Best Life Insurance for Expats in 2025 (Your Guide to the Top 10 Companies)

The best life insurance for expats includes Aetna, AIG and Allstate, offering comprehensive international life insurance at competitive rates, starting at $45 per month. These top companies excel in providing tailored coverage, ensuring peace of mind for expats with flexible terms and global protection.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Mar 18, 2025

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Mar 18, 2025

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

163 reviews

163 reviewsCompany Facts

Full Coverage for Expats

A.M. Best Rating

Complaint Level

Pros & Cons

163 reviews

163 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Expats

A.M. Best Rating

Complaint Level

11,638 reviews

11,638 reviewsThe top picks for the best life insurance for expats are Aetna, AIG, and Allstate, offering competitive rates starting at $45 per month.

These top providers offer comprehensive international coverage tailored to expatriates’ unique needs. This article explores their advantages, coverage options, and essential factors to assist you in selecting the best policy.

Our Top 10 Company Picks: Best Life Insurance for Expats

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 5% | A | Global Coverage | Aetna | |

| #2 | 7% | A | Flexible Plans | AIG |

| #3 | 6% | A+ | Broad Access | Allstate | |

| #4 | 5% | A+ | Comprehensive Benefits | AXA |

| #5 | 4% | A | Flexible Coverage | Generali |

| #6 | 6% | A- | Wide Network | Bupa |

| #8 | 5% | A+ | Expansive Coverage | Zurich | |

| #7 | 7% | A | International Support | Kaiser | |

| #9 | 4% | A | Tailored Coverage | Cigna | |

| #10 | 5% | A | Global Reach | HSBC |

Securing life insurance before relocating abroad ensures peace of mind and protection for you and your family. For a comprehensive analysis, refer to our guide titled, “How does life insurance work?”

Simplify your life insurance shopping by entering your ZIP code into our free quote comparison tool above and find coverage that fits your budget and needs.

- Aetna’s top-rated expat life insurance starts at $45/month

- Comprehensive coverage meets expatriates’ specific needs

- The best life insurance for expats offers global coverage plans

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#1 – Aetna: Overall Top Pick

Pros:

- Extensive International Network: Aetna provides the best life insurance for expats with a robust global network, ensuring accessibility to services and support no matter where you are.

- Comprehensive Coverage Options: Aetna offers various plans that cater to diverse needs, making it one of the best life insurance options for expats who require tailored solutions. See our Aetna life insurance review for further details.

- Strong Financial Stability: With high ratings from financial institutions, Aetna ensures peace of mind, which is crucial for the best life insurance for expats.

Cons:

- Higher Premiums: While offering comprehensive options, Aetna’s policies may come with higher premiums, which can be a drawback for cost-sensitive expats.

- Limited Customization: Some expats may find Aetna’s policies less customizable compared to other providers in the best life insurance for expats category.

#2 – AIG: Best for Flexible Plans

Pros:

- Variety of Policy Options: AIG stands out in the best life insurance for expats by providing numerous flexible plan options, accommodating various expat lifestyles and needs. Uncover insights in our AIG life insurance review.

- Adjustable Coverage Terms: AIG allows policyholders to adjust their coverage as their needs change, making it an excellent choice for those seeking the best life insurance for expats.

- Global Reach: AIG’s extensive international presence ensures that expats can access benefits and support, solidifying its reputation as the best life insurance for expats.

Cons:

- Complex Policy Structure: Some expats may find AIG’s policy structure complex, which can make understanding coverage details more challenging in the context of the best life insurance for expats.

- Slower Claims Processing: Reports of longer claims processing times may deter some expats looking for efficient support in the best life insurance for expats.

#3 – Allstate: Best for Broad Access

Pros:

- Wide Accessibility: Allstate provides the best life insurance for expats with a wide range of accessible services and resources worldwide, making it easy to manage policies from anywhere.

- User-Friendly Online Tools: With intuitive online tools, Allstate simplifies the process of managing life insurance, a significant advantage for expats seeking the best life insurance for expats.

- Strong Customer Support: Allstate is known for its reliable customer service, ensuring expats can easily navigate their policies and benefits. Find additional details in our Allstate life insurance review.

Cons:

- Limited International Options: Allstate may not offer as many specialized international plans as other companies, which could impact its standing in the best life insurance for expats.

- Potentially Higher Costs: Some policies may come with higher costs compared to competitors, which can be a concern for expats looking for the most affordable best life insurance for expats.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#4 – AXA: Best for Comprehensive Benefits

Pros:

- Wide Range of Benefits: AXA offers some of the most comprehensive benefits in the best life insurance for expats, ensuring that policyholders have access to various essential services.

- Global Assistance Services: AXA provides global assistance services, which is invaluable for expats in emergencies, reinforcing its position as the best life insurance for expats.

- Customizable Policy Features: Expats can tailor their policies with riders and additional coverage options, enhancing AXA’s appeal as the best life insurance for expats. Gain knowledge from our resource titled, “What to Do if Your Life Insurance Claim Is Denied.”

Cons:

- Higher Premiums for Comprehensive Coverage: The extensive benefits offered may lead to higher premiums, which could be a drawback for budget-conscious expats.

- Complex Claims Process: Some users report a more complicated claims process, which may be frustrating for expats relying on timely support from the best life insurance for expats.

#5 – Generali: Best for Flexible Coverage

Pros:

- Adaptable Policies: Generali provides flexible policy options that cater to the evolving needs of expats, positioning itself as one of the best life insurances for expats. Uncover insights in our guide titled, “Life Insurance Terms and Definitions.”

- Worldwide Coverage: Their plans include extensive worldwide coverage, ensuring that expats have protection no matter where their travels take them.

- Competitive Premium Rates: Generali’s pricing structures are competitive, making it a cost-effective choice for those seeking the best life insurance for expats.

Cons:

- Limited Recognition: Compared to larger insurers, Generali may not have the same level of brand recognition, which could affect trust for some expats seeking the best life insurance for expats.

- Availability Issues: Certain policies may not be available in all countries, limiting options for some expats looking for the best life insurance for expats.

#6 – Bupa: Best for Wide Network

Pros:

- Extensive Global Network: Bupa’s wide network of medical and support services makes it a top contender for the best life insurance for expats.

- Strong International Presence: With a significant international presence, Bupa ensures that expatriates have access to the best life insurance for expats wherever they are.

- Additional Health Benefits: Provides additional health benefits and services, enhancing its value as the best life insurance for expats. Discover more details in our resource titled, “Do Health Insurance Companies Have Access to Medical Records?“

Cons:

- Potentially High Costs: Bupa’s comprehensive services might lead to higher costs, which can be a barrier for some expats seeking affordable options in the best life insurance for expats.

- Complex Policy Details: The variety of options and features may lead to confusion about what coverage is included, which could complicate the process for expats.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#7 – Zurich: Best for Expansive Coverage

Pros:

- Global Insurance Solutions: Zurich provides expansive global coverage, ensuring that expats have access to benefits wherever they reside, making it a top contender for the best life insurance for expats.

- Comprehensive Risk Management: Zurich’s expertise in risk management can help expats navigate challenges while living abroad, reinforcing its status as the best life insurance for expats. Dive into our guide titled, “Life Insurance and Financial Planning: How They Work Together.”

- Flexible Premium Payment Options: Policyholders can choose from various premium payment structures, enhancing affordability and flexibility for expats.

Cons:

- Complicated Claims Process: Some expats report a complicated claims process that may delay support, which is a concern for those seeking efficient service in the best life insurance for expats.

- Limited Customization: While Zurich offers many benefits, the lack of extensive customization options may not meet every expat’s specific needs regarding the best life insurance for expats.

#8 – Kaiser: Best for International Support

Pros:

- Strong International Support: Kaiser excels in providing international support services, crucial for expats who may need assistance navigating life insurance needs abroad.

- Comprehensive Health Coverage: As part of its life insurance offerings, Kaiser includes health benefits, making it a holistic option for the best life insurance for expats.

- User-Friendly Online Access: Kaiser’s online tools facilitate easy management of policies, enhancing the experience for expats searching for the best life insurance for expats.

Cons:

- Limited Availability: Kaiser may not be available in all countries, which could restrict access for some expats looking for the best life insurance for expats.

- Potentially High Premiums: The robust coverage options might come with higher costs, making it less appealing for budget-conscious expats. For a comprehensive analysis, refer to our detailed guide titled, “How much life insurance do I really need?“

#9 – Cigna: Best for Tailored Coverage

Pros:

- Highly Customizable Plans: Cigna stands out for offering tailored coverage options, making it one of the best life insurances for expats who need specific benefits. To enhance your understanding, explore our resource titled, “What are the benefits of buying life insurance?“

- Global Support Services: With a strong international presence, Cigna provides reliable support for expats, ensuring they have access to essential services.

- Health Integration: Cigna integrates health and life insurance benefits, enhancing overall coverage and making it a compelling option for the best life insurance for expats.

Cons:

- Complex Policy Options: The variety of tailored options may lead to confusion for some expats trying to select the best life insurance for expats.

- Higher Cost for Customization: Customized plans may come with higher premiums, which can be a deterrent for expats seeking more affordable solutions in the best life insurance for expats.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#10 – HSBC: Best for Global Reach

Pros:

- Wide Global Presence: HSBC’s global reach makes it a top choice for the best life insurance for expats, ensuring coverage in numerous countries.

- Flexible Policy Options: Offers flexible policy options suited to the needs of expatriates, enhancing its suitability as the best life insurance for expats.

- Comprehensive Services: Provides comprehensive services and support, adding significant value to its policies for expatriates seeking the best life insurance for expats. To gain profound insights, consult our guide titled, “How long should life insurance coverage last?“

Cons:

- Higher Costs: The extensive global reach and flexible options may result in higher premiums, which could be a downside for some expats looking for budget-friendly options in the best life insurance for expats.

- Potential Policy Complexity: The wide range of policy options might result in complexity, making it harder for some expats to choose the best life insurance for expats based on their specific needs.

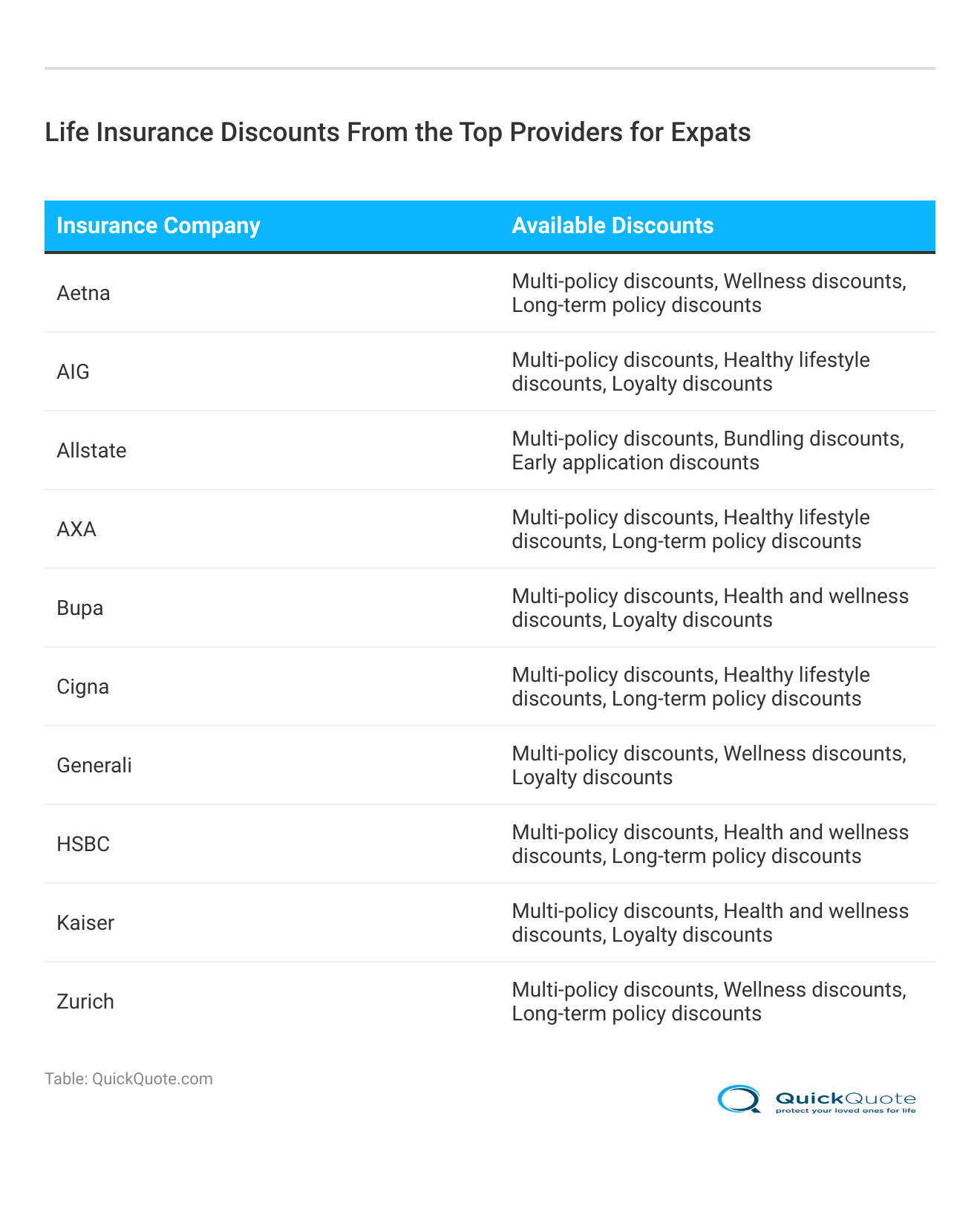

Expats Life Insurance Monthly Rates: Coverage Levels by Provider

For expatriates seeking life insurance, knowing about available discounts and understanding the costs associated with different coverage levels and providers is crucial. Here’s a comprehensive breakdown of available discounts and monthly rates for both minimum and full coverage from leading international life insurance companies.

Expats Life Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Aetna | $50 | $150 |

| AIG | $55 | $160 |

| Allstate | $52 | $155 |

| AXA | $48 | $145 |

| Bupa | $53 | $155 |

| Cigna | $45 | $135 |

| Generali | $50 | $150 |

| HSBC | $49 | $145 |

| Kaiser | $51 | $150 |

| Zurich | $47 | $140 |

For minimum coverage, rates range from $45 with Cigna to $55 with AIG. Full coverage starts at $135 with Cigna and goes up to $160 with AIG. Aetna, Generali, and Kaiser offer full coverage starting at $150, while AXA and Zurich offer slightly lower rates at $145 and $140, respectively.

Choosing the right life insurance policy as an expat involves evaluating both coverage levels and costs. This range helps expatriates find a plan that suits their coverage needs and budget. For more details, explore our resource titled, “How much does life insurance cost?”

Securing Life Insurance Coverage While Abroad

Securing life insurance coverage while abroad is essential for expatriates seeking financial protection and peace of mind. To ensure you obtain the best policy, it is crucial to provide accurate personal details during the application process. Insurers need accurate details about your age, health, and lifestyle to assess risk and set coverage.

Aetna offers the most comprehensive life insurance coverage for expats, combining extensive global protection with competitive rates.Jimmy McMillan Licensed Life Insurance Agent

Falsifying any details can lead to disputes or denial of claims, potentially leaving you without protection when you need it most. Being transparent and thorough ensures a smoother application and a policy that meets your needs abroad. To delve deeper, refer to our in-depth report titled, “How to File a Life Insurance Claim.”

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Factors When Choosing Global Life Insurance

Selecting the right global life insurance policy is crucial for expatriates seeking financial security and peace of mind while living abroad. It ensures that you have appropriate coverage tailored to international needs, safeguarding you and your family against unexpected events and providing financial protection in diverse global contexts.

Unlike traditional life insurance, global coverage must account for unique circumstances associated with international living. Various factors influence both coverage options and premiums, making it essential for expats to understand what providers consider when assessing their applications.

- Place of Residency: Insurers often require U.S. residency or a U.S. bank account.

- Destination: Low-risk areas are easier to insure.

- Length of Stay: Shorter stays generally make insurance qualification easier.

- Occupation: High-risk jobs can impact eligibility and premiums.

- Apply in the U.S.: Apply in advance to secure international life insurance.

This requires careful consideration of key factors that impact both your coverage and costs. By carefully evaluating these factors, you can choose a policy that provides the protection you need abroad. To gain in-depth knowledge, consult our resource titled, “Life Insurance Savings Account: What You Need To Know.”

Updating Existing Policy to Include International Life Insurance

When relocating abroad, updating your existing life insurance policy to include international coverage can be a practical solution. This approach allows you to maintain continuity in your coverage while addressing the unique risks and requirements associated with living outside your home country.

Start by contacting your current insurance provider to explore options for adding international coverage. They may offer riders or policy adjustments tailored to expatriates. Ensure that your updated policy accurately reflects your new residency status, travel plans, and any changes in your lifestyle or occupation.

By proactively modifying your existing policy, you can secure the protection you need while enjoying your time abroad. Gain more insights from our guide titled, “Can you change your life insurance beneficiary?”

Choosing Between International Life Insurance Companies

There are companies that specialize in providing life insurance to expats and know the intricacies that it requires. They also commonly offer shorter term lengths than what is standard; some are as short as 90 days. International life insurance providers also can offer policies that provide benefits even if you plan on going to more than one country.

Rates will fluctuate based on the risk factors discussed above, but an overseas life insurance provider will be well-versed in understanding the issues that can arise when applying for expat life insurance. To delve deeper, refer to our in-depth report titled, “How to Buy Life Insurance.”

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Permanent and Term Life Insurance Comparison

Choosing between permanent and term life insurance abroad depends on your long-term financial goals and current needs. Term Life Insurance are favored by expatriates for its affordable, temporary coverage, ideal for cost-effective protection abroad which is covered in our report titled, “Types of Term Life Insurance.”

However, Permanent Life Insurance offers lifelong coverage with a growing cash value, making it a valuable asset. This is especially beneficial for expats staying abroad long-term or those needing funds for major expenses like buying property overseas. To gain in-depth knowledge, consult our resource titled, “Permanent Life Insurance.”

View this post on Instagram

Term life is more straightforward and affordable, while permanent life provides greater security and flexibility for complex financial needs. The choice depends on your time abroad, financial goals, and needed coverage.

Case Studies: Life Insurance for Expatriates

Case Study 1: John’s Secure Coverage

John, an American citizen, decided to move abroad for work and wanted to ensure his family’s financial security. He compared international life insurance companies using the free quote tool provided.

After careful consideration, John purchased a worldwide life insurance policy with comprehensive coverage and competitive premiums, providing peace of mind for his loved ones. For additional details, explore our comprehensive resource titled, “What is the minimum coverage amount for life insurance?”

Case Study 2: Sarah’s Existing Policy Update

Sarah already had a life insurance policy but needed coverage while living abroad. She contacted her current insurance provider, but they couldn’t offer international travel plans. Sarah then explored companies specializing in international life insurance policies.

She found a suitable option that allowed her to update her existing policy, accommodating her travel plans and providing the necessary coverage. For additional insights, check our guide titled, “Life Insurance Policy Backdating.”

Case Study 3: Expats’ Term Life Insurance

Mark and Lisa, a married couple, were planning to live abroad temporarily for a year. They researched international life insurance companies and discovered providers that specifically catered to expats. They opted for a term life insurance plan with a shorter duration of 12 months.

This policy ensured their coverage during their time overseas, allowing them to enjoy their expat experience with peace of mind. For a comprehensive analysis, refer to our guide titled, “Term Life Insurance Quotes.”

Case Study 4: Peter’s Whole Life Insurance

Peter, an expat planning to live abroad long-term, evaluated the benefits of different life insurance options. He decided that a whole life insurance policy would suit his needs best.

By keeping his permanent life insurance, Peter used its cash value for major expenses abroad, ensuring flexibility and security during his move. For more information, check our resource titled, “Whole Life Insurance vs. Universal Life Insurance: Which Is Better for You.”

Case Study 5: Anna’s Comparative Analysis

Anna, a potential expat, understood the importance of thorough research before purchasing international life insurance. She utilized the free quote tool to compare rates from various international life insurance providers.

By considering the coverage options and costs available, Anna made an informed decision that aligned with her needs and budget. To broaden your understanding, explore our comprehensive resource titled, “How QuickQuote Helps You Shop for Life Insurance.”

Comprehensive Guide to the Best Life Insurance for Expats

This guide offers a detailed overview of the best life insurance options for expatriates, highlighting top providers such as Aetna, AIG, and Allstate. It covers essential aspects like coverage levels, monthly rates, and key factors to consider when selecting a policy.

The article covers updating policies for international coverage, comparing provider rates, and choosing between term and permanent life insurance. It aims to help expats find the best coverage for their needs abroad. To broaden your understanding, explore our resource titled, “Term Life Insurance vs. Whole Life Insurance.”

Save time on your life insurance search by entering your ZIP code below into our free comparison tool today.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Frequently Asked Questions

Which type of life insurance is best for overseas living?

For overseas living, term life insurance is often favored due to its affordability and temporary coverage. However, permanent life insurance may be a better choice for long-term expatriates, as it provides lifelong coverage and a growing cash value that can be useful for significant expenses abroad.

Check out our Permanent life insurance review for more information.

Can I get life insurance coverage while living abroad?

Yes, it is possible to get life insurance coverage while living abroad. You can update your existing policy or purchase a new worldwide life insurance policy to ensure you’re covered.

What should I consider when choosing worldwide life insurance?

When choosing worldwide life insurance, factors such as your age, health, lifestyle, and travel plans are taken into account. Even for a no medical exam policy, you may need to be in the U.S. during the application process.

Should I update my existing policy to include overseas life insurance?

If you already have a life insurance policy, updating it to reflect your travel plans may be a convenient way to get coverage while living abroad. Some insurance carriers offer riders or updates to accommodate international coverage.

How do I choose between international life insurance companies?

There are companies specializing in providing life insurance to expats. They offer shorter term lengths and policies that cover multiple countries. Rates may vary based on risk factors, so it’s essential to compare quotes from different international life insurance providers.

Read our review of “How To Buy Term Life Insurance” for full details.

Should I choose whole or term life insurance while living abroad?

Most international life insurance policies are term life insurance plans. However, depending on your needs, you may consider the benefits of permanent life insurance policies. Consult with your insurance provider to determine the best option for you.

Find the best term life insurance rates by entering your ZIP code into our free comparison tool below.

What is the most recommended life insurance for expats?

The most recommended life insurance for expats includes top providers such as Aetna, AIG, and Allstate. These companies offer comprehensive international coverage, tailored to meet the unique needs of expatriates, and are known for their flexible terms and global protection.

What is a good amount of life insurance for expats?

The appropriate amount of life insurance for expatriates depends on individual financial needs and goals. Typically, a coverage amount can vary based on factors such as dependents, debt, and living expenses abroad.

Does life insurance cover death in other countries?

Yes, many life insurance policies provide coverage for death that occurs in other countries. It is crucial to select a policy with global coverage to ensure that you are protected regardless of where you are residing or traveling.

Gain insights from our resource titled, “How do life insurance companies handle death with dignity cases?”

What is the age limit for life insurance for expats?

The age limit for obtaining life insurance as an expat varies by provider and policy type. Generally, policies are available for individuals up to age 70, though some providers may offer coverage up to age 80 or beyond. It is important to check specific age restrictions with the insurance provider.

See how much you can save on whole life insurance by entering your ZIP code below into our free comparison tool.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.