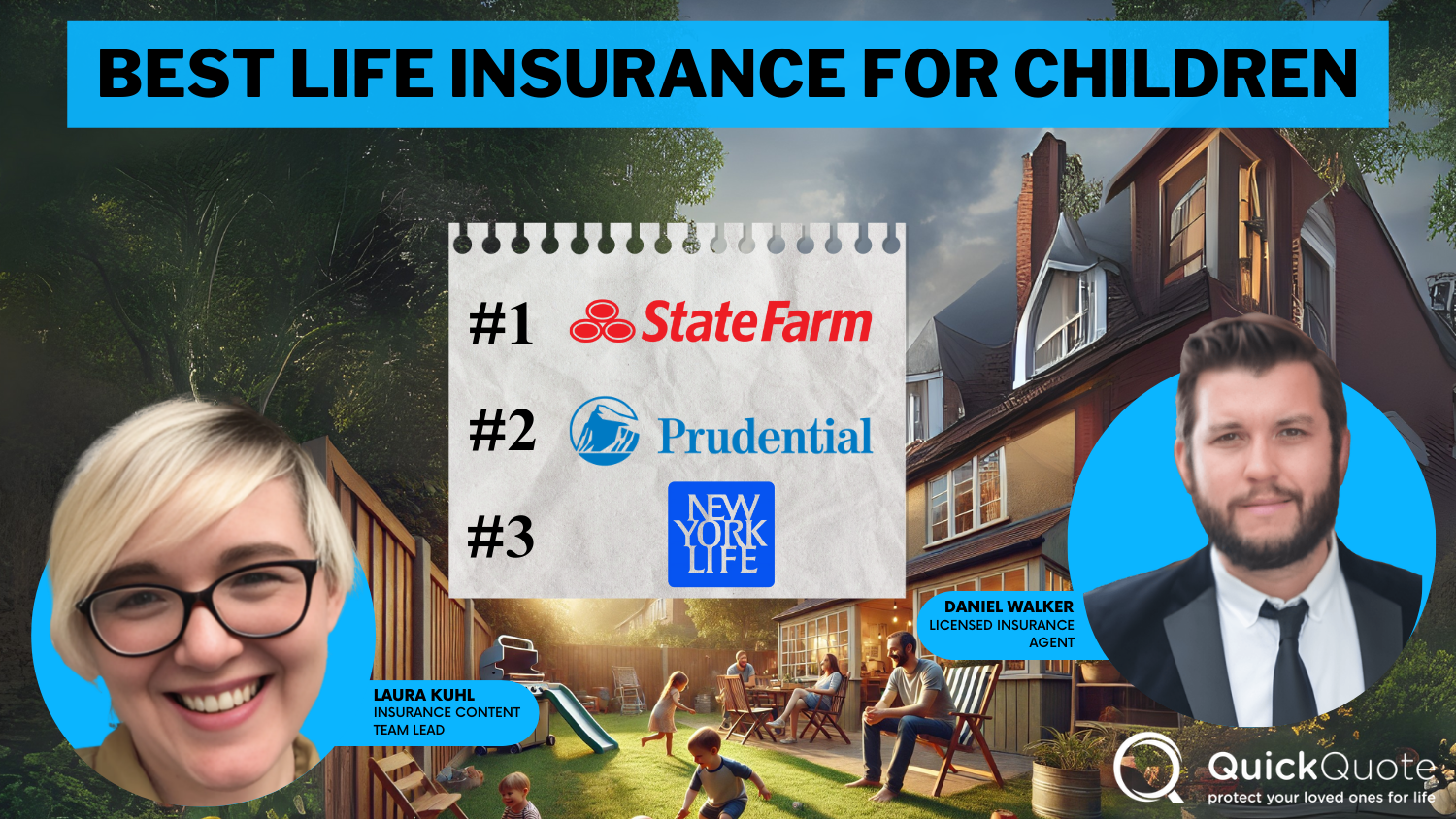

Explore State Farm, Prudential, and New York Life, the top providers of the best life insurance for children, with rates beginning at just $5 a month. These companies are distinguished by their comprehensive coverage options and exceptional customer service, ensuring excellent protection for your children.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Life Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Licensed Life Insurance Agent

UPDATED: Mar 24, 2025

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Mar 24, 2025

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Children

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 0 reviews

0 reviewsCompany Facts

Full Coverage for Children

A.M. Best Rating

Complaint Level

0 reviews

0 reviews 0 reviews

0 reviewsCompany Facts

Full Coverage for Children

A.M. Best Rating

Complaint Level

0 reviews

0 reviews

The best life insurance for children is offered by State Farm, Prudential, and New York Life, known for their reliability and comprehensive policies.

These providers excel not just in affordability but also in offering robust coverage that can grow with your child into adulthood. Learn more on how to buy life insurance.

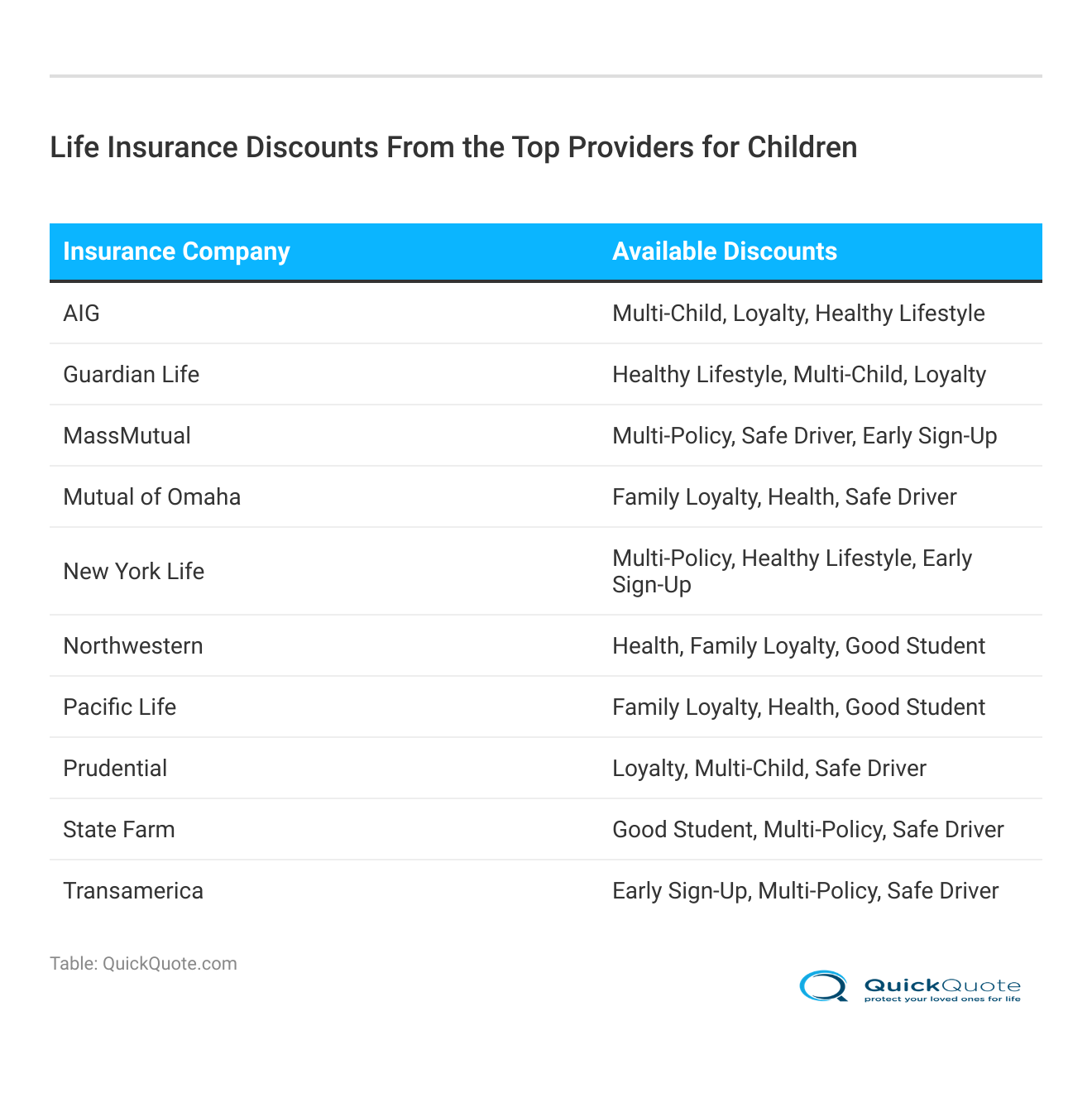

Our Top 10 Company Picks: Best Life Insurance for Children

Company Rank Sign Up Discount Multi-Child Discount Best For Jump to Pros/Cons

#1 10% 5% Trusted Provider State Farm

#2 12% 8% Strong Benefits Prudential

#3 11% 6% Excellent Plan New York Life

#4 15% 10% Custom Coverage Mutual of Omaha

#5 10% 5% Comprehensive Plans Guardian Life

#6 14% 7% High Ratings Northwestern

#7 13% 9% Financial Strength MassMutual

#8 10% 5% Broad Coverage AIG

#9 9% 6% Affordable Rates Transamerica

#10 12% 8% Reliable Coverage Pacific Life

Parents considering such policies should evaluate their long-term financial goals and the potential benefits of securing a policy early in their child’s life. Choosing the right insurance plan can provide peace of mind, ensuring financial support for unforeseen circumstances.

Looking for lower life insurance rates? Enter your ZIP code into our free quote comparison tool today and find the cheapest providers near you.

- State Farm is the top pick for children’s life insurance

- Policies adapt to your child’s changing needs

- Coverage includes educational and health benefits

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Bundling Policies: Significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: Substantial discount for low-mileage usage.

- Wide Coverage: Various coverage options tailored for different needs. Unlock details in our State Farm life insurance review.

Cons

- Limited Multi-Policy Discount: Lower than some competitors.

- Premium Costs: This may be higher for certain coverage levels despite discounts.

#2 – Prudential: Best for Strong Benefits

Pros

- Higher Sign-Up Discount: Offers a 12% discount on initial sign-up.

- Better Multi-Child Discount: Provides an 8% discount for families insuring multiple children.

- Extensive Benefits: Known for offering robust benefits packages. Find out more in our guide titled “Prudential Life Insurance Company Review.”

Cons

- Higher Premiums: Premiums may be higher due to extensive benefits.

- Complex Policy Options: Options can be complex and require careful consideration.

#3 – New York Life: Best for Excellent Plan

Pros

- Solid Discounts: 11% sign-up discount with a 6% multi-child discount. Delve into our evaluation of the New York life insurance company review.

- Diverse Plan Options: Offers a range of plans suitable for varying needs.

- Reputation for Quality: Well-known for high-quality service and reliability.

Cons

- Pricing Structure: This can be expensive compared to others.

- Limited Customization: Fewer customization options for specific needs.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#4 – Mutual of Omaha: Best for Custom Coverage

Pros

- Highest Multi-Child Discount: 10% discount, highest among competitors.

- Customizable Plans: Offers highly customizable plans to fit individual needs.

- Generous Sign-Up Discount: 15% discount on signing up. Access comprehensive insights into our guide titled “Mutual of Omaha Life Insurance Review.”

Cons

- Pricing Variability: Costs can vary significantly based on coverage customization.

- Complex Policy Structures: Policies can be complex, requiring more time to understand.

#5 – Guardian Life: Best for Comprehensive Plan

Pros

- Wide-Ranging Coverage: Offers comprehensive plans covering a broad spectrum of needs.

- Balanced Discounts: 10% sign-up and 5% multi-child discounts. Discover more about offerings in our Guardian life insurance review.

- Strong Customer Support: Known for excellent customer service and support.

Cons

- Higher Cost: Comprehensive coverage comes at a higher price point.

- Limited Flexibility: Less flexibility in plan modifications compared to others.

#6 – Northwestern Mutual: Best for High Ratings

Pros

- Industry-Leading Ratings: Consistently high ratings for customer satisfaction and reliability.

- Competitive Discounts: 14% sign-up and 7% multi-child discounts. Unlock details in our guide titled “Northwestern Mutual Life Insurance Review.”

- Strong Financial Stability: Known for its strong financial health and longevity.

Cons

- Premium Pricing: Premiums tend to be on the higher side due to high ratings.

- Less Aggressive Discounts: Discounts are not as aggressive as some other companies.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#7 – MassMutual: Best for Financial Strength

Pros

- Robust Financial Base: Known for exceptional financial strength and security.

- Higher Multi-Child Discounts: Offers a 9% discount for insuring multiple children.

- Solid Sign-Up Discount: 13% discount on initial sign-up. Discover insights in our guide titled “MassMutual Life Insurance Review.”

Cons

- Costlier Premiums: A strong financial base may translate into higher premiums.

- Complex Offerings: Offers can be complex and may require expert advice.

#8 – AIG: Best for Broad Coverage

Pros

- Broad Coverage Options: Known for offering a wide range of coverage options.

- Equalized Discounts: Offers both 10% sign-up and 5% multi-child discounts.

- Global Expertise: Benefits from a broad global presence and expertise. Learn more in our AIG life insurance review.

Cons

- Variable Service Quality: Service quality can vary globally.

- Pricing Complexity: Pricing can be complex due to broad coverage options.

#9 – Transamerica: Best for Affordable Rates

Pros

- Competitive Pricing: Known for offering some of the most affordable rates.

- Solid Discounts: Offers a 9% sign-up and a 6% multi-child discount. Read up on the “Transamerica Life Insurance Review” for more information.

- Reliable Service: Maintains reliable customer service across various products.

Cons

- Limited Plan Variety: Fewer options compared to others with broader offerings.

- Slower Claim Processing: Sometimes experiences slower claim processing times.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#10 – Pacific Life: Best for Reliable Coverage

Pros

- Reliable Coverage Options: Known for reliable and consistent coverage. Unlock details in our guide titled “Pacific Life Insurance Review.”

- Higher Multi-Child Discount: Offers an 8% discount for multiple children.

- Strong Reputation: Maintains a strong reputation for stability and reliability.

Cons

- Higher Premiums: Generally, premiums are higher due to the quality of coverage.

- Less Personalized Service: Larger scale can result in less personalized service.

Comparative Monthly Rates for Children’s Life Insurance

When evaluating life insurance for children, understanding the cost associated with various coverage levels across different providers is crucial. This section details the monthly rates for minimum and full coverage options from several insurance companies.

Children Life Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AIG $6 $26

Guardian Life $5 $27

MassMutual $7 $30

Mutual of Omaha $6 $28

New York Life $6 $29

Northwestern $8 $31

Pacific Life $7 $30

Prudential $7 $32

State Farm $5 $30

Transamerica $5 $28

AIG, Mutual of Omaha, New York Life, and Transamerica offer competitive rates starting at $6 for minimum coverage, while Guardian Life, State Farm, and Transamerica offer the lowest entry point at just $5 per month. See more details on our “What is the minimum coverage amount for life insurance?”

On the higher end of the spectrum, Northwestern and Prudential start their coverage at $8 and $7 respectively, but provide more comprehensive benefits for the premium.

Full coverage monthly rates vary more significantly, with Guardian Life and AIG at the lower end at $27 and $26, and Prudential at the highest at $32. This diversity in pricing reflects the varying levels of coverage and additional benefits each provider offers, allowing families to choose based on their specific needs and budget constraints.

Types of Life Insurance for Children

What is the best life insurance for a child? There are three types of life insurance available for children: term life insurance, term life rider, and whole life insurance. The best life insurance policy for a child depends on your specific goals and needs. Let’s break down the best child life insurance plans.

Term Life: Term life is inexpensive, affordable life insurance for children and provides coverage for a particular period or term. You can purchase a term policy for $20,000 coverage on a 4-year-old child at a monthly rate of about $7.08 from Genworth Life Insurance Company.

Read more: Genworth Life Insurance Company Review

Considering that term life insurance quotes for adults can be almost double that rate, locking in a lower rate as a child might be a good idea over the long run, especially if the child has longer-term health concerns.

At age 30, your child would have the option of extending the coverage on the policy, replacing the policy with a new one, or converting the policy to a permanent life insurance policy such as Universal Life. Keep in mind all of these options would be at a much higher cost at that time.

Term Life Rider: A rider is an additional benefit added to an insurance policy. In this case, a children’s term life rider would be added to a parent’s policy.

These riders max out between $10,000 and $20,000 worth of coverage and will cover your dependent children to a specific age, usually 23-25. You can purchase a children’s term life rider for $20,000 coverage at an annual rate of $120.00 from Protective Life Insurance Company.

It’s important to note that one rider covers all of your eligible children. You don’t need a separate one for each!

Whole Life: Whole life insurance provides permanent life coverage. Unlike term life, coverage continues as long as the premiums are paid. A popular whole life insurance policy for children offers $5,000 coverage on a 10-year-old child at a monthly rate of $3.27 from Gerber Life Insurance Company, depending on the state you live in.

The rate on their Grow-Up Plan will vary depending on your state and your child’s gender. Some nice features of the plan are coverage doubling at age 18, the premiums never increase, and the policy builds cash value (For more information, read our “Gerber Life Grow-Up Plan Review.“)

Melanie Musson Published Insurance Expert

Gerber Life Insurance also offers a similar plan that acts as a combination policy for child life insurance and college funds. They might not be the best whole life insurance policy for your child, however, so shop around.

Read more: How To Cancel Your Gerber Life Insurance Policy

What Is the Youngest Age You Can Get Life Insurance

Child life insurance is offered for children as young as six months of age. Lower rates can be locked in for parents who purchase insurance earlier. This also allows for a longer time window to accumulate cash value.

Of course, if you opt for term life insurance, you would not accumulate any cash value and your plan would simply expire when policy premiums are not paid (For more information, read our “How To Find a Lower Term Life Insurance Premium.”)

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Pros and Cons of Child Life Insurance

Let’s look at a quick summary of the pros and cons of child life insurance before we consider whether you should buy life insurance for a child (For more information, read our “Life Insurance for Adult Children.”)

Reasons to Buy Life Insurance for Children

- Provide a Savings Plan

- Lock-In Insurability

- Protect Student Loans

- Financial Support for a Grieving Family

Reasons Not to Buy Life Insurance for Children

- Children Have No Income to Protect

- Better Savings Vehicles Available

Should I buy life insurance for my child?

In a recent CNNMoney Ask the Expert column, Sarah Max asked the question, “Should I buy life insurance for my child?” Sarah included expert opinions on the value of insuring a child against premature death versus utilizing those premium dollars to build a college fund instead.

The consensus was to invest the money and forego life insurance. But the primary discussion was about whole life insurance, which is where most people wonder which insurance policy is best for children’s insurance.

As Sarah and the experts point out, whole life insurance builds cash value and can be used to guarantee a person’s insurability should she become seriously injured or develop an illness later in life.

But those features come at a steep cost in the form of fees and other charges, which can slow the cash value growth and delay the return on your investment for decades. Thankfully, there’s a better way — which we’ll get to shortly. But first, here are some expenses that a child’s life insurance plan will cover.

Final Expenses

The National Funeral Directors Association estimates the cost of an average funeral in 2013 was approximately $7,400. According to the Bureau of Labor Statistics, funeral costs have risen over 20 percent since 2013.

Finding that much money for an unexpected funeral is difficult for many people. If you don’t have savings or a suitable emergency fund, a life insurance policy can help if you cannot afford to provide a proper burial for your child.

Time to Grieve

This is the primary reason I believe in life insurance for children. I can not imagine the grief I would experience if one of my children were to die. And returning to work would be the furthest thing from my mind. How long would it take before you could effectively return to work? A week? A month? Longer?

Would your employer, customers, or clients give you the time you need to grieve? If so, at what cost? A life insurance policy on your children can offset the loss of income you would experience from an extended time away.

Family Help and Counseling

Even after the initial grief wanes, you and your family will likely want to seek counseling to help get through this difficult time. Sadly, not all health insurance policies provide adequate mental health benefits.

With State Farm, parents find peace of mind through robust policies that grow with their children's future needs.

Brad Larson Licensed Insurance Agent

You may need to pay out-of-pocket for any ongoing counseling or therapy you or your loved one require. Life insurance policy proceeds can help cover the cost of such services.

Consider that grief counseling might be necessary for other children in the family. The Center for Grief Recovery and Therapeutic Services acknowledges that we still don’t know exactly how children grieve loss, but it can manifest in very different ways from parents. Having access to good counseling can help minimize lasting psychological issues.

Read more: Life Insurance for Low-Income Families

A Children’s Term Life Insurance Rider May be the Answer

Genworth Life Insurance Company is one of the very few child life insurance companies that offer term life insurance policies for children. Most companies offer policies beginning at the age of 18.

But you can purchase term life insurance for your children in the form of a rider on your policy from almost any company. A rider is simply additional coverage added to a policy to insure something other than the primary insured’s life.

These riders vary slightly by the company, but they provide similar coverage at comparable costs. Here’s how ING ReliaStar Life’s child term rider works.

- Coverage Amount – $2,000 to $10,000

- Cost – $12.00 to $60.00 annually

- Cost covers all children regardless of the number

- Age Coverage Begins – 15 days

- Age Coverage Ends – 25 years

- Conversion to an individual permanent insurance policy is available

The primary differences you’ll find are in cost and the coverage amount. For example, some companies offer child term riders up to $25,000. Another key point to note is that one rider will cover all children in the family.

So a $60.00 child term rider would provide $10,000 coverage for each child, whether you have one or ten. Many riders will extend coverage to stepchildren and adopted children of the insured as well.

State Farm leads the industry in children's life insurance by offering tailored solutions that cater to family dynamics and changing lifestyles.Justin Wright Licensed Insurance Agent

Term life insurance provides the best value in life insurance protection. Adding a children’s term life rider can add more even value and help you achieve a more well-rounded approach to protecting your loved ones (For more information, read our “Best Life Insurance Companies that Offer 10-Year Term Policies“).

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

About Term Life Insurance Coverage for Children

As you consider investing in life insurance to cover your children, you’re likely sensitive to the potential premium costs. After all, raising a family isn’t inexpensive, and a high life insurance premium may not work well with your budget.

Fortunately, most insurance companies that handle term life policies provide you with the option to purchase term life or obtain coverage for your children by visiting our guide titled “5 Ways to Get Term Life Insurance Quotes.”

According to Bain, “A rider is simply additional coverage added to a policy to insure something other than the primary insured’s life. As an example, imagine adding a jewelry rider to a homeowner’s policy to insure expensive items beyond what the base policy provides.

It’s the same concept with a children’s term rider. These riders vary slightly by the company, but they provide similar coverage at comparable costs.”

Important to note is that one rider will cover all children in your family. So if you’re paying $60.00 for a $10,000 child term rider, the death benefit is $10,000 for each child, regardless of whether you have one, two, five, or even more children. Some riders extend coverage to adopted and stepchildren as well.

Preparation, Not Premonition

Considering life insurance for your children doesn’t mean you’re expecting or willing the worst to happen to your loved ones; it simply means you care enough about your family to ensure you’re prepared for anything.

If you’d like to learn more about term life policies and child term riders for you and your loved ones, talk with a trusted professional who can answer all of your questions.

Buying Term Life Insurance for Your Children

It may seem strange to think about buying term life insurance for a child. After all, beyond the emotional loss, your family likely wouldn’t suffer from the loss of income, which is typically the reason people buy life insurance in the first place.

Life insurance is designed to care for loved ones that depend on you once you are gone, it does not make sense to purchase a life insurance policy for a child. You don’t need life insurance for your children as they do not have dependents that need financial care once they are gone.

Death Expenses

Of course, there are some reasons to get your child’s life insurance. When considering purchasing such insurance for your children, think carefully about how their death could affect you financially.

Consider expenses such as funeral costs and, depending on the age of the child, the possibility of having to take care of any unsettled debts. In this case, term life insurance for a child does make sense. Burying a child is unimaginable, but struggling to pay for the funeral would make it even more challenging.

Child Riders

Unfortunately, very few insurance companies offer separate policies for children. There are child riders, however, which many companies offer as an add-on to a parent’s insurance coverage. Typically parents can pay an additional flat fee and in the unfortunate event that their child died they could receive some coverage for these costs.

Can you get a life insurance policy on your child’s father? Yes. If you are not happy with plans and providers for a child plan, you can purchase life insurance for the child’s father and get a child life rider to cover your children.

Read more: Life Insurance for Parents

Case Studies: Best Life Insurance for Children

Selecting the right life insurance for children ensures financial security and peace of mind. Below are fictional case studies based on real-world scenarios, illustrating the effectiveness of State Farm, Prudential, and New York Life.

- Case Study #1 – State Farm: The Johnsons easily upgraded their child’s life insurance with State Farm after a major life event, appreciating the swift and flexible service.

- Case Study #2 – Prudential: The Kims chose Prudential for its strong financial stability, ensuring their child’s future financial needs are well-secured.

- Case Study #3 – New York Life: The Chavez family benefited from New York Life’s tailored plans that adapt to their child’s growing needs, providing continuous protection.

These examples highlight the importance of selecting a provider that offers both competitive rates and adaptable, reliable coverage for your family’s evolving needs.

Learn more: What is universal life insurance?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

The Bottom Line: How to Buy Life Insurance for a Child

Life insurance policies for children are a type of investment designed to protect your family from unexpected life events while offering an opportunity to save for the future.

Choosing State Farm means securing your child’s financial future with a provider known for reliability and trustworthiness.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

However, insuring a child is not necessarily the best idea for everyone. A trusted agent can guide you through the advantages and disadvantages of insuring your child. See more details in our guide titled “How To Calculate Your Life Insurance Age.”

Sometimes, parental good intentions might be misguided. Before you consider coverage for your child, consider how comfortable you are with your insurance. You should always prioritize having good coverage for yourself first.

Our quote comparison tool below will allow you to shop for affordable life insurance rates from the top companies near you — just enter your ZIP code to get started.

Frequently Asked Questions

Should I buy life insurance for my child?

Choosing to purchase child life insurance hinges on your specific situation and viewpoint. This subject often sparks discussions among insurance and financial advisors. Before deciding, reflect on your objectives and requirements for insurance.

For additional details, explore our comprehensive resource titled “The Role of Life Insurance in Your Financial Plan.”

What is the best life insurance for a child?

Three varieties of life insurance are offered for children: term life insurance, term life rider, and whole life insurance. Selecting the optimal policy hinges on your individual goals and necessities. It is advisable to assess various choices to secure the most appropriate coverage, especially when considering life insurance for adult children.

What is the youngest age you can get life insurance?

Child life insurance is offered for children as young as six months of age. Purchasing insurance at a young age allows for lower rates and a longer time window to accumulate cash value, especially with whole-life insurance.

Looking for lower life insurance rates? Enter your ZIP code into our free quote comparison tool today and find the cheapest providers near you.

What are the cons of child life insurance?

Cons include the cost of premiums and the debate over investing the money instead of buying insurance.

How can I buy term life insurance for my child?

Although it might appear unconventional, purchasing term life insurance for a child offers distinct advantages. This type of insurance can assist with covering expenses related to death, including funeral costs and outstanding debts. Many insurance companies provide child riders that can be included in a parent’s insurance policy as part of child life insurance plans.

To find out more, explore our guide titled “Calculate Your Term Life Insurance Needs.”

What are child life insurance plans?

Child life insurance plans are policies designed to provide financial protection for your child’s future, covering aspects like education, health, and unexpected events.

How do I choose the best children’s life insurance policy?

To choose the best children’s life insurance policy, compare features such as coverage amount, premium costs, and policy benefits across different providers.

Where can I get life insurance quotes for children?

You can obtain life insurance quotes for children from insurance providers’ websites, through financial advisors, or by using online comparison tools.

Why should I consider whole life insurance for children?

Whole life insurance for children provides lifelong coverage and can build cash value, serving as a financial tool for future needs like college expenses.

To learn more, explore our comprehensive resource on “Best Whole Life Insurance Companies.”

What is child life insurance?

Child life insurance is a policy taken out by a parent or guardian to provide financial security and cover potential future expenses for a child.

What should parents consider when choosing children’s life insurance?

Parents should evaluate the policy’s coverage terms, potential benefits like cash value and future insurability, and the overall cost to ensure it aligns with their long-term financial planning for their child’s future.

What are the benefits of infant life insurance?

Infant life insurance can lock in low premiums, cover future uninsurability, and provide financial support during unexpected events.

What age should you get life insurance?

You can get life insurance for a child as soon as they are born to benefit from lower premiums and early financial protection.

Learn more by reading our guide titled “Life Insurance Rates by Age & Gender.”

What is child-term life insurance?

Child term life insurance provides coverage for a specified period, offering a death benefit if the child passes away during the term.

What is voluntary child life insurance?

Voluntary child life insurance is additional coverage that you can opt into through your employer’s benefits package to provide extra security for your family.

What should I know about a child’s life insurance?

A child’s life insurance typically includes features like guaranteed future insurability, fixed premiums, and, in some cases, cash value accumulation.

What are the pros of child life insurance?

Pros of child life insurance include covering final expenses, providing time to grieve without financial stress, and offering access to family help and counseling.

Access comprehensive insights into our guide titled “What are the benefits of buying life insurance?“

How much is insurance for a child?

The cost of insurance for a child varies based on factors like the type of policy, coverage amount, and the child’s age at the time of policy purchase.

What happens with life insurance for my child if I die?

If you die, a child’s life insurance policy you own can continue if arrangements are made for premium payments, like setting up a trust or assigning a new policy owner.

How do I select a child insurance plan?

Select a child insurance plan by assessing your financial goals for your child, understanding the policy benefits, and comparing offers from various insurers.

Simplify your life insurance shopping by entering your ZIP code into our free quote comparison tool below and find coverage that fits your budget and needs.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Life Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Licensed Life Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.