Best Life Insurance for Firefighters in 2025 (Find the Top 10 Companies Here)

Discover the best life insurance for firefighters with top picks Liberty Mutual, Nationwide, and Erie offering policies starting at just $45 a month. These companies stand out for their affordable rates, comprehensive coverage, and tailored plans specifically designed to meet the unique needs of firefighters.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: Dec 15, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Dec 15, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,071 reviews

3,071 reviewsCompany Facts

Full Coverage for Firefighters

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 1,883 reviews

1,883 reviewsCompany Facts

Full Coverage for Firefighters

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews

These companies provide policies specifically designed to address the high-risk nature of firefighting, ensuring that firefighters receive the protection they deserve. While exploring these options, firefighters should consider not only the cost but also the comprehensive benefits each provider offers.

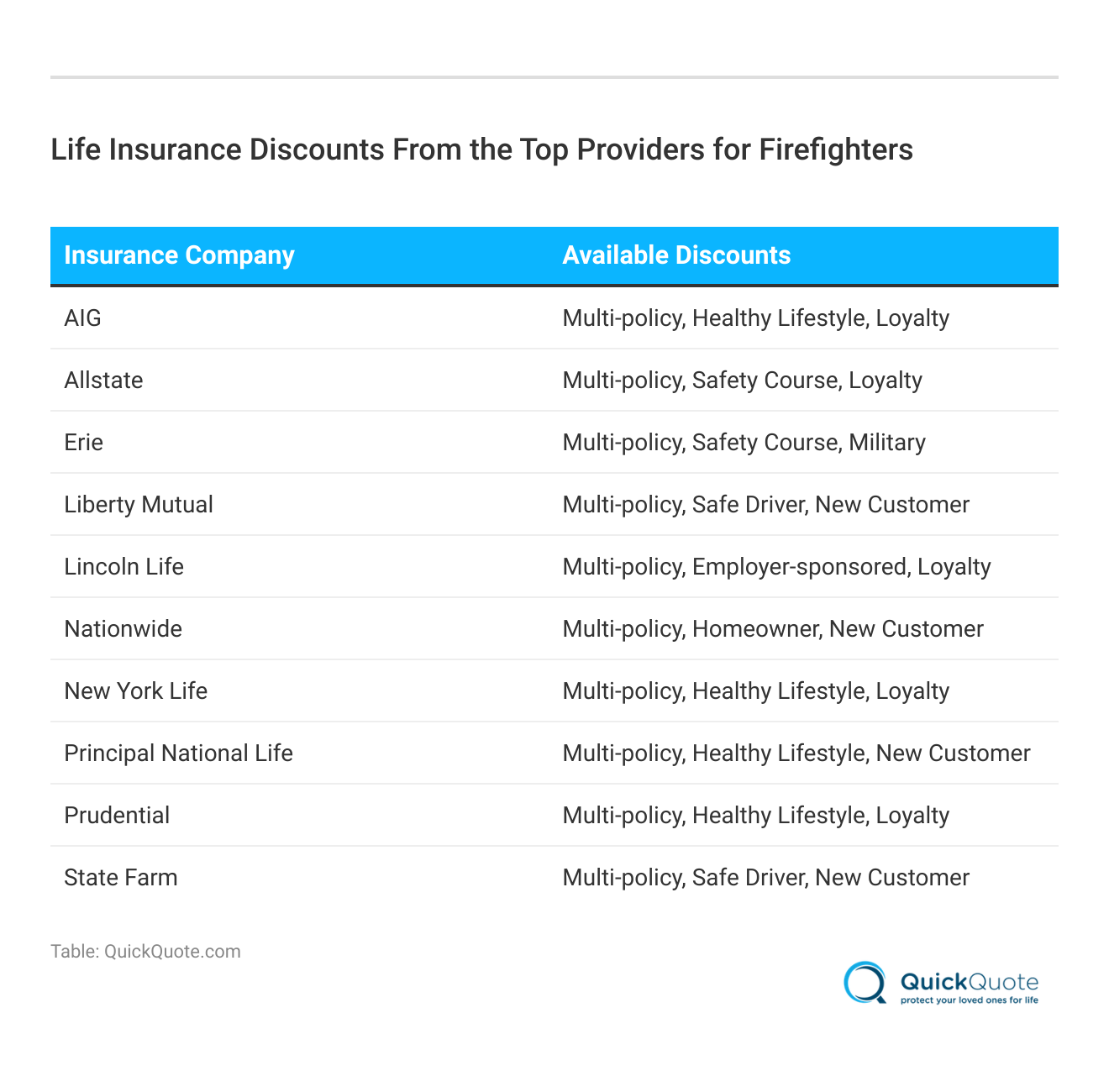

Our Top 10 Company Picks: Best Life Insurance for Firefighters

Company Rank Multi Vehicle-Discount A.M. Best Best For Jump to Pros/Cons

#1 25% A Financial Stability Liberty Mutual

#2 20% A+ Competitive Rates Nationwide

#3 10% A+ Broad Options Erie

#4 12% A+ Comprehensive Coverage Prudential

#5 15% A++ Reliable Service New York Life

#6 8% A Flexible Policies Lincoln Life

#7 15% A- Global Reach AIG

#8 12% A+ Customer Support Principal National Life

#9 25% A+ Community Focused Allstate

#10 20% B Strong Reputation State Farm

It’s crucial for firefighters to secure a policy that remains effective beyond their active duty years, providing long-term security for themselves and their families. With a little research and quote comparison, you can easily find the right type of life insurance policy.

You can get free quotes for life insurance and secure financial protection for your loved ones by entering your ZIP code into our tool above.

- Liberty Mutual leads as the top choice for firefighter life insurance

- Policies cater specifically to the high-risk nature of firefighting

- Coverage secures long-term protection beyond active service

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#1 – Liberty Mutual: Top Overall Pick

Pros

- Multi-Vehicle Discount: Offers a 25% discount for multiple vehicle insurance. See more details on our article titled Liberty Mutual life insurance review.

- Strong Financial Rating: Maintains an A.M. Best rating of A, indicating robust financial health.

- Diverse Policy Options: Provides a variety of insurance policies tailored to different needs.

Cons

- Higher Premiums: Premium costs may be higher compared to competitors.

- Limited Customization: Fewer options for policy customization relative to other insurers.

#2 – Nationwide: Best for Competitive Rates

Pros

- Competitive Multi-Vehicle Discount: 20% discount for insuring multiple vehicles.

- Excellent Financial Rating: Achieves an A+ rating from A.M. Best, ensuring reliability.

- Wide Range of Policies: Offers a broad selection of insurance products. More information is available about this provider in our article titled Nationwide life insurance review.

Cons

- Inconsistency in Customer Service: Customer service quality may vary regionally.

- Policy Cost Variability: Some policies may be pricier depending on the coverage level.

#3 – Erie: Best for Broad Options

Pros

- Modest Multi-Vehicle Discount: Provides a 10% multi-vehicle discount.

- Top-Notch Financial Rating: Holds an A+ rating from A.M. Best. Read up on the “Erie Life Insurance Review” for more information.

- Extensive Coverage Options: Known for offering a wide range of insurance options.

Cons

- Limited Geographic Availability: Services may not be available in all areas.

- Slower Claim Processing: Some customers may experience delays in claim processing.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#4 – Prudential: Best for Comprehensive Coverage

Pros

- Decent Multi-Vehicle Discount: Offers a 12% discount on multi-vehicle policies.

- Superior Financial Rating: Carries an A+ rating from A.M. Best. Learn more in our article titled Prudential life insurance review.

- Wide-Ranging Policy Offerings: Known for comprehensive and inclusive insurance policies.

Cons

- Higher Premiums for Certain Plans: Some coverage plans can be expensive.

- Complex Policy Details: Policies may be complex and hard to understand for new clients.

#5 – New York Life: Best for Reliable Service

Pros

- Good Multi-Vehicle Discount: Provides a 15% discount on multi-vehicle insurance.

- Highest Financial Rating: Boasts an A++ rating from A.M. Best, the highest possible.

- Dependable Service: Recognized for reliable and consistent insurance services. Check out insurance savings in our complete guide titled “New York Life Insurance Company Review.”

Cons

- Premium Cost: Relatively higher premiums than some competitors.

- Conservative Investment Options: More conservative approach may not suit all clients.

#6 – Lincoln Financial: Best for Flexible Policies

Pros

- Moderate Multi-Vehicle Discount: Offers an 8% discount for multi-vehicle policies.

- Strong Financial Health: Maintains an A rating from A.M. Best.

- Flexible Policy Options: Known for flexible insurance solutions. Discover more about offerings in our guide titled “Lincoln National Life Insurance Review.”

Cons

- Premium Variability: Premiums may vary greatly between policies.

- Limited Reach: Not as widely available as some larger competitors.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#7 – AIG: Best for Global Reach

Pros

- Competitive Multi-Vehicle Discount: 15% discount on insuring multiple vehicles.

- Broad International Coverage: Extensive global reach and coverage options. Access comprehensive insights into our article titled AIG life insurance review.

- Diverse Financial Products: Offers a wide range of financial and insurance products.

Cons

- Variable Customer Service: Customer service quality can be inconsistent globally.

- Complexity in Claims: Claims process can be complicated and lengthy.

#8 – Principal: Best for Customer Support

Pros

- Solid Multi-Vehicle Discount: 12% discount on multi-vehicle policies.

- Excellent Financial Rating: Holds an A+ rating from A.M. Best. Delve into our evaluation of “Principal National Life Insurance Company Review.”

- Strong Customer Support: Known for exceptional customer service and support.

Cons

- Pricing Inconsistencies: Some customers may find pricing to be inconsistent.

- Policy Limitations: Some specific policy options may be limited.

#9 – Allstate: Best for Community Focused

Pros

- High Multi-Vehicle Discount: Offers a 25% discount for multi-vehicle policies.

- Strong Community Engagement: Actively involved in community initiatives.

- Robust Policy Selection: Wide range of insurance options available. Unlock details in our guide titled Allstate life insurance review.

Cons

- Higher Pricing: Can be more expensive than some other options.

- Varied Service Quality: Customer service can vary depending on location.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#10 – State Farm: Best for Strong Reputation

Pros

- Significant Multi-Vehicle Discount: 20% discount on multiple vehicle policies.

- Reputation for Reliability: Known for its strong reputation in the insurance industry.

- Diverse Coverage: Offers a variety of coverage options suited to different needs. Discover insights in our article titled State Farm life insurance review.

Cons

- Lower Financial Rating: Holds a B rating from A.M. Best.

- Higher Premiums: Premium costs might still be relatively higher for certain coverage levels.

Firefighter Life Insurance: Comparative Monthly Rates

The table below provides an insightful look into the monthly rates for firefighter life insurance across various companies, distinguishing between minimum and full coverage options.

Firefighter Life Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AIG $51 $108

Allstate $49 $103

Erie $47 $100

Liberty Mutual $45 $95

Lincoln Life $48 $102

Nationwide $50 $105

New York Life $55 $115

Principal National Life $53 $112

Prudential $52 $110

State Farm $50 $105

Insurance providers offer a range of monthly rates tailored to firefighters’ specific needs, reflecting both minimum and full coverage levels. For example, Liberty Mutual offers one of the most competitive rates at $45 for minimum coverage, escalating to $95 for full coverage.

On the higher end, New York Life charges $55 and $115 for minimum and full coverage, respectively. This variability allows firefighters to choose a plan that not only fits their budget but also provides the level of security they require in such a high-risk profession.

Learn more: What is the minimum coverage amount for life insurance?

Life Insurance for Firefighters

There are some jobs that could raise your life insurance premium, including firefighters. However, every company uses a different underwriting process when determining life insurance rates, which means firefighters still have a chance of receiving standard or even preferred rates.

While many firefighters are offered group life insurance at almost no cost as a workplace benefit, those policies are commonly terminated if they change jobs.

When you retire, what will remain of your work provided life insurance policy? You are at risk of having no coverage when you move on from firefighting.

To avoid this issue, consider purchasing a whole life insurance policy. Unlike term policies, which expire after a set number of years, a whole policy will last for the duration of your life.

Life insurance rates increase with age, which means applying for a new policy after you retire will cost you a lot more money than if you were to secure a whole term policy today.

The table below details the average monthly rates by age for a whole term life insurance policy with a death benefit of $250,000 from Foresters Financial. We’ve included both standard and substandard rates.

Firefighter Life Insurance Monthly Rates by Age & Standard vs. Substandard Coverage

| Age | Standard Rates | Substandard Rates |

|---|---|---|

| 25-Year-Old | $157 | $196 |

| 30-Year-Old | $189 | $236 |

| 35-Year-Old | $231 | $288 |

| 40-Year-Old | $278 | $347 |

| 45-Year-Old | $349 | $437 |

| 50-Year-Old | $429 | $536 |

| 55-Year-Old | $550 | $687 |

| 60-Year-Old | $701 | $876 |

| 65-Year-Old | $913 | $1,141 |

The average firefighter is 38-years-old. The mandatory retirement age for firefighters is 65.

If you were to invest in whole term life insurance for firefighters right now, you would save $635 per month compared to if you wait until the retirement age. That’s a difference of $7,615 per year.

Keep in mind that this data is specifically from Foresters Financial.

Firefighters also have the option of joining the Police and Firemen’s Insurance Association, also known as PFIA. PFIA insurance was created to provide firefighters and police officers with affordable life insurance rates despite the high-risks associated with each job.

No matter what, you’ll want to seek out more than one quote. By comparing rates from multiple companies, you will find the best possible rates for the right policy that will not expire when you retire from your job.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Best Life Insurance Policy Options for Firefighters

You might think your workplace insurance is enough, but what happens when that policy is terminated? How will you protect your family? Fortunately, firefighters can apply for almost any type of life insurance policy.

Some insurance companies, like The Hartford, offer group life insurance for volunteer firefighters. See more details on our guide titled “Getting Life Insurance.”

What should you expect when you fill out an application? When you apply for a life insurance policy, an underwriter will cross-reference your information and place you in a rating class based on your perceived risk.

Younger, healthy adults who make positive lifestyle choices and have great medical backgrounds will be placed in the preferred category and receive the lowest rates. Folks who are perceived to be in average health will be placed in the standard category and will receive the base life insurance rates.

If you are older, at higher-risk, or have pre-existing medical conditions, you’ll be placed in the substandard category and will receive the highest rates.

Expect to answer the following questions:

- What is your height and weight?

- When is your birthday?

- What are your lifestyle habits?

- What are your exercise habits?

- What is your occupation and what specifically do you do?

- Do you use tobacco products?

- What are your health risks?

- What are your family health risks?

- Do you have a criminal record?

Even if you are applying for a type of insurance that does not require a medical examination, you will want to answer honestly.

Accidental errors will be dismissed, but if you are caught lying on your application, you risk losing coverage, receiving higher rates, or even a lower death benefit.

Pros and Cons of Workplace Life Insurance for Firefighters

It is standard for firefighters to receive life insurance benefits through their department at little to no cost. This is known as group insurance.

The underwriting process for group insurance is not the same as for an individual policy. Technically, you do not own your group insurance policy; your employer does.

If there is a cost associated with your group life insurance, your fellow firefighters are also paying those same rates.

There is often no medical examination associated with employer-provided life insurance, which means you’ll be covered at the set rate even if you have pre-existing medical conditions that may have otherwise caused your rates to increase.

The following video from eHowFinance further explains group insurance.

Group insurance is a great benefit that can provide you with some peace of mind. However, it would be wise for firefighters to invest in another policy to ensure they’ll be protected even after they’ve left their job.

Some of the other cons associated with an employer provided life insurance policy include a much lower death benefit, and rates depend on how many people are employed at the place of business.

We recommend investing in a second, independent life insurance policy. It’s legal and common to hold multiple policies. Many who have workplace life insurance also buy a secondary whole policy that never expires.

As a firefighter, utilize your group policy fully but plan for additional coverage for retirement or job changes.

How Does Being a Firefighter Affect Life Insurance Rates

The job of a firefighter can be extremely high-risk. Firefighters routinely put themselves in the face of danger in order to rescue civilians, put out major fires, and protect the general public.

Because of the associated risks, some life insurance providers will charge firefighters higher rates. Therefore, as a firefighter, it’s important you learn how your lifestyle can affect your term life insurance rate or whole life insurance rate.

For example, smokers pay higher rates for life insurance than non-smokers. Similarly, exercising is already part of a firefighter’s daily life.

Don’t forget to also practice healthy eating habits and to manage your stress levels. This will help you during your paramedical examination that may be required when applying for firefighters life insurance.

Fortunately, data gathered from 2019 proves that the death rate for firefighters while on duty continues to drastically decrease. According to the National Fire Protection Association, there were only 48 on-duty firefighter deaths in 2019, the lowest number ever on record.

As firefighting becomes safer, the likelihood of higher rates due to your job decreases. Having workplace life insurance is great, but it’s important to secure a policy that protects you and your family after retirement.

Ready to buy firefighter life insurance? Don’t wait—enter your ZIP code into our free quote tool below to find the best rates.

Read more:

Case Studies: Best Life Insurance for Firefighters

Choosing the right life insurance is crucial for firefighters, given the high risks associated with their profession. The following case studies are based on real-world scenarios to illustrate how Liberty Mutual, Nationwide, and Erie meet the unique needs of firefighters effectively.

- Case Study #1 – Comprehensive Coverage with Liberty Mutual: John, a veteran firefighter, opted for Liberty Mutual’s full coverage plan. When he was critically injured on duty, his policy provided extensive benefits that supported both his medical expenses and family’s financial needs.

- Case Study #2 – Nationwide’s Competitive Rates Benefit: Sarah, a young firefighter, chose Nationwide for its competitive rates. Her policy not only fit her budget but also offered substantial death benefits, ensuring her family’s future was secure in the event of any mishap.

- Case Study #3 – Flexible Options from Erie: Mark found Erie’s flexible policy options appealing as they allowed him to adjust his coverage as his career and family needs evolved. This adaptability proved invaluable when he needed to increase his coverage after the birth of his first child.

These scenarios emphasize the need for firefighters to choose life insurance policies that offer comprehensive coverage for long-term injuries and critical conditions, tailored to the high risks of their profession.

Liberty Mutual sets the standard for firefighter life insurance with unmatched financial stability and tailored coverage options.Daniel Walker Licensed Insurance Agent

Additionally, such policies must be adaptable, allowing for adjustments in coverage as personal and professional circumstances evolve, ensuring all-around security for firefighters and their families. Learn more in our guide titled “The Role of Life Insurance in Your Financial Plan.”

Safeguard your family’s future while saving on coverage — enter your ZIP code below to compare life insurance quotes with our free tool today.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Frequently Asked Questions

Why might my workplace insurance policy not be enough as a firefighter?

If your term policy expires or you leave your job, it may be challenging to find affordable coverage. Consider a whole policy.

For additional details, explore our comprehensive resource titled “Managing Your Life Insurance Policy.”

Can firefighters qualify for preferred rates on insurance?

Yes, depending on your age and medical history, you might qualify for preferred rates. Shopping around is recommended.

What are the best insurance policy options for firefighters?

Firefighters can apply for various types of policies. Some companies offer group insurance for volunteer firefighters. Comparing quotes is essential.

What are the pros and cons of workplace insurance for firefighters?

Pros include low or no cost and coverage without a medical examination. Cons include lower death benefits and dependence on employment status.

How does being a firefighter affect insurance rates?

Firefighters may be charged higher rates due to the high-risk nature of their job. However, rates can be influenced by overall health and lifestyle choices.

To find out more, explore our guide titled “Best Life Insurance for High-Risk Individuals.”

What is firefighter life insurance?

Firefighter life insurance is a specialized policy designed to meet the unique needs of those in this high-risk profession, offering financial protection against job-related hazards.

How does firefighter insurance benefit me?

Firefighter insurance provides comprehensive coverage tailored to the risks associated with firefighting, including life, health, and injury-related benefits.

Why should I consider life insurance for firefighters?

Life insurance for firefighters is crucial because it provides financial security and peace of mind, knowing that you and your family are protected financially in case of tragedy.

What is the typical firefighter health insurance cost?

Firefighter health insurance costs vary based on coverage, location, and provider, but generally offer affordable premiums due to group policy discounts.

To learn more, explore our comprehensive resource on “How To Find a Lower Term Life Insurance Premium.”

What types of insurance for firefighters are available?

Insurance for firefighters includes life, health, auto, and home insurance, each tailored to address the specific risks faced by firefighters.

Can firefighters get life insurance easily?

Yes, firefighters can get life insurance, with many providers offering policies specifically designed for the risks of the firefighting profession.

Find cheap life insurance quotes by entering your ZIP code into our free quote comparison tool below.

Is there special volunteer firefighter life insurance?

Yes, volunteer firefighter life insurance is available and often includes benefits similar to those offered to full-time firefighters at potentially lower rates.

Which is the best life insurance for firefighters?

The best life insurance for firefighters offers comprehensive coverage, competitive premiums, and is responsive to the specific risks and needs of the profession.

Learn more by reading our guide titled “How much term life insurance can you buy?”

What does police and fire life insurance cover?

Police and fire life insurance typically covers life-threatening incidents that occur on the job, providing benefits to both police officers and firefighters.

How does firefighter health insurance work?

Firefighter health insurance works by providing specialized health coverage that addresses the unique medical and health needs of firefighters.

What should I know about firefighter auto insurance?

Firefighter auto insurance often includes discounts and tailored coverage options that recognize the reliability and community importance of firefighters.

What are the benefits of volunteer firefighter health insurance?

Benefits of volunteer firefighter health insurance include lower premiums and coverage options designed for volunteers who may not have access to full-time benefits.

Access comprehensive insights into our guide titled “Private Health Insurance.”

Which fire department insurance companies are recommended?

Recommended fire department insurance companies are those with strong financial ratings and extensive experience in providing targeted coverage for fire services.

How is firefighter home insurance different?

Firefighter home insurance may offer special discounts and conditions considering the demanding nature of firefighting and the associated risks.

Who operates the firefighters insurance company?

The firefighters insurance company is typically operated by entities specializing in insurance for public service professionals, offering policies that address the specific needs of firefighters.

Enter your ZIP code below to compare instant life insurance quotes from highly-rated insurers and begin investing in your family’s future.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.