Best Life Insurance for a Non-Working Spouse in 2025 (Find the Top 10 Companies Here)

MassMutual, Banner Life, and Transamerica offer the best life insurance for a non-working spouse, with rates starting at $45/month. MassMutual provides strong financial stability. Banner Life is known for flexible terms, and Transamerica offers customizable plans. All ensure reliable coverage and affordability.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Life Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Licensed Life Insurance Agent

UPDATED: Mar 25, 2025

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Mar 25, 2025

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

0 reviews

0 reviewsCompany Facts

Full Coverage for Non-Working Spouse

A.M. Best Rating

Complaint Level

Pros & Cons

0 reviews

0 reviews 0 reviews

0 reviewsCompany Facts

Full Coverage for Non-Working Spouse

A.M. Best Rating

Complaint Level

0 reviews

0 reviewsThe top providers for the best life insurance for a non-working spouse are MassMutual, Banner Life, and Transamerica. MassMutual is distinguished by its strong cash value growth benefits and solid financial stability, making it a standout choice.

Banner Life offers exceptional flexibility with its policy options and has a reputation for excellent customer service. Transamerica provides extensive customization options and a wide range of life insurance riders to tailor coverage to individual needs.

Our Top 10 Company Picks: Best Life Insurance for a Non-Working Spouse

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 6% | A++ | Financial Security | MassMutual | |

| #2 | 7% | A+ | Affordable Premiums | Banner Life |

| #3 | 6% | A+ | Flexible Coverage | Transamerica | |

| #4 | 5% | A++ | Lifetime Coverage | Northwestern Mutual | |

| #5 | 7% | A- | Easy Application | Globe Life | |

| #6 | 12% | A | Extensive Coverage | AIG |

| #7 | 6% | A+ | Vitality Rewards | John Hancock |

| #8 | 5% | A+ | Customizable Policies | Pacific Life | |

| #9 | 6% | A+ | Customer Service | Nationwide |

| #10 | 4% | A+ | Flexible Underwriting | Mutual of Omaha |

Together, these providers deliver an ideal mix of affordability and comprehensive protection. They also offer tailored features specifically designed for non-working spouses.

Enter your ZIP code into our free quote comparison tool above to instantly compare life insurance quotes from trusted insurers near you.

- MassMutual offers best life insurance for a non-working spouse

- Banner Life and Transamerica provide flexible policies

- Non-working spouses benefit from comprehensive coverage

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#1 – MassMutual: Top Overall Pick

Pros

- Strong Financial Stability: Known for providing the solid financial security and stability for the best life insurance for a non-working spouse.

- Cash Value Growth: Discover our MassMutual life insurance review for details on substantial cash value accumulation benefiting non-working spouses.

- Comprehensive Coverage: Provides a wide range of comprehensive and adaptable coverage tailored to the needs of non-working spouses.

Cons

- Higher Premiums: Premiums may be higher, which could affect affordability for non-working spouse life insurance.

- Complex Choices: The variety of policy options might be overwhelming for non-working spouses to navigate.

#2 – Banner Life: Best for Affordable Premiums

Pros

- Budget-Friendly Rates: Offers excellent value with competitive pricing, making it ideal for the best life insurance for a non-working spouse.

- Flexible Policy Terms: Provides adaptable policy terms that can be customized to fit non-working spouses’ needs.

- Strong Customer Service: Explore our Banner Life life insurance review to see how high customer satisfaction enhances the experience for non-working spouses.

Cons

- Limited Riders: Offers fewer rider options, which might limit customization spouse life insurance

- Stricter Underwriting: The underwriting process may be more rigorous, impacting coverage for non-working spouses.

#3 – Transamerica: Best for Flexible Coverage

Pros

- Customizable Plans: View our Transamerica life insurance review to learn about customizable policies with tailored coverage options that make it a top choice for non-working spouses.

- Diverse Riders: Offers an array of riders to adjust coverage according to the unique needs of non-working spouses.

- Affordable Options: Features competitive pricing, making it easier for non-working spouses to access thorough and cost-effective coverage.

Cons

- Inconsistent Coverage Quality: Coverage can vary, which might affect the effectiveness for non-working spouse life insurance coverage

- Customer Service Concerns: Some users report less satisfactory service, impacting the experience for non-working spouses.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#4 – Northwestern Mutual: Best for Lifetime Coverage

Pros

- Customizable Plans: Offers flexible and lifetime policies, ideal for the best life insurance for a non-working spouse seeking long-term security.

- Strong Cash Value Growth: Delve into our Northwestern Mutual life insurance review for insights on substantial cash value accumulation and long-term financial benefits and growth.

- Reliable Service: Renowned for outstanding customer support, enhancing the overall experience for life insurance for spouses

Cons

- Higher Premium Costs: Policies may come with higher premiums, which could affect affordability for non-working spouses.

- Complex Policy Options: The variety of policy options can be complex and challenging to choose from.

#5 – Globe Life: Best for Easy Application

Pros

- Simple Application Process: The easy application process suits non-working spouses seeking hassle-free coverage for the best life insurance for a non-working spouse.

- Affordable Premiums: Check out our Globe Life life insurance review for budget-friendly rates that make it accessible for non-working spouses.

- Quick Approval: The application process is quick, allowing non-working spouses to secure coverage promptly.

Cons

- Basic Coverage Options: Limited policy options may not fully address all needs of non-working spouses.

- Limited Customization: Limited policy options could restrict flexibility for non-working spouses seeking non-working spouse life insurance.

#6 – AIG: Best for Extensive Coverage

Pros

- Broad Coverage Choices: Offers a wide range of coverage options, ideal for the best life insurance for a non-working spouse with diverse needs.

- Customizable Plans: Provides extensive customization to tailor policies for non-working spouses, ensuring a perfect fit for their needs.

- Competitive Rates: See our AIG life insurance review for affordable premiums that provide comprehensive coverage for non-working spouses.

Cons

- Complex Policy Details: The extensive range of options can be complex, which might confuse non-working spouses.

- Customer Service Issues: Some users report issues with customer service, impacting the overall experience for non-working spouses.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#7 – John Hancock: Best for Vitality Rewards

Pros

- Vitality Rewards Program: Read our John Hancock life insurance review to understand how its rewards program adds value to life insurance for non-working spouses.

- Customizable Policies: Provides flexible policy options tailored for non-working spouses.

- Health Incentives: Includes health incentives, which can be a significant benefit for non-working spouses.

Cons

- Complex Rewards System: The rewards program can be complicated, potentially making it challenging for non-working spouses.

- Higher Premiums: Policies may be more expensive due to the added rewards and features.

#8 – Pacific Life: Best for Customizable Policies

Pros

- Highly Customizable Plans: Offers a variety of customizable policies, making it a top choice for the best life insurance for a non-working spouse.

- Diverse Rider Options: Explore our Pacific Life life insurance review to find out about the range of riders available for non-working spouses.

- Competitive Pricing: Provides affordable options for comprehensive life insurance, ideal for non-working spouses.

Cons

- Overwhelming Choices: The extensive range of customization options can be overwhelming for some non-working spouses.

- Inconsistent Coverage Quality: Coverage quality may vary, which could affect satisfaction for non-working spouses.

#9 – Nationwide: Best for Customer Service

Pros

- Exceptional Customer Service: Discover our Nationwide life insurance review to see how strong customer service supports the best life insurance for non-working spouses.

- Affordable Policies: Offers budget-friendly options that are ideal for non-working spouses, ensuring economical coverage.

- Flexible Policy Terms: Provides adaptable terms to meet the specific needs of non-working spouses, allowing for personalized coverage.

Cons

- Limited Rider Options: Fewer rider choices may restrict the ability to customize coverage for non-working spouses.

- Coverage Limits: Some policies might have limits that affect the comprehensive needs of non-working spouses.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#10 – Mutual of Omaha: Best for Flexible Underwriting

Pros

- Adaptable Underwriting: Flexible underwriting process is ideal for the best life insurance for a non-working spouse.

- Cost-Effective Coverage: Offers competitive pricing for comprehensive life insurance, making it an affordable option.

- Customizable Plans: View our Mutual of Omaha life insurance review for information on plans tailored to meet the specific needs of non-working spouses.

Cons

- Limited Riders: Fewer rider options might limit customization for non-working spouses.

- Variable Coverage Quality: Quality of coverage can vary, which may impact best life insurance for spouse.

Leading on Best Life Insurance for Non-Working Spouse

Evaluating the best life insurance for a non-working spouse requires a comprehensive comparison of various insurance providers and their respective coverage options. It’s crucial to assess not only the affordability but also the extent of coverage each provider offers. The following table provides a detailed comparison of these providers:

Non-Working Spouse Life Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AIG | $48 | $142 |

| Banner Life | $47 | $140 |

| Globe Life | $45 | $135 |

| John Hancock | $51 | $150 |

| MassMutual | $50 | $150 |

| Mutual of Omaha | $46 | $140 |

| Nationwide | $49 | $146 |

| Northwestern Mutual | $52 | $155 |

| Pacific Life | $50 | $148 |

| Transamerica | $49 | $145 |

MassMutual is the top pick for the best life insurance for a non-working spouse, offering strong financial stability and comprehensive coverage. AIG provides affordable options, making it ideal for cheap life insurance for couples seeking solid protection.

Banner Life balances cost and coverage, while Globe Life is known for budget-friendly rates. John Hancock offers a rewards program, and Mutual of Omaha features competitive pricing and tailored plans.

Nationwide excels in customer service, Northwestern Mutual provides extensive coverage with strong financial backing, Pacific Life offers customizable policies, and Transamerica is noted for flexible policy options.

These providers assist in finding the best spouse life insurance and affordable options for couples. Life insurance and financial planning insights will guide you in selecting a plan that ensures comprehensive coverage for your non-working spouse’s future.

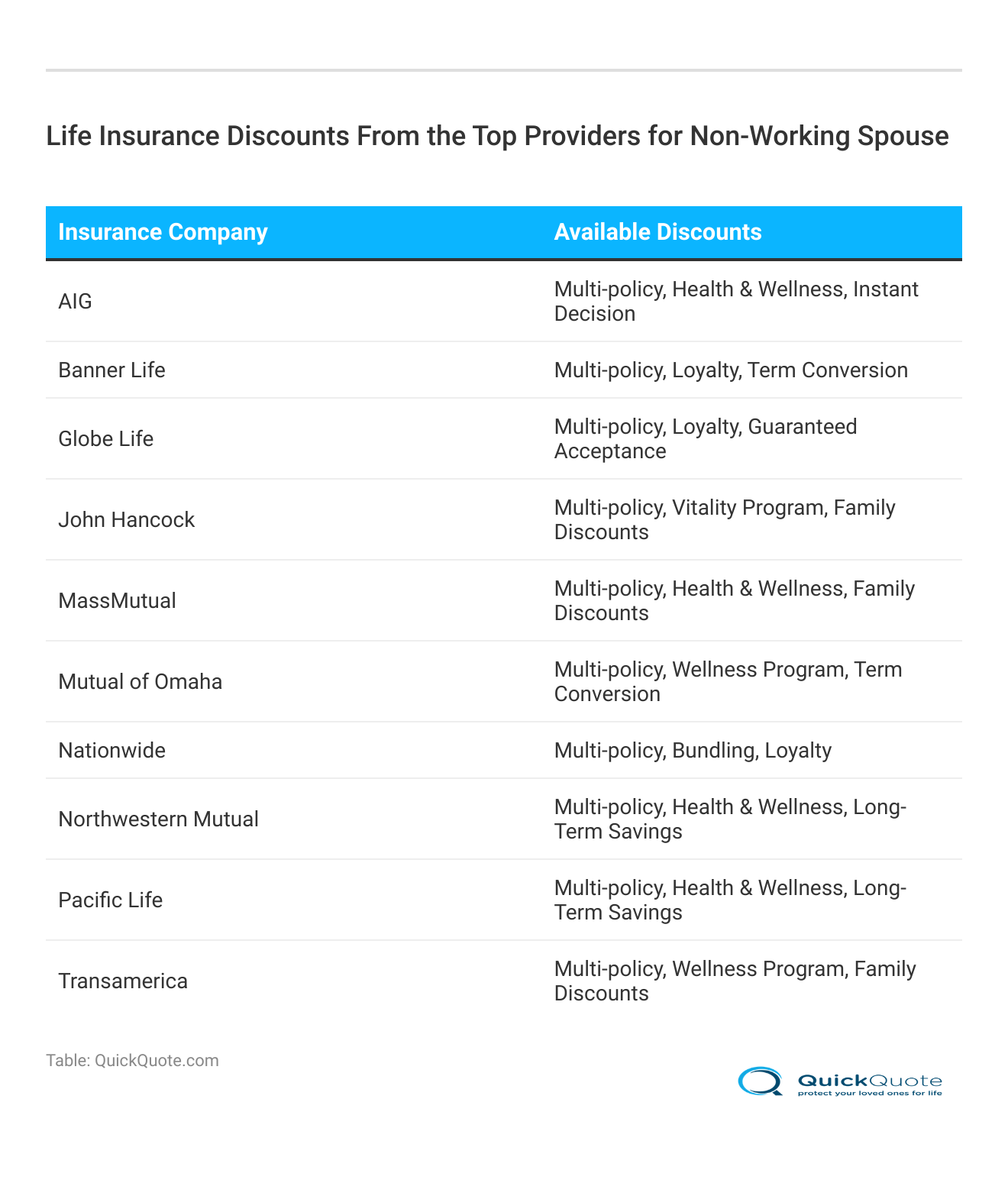

Get Affordable Best Life Insurance for Non-Working Spouse

To ensure you get the best value from life insurance for a non-working spouse, it’s essential to explore and understand the various discounts offered by top insurance providers.

These discounts can significantly influence the overall cost of your policy and enhance the benefits you receive. The following table outlines the discounts offered by leading insurance companies:

MassMutual stands out as the top choice for the best life insurance for a non-working spouse. It provides a range of valuable discounts, This discount helps reduce overall costs by bundling multiple policies. AIG offers health and wellness discounts, reducing costs for non-working spouses who stay healthy.

Banner Life offers loyalty discounts for long-term policyholders, while Globe Life provides guaranteed acceptance discounts. John Hancock makes coverage more affordable with family discounts.

MassMutual remains the best pick for non-working spouse life insurance, offering unmatched benefits and coverage.

Jimmy McMillan Licensed Insurance Agent

These options are beneficial for life insurance for an unemployed spouse. How to save money when buying life insurance? Here are strategies to maximize benefits:

- Discounts for Healthy Living: Maintaining a healthy lifestyle can lead to discounts on your premiums. Providers often offer health and wellness discounts for those who engage in activities that promote good health.

- Loyalty Discounts: Long-term policyholders may be rewarded with loyalty discounts. This can help lower costs over time as you continue to maintain your coverage.

- Bundle Insurance Policies: Combining life insurance with other types of insurance policies can lead to significant savings through bundling discounts.

- Long-Term Savings Discounts: Opting for long-term savings discounts can help you benefit from lower premiums and secure coverage over an extended period.

Utilizing the various discounts offered by top providers and carefully selecting the right plan, you can achieve both affordability and comprehensive protection with the best life insurance for unemployed spouse.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Life Insurance Costs for Non-Working Spouses

Determining the best life insurance for a non-working spouse can be complex due to varying premiums between policy types. Premiums depend on factors like policy type, coverage amount, age, and gender.

If you’re wondering, “what is spouse life insurance?” it’s coverage tailored for a spouse to provide financial security for the family. The first table provides an overview of average monthly rates for a 20-year term life insurance policy, showing how these premiums differ by age and gender.

This snapshot helps in understanding the baseline costs associated with term insurance for non-working spouse, which generally offers lower premiums compared to whole life insurance.

Term Life Insurance Monthly Rate By Age & Gender

| Policyholder Age | Male Rates | Female Rates |

|---|---|---|

| 25 | $15 | $13 |

| 30 | $15 | $13 |

| 35 | $18 | $15 |

| 40 | $21 | $19 |

| 45 | $27 | $23 |

| 50 | $36 | $29 |

| 55 | $51 | $38 |

| 60 | $85 | $60 |

| 65 | $145 | $97 |

Now, compare these figures with those in the second table, which details the monthly premiums for whole life insurance policies across various ages and coverage amounts.

This table highlights how premiums rise significantly with age and coverage level, illustrating the generally higher cost of whole life insurance compared to term life insurance.

Whole Life Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 25 Female | $50 | $150 |

| Age: 25 Male | $55 | $160 |

| Age: 35 Female | $65 | $170 |

| Age: 35 Male | $70 | $180 |

| Age: 45 Female | $80 | $220 |

| Age: 45 Male | $85 | $230 |

| Age: 55 Female | $105 | $290 |

| Age: 55 Male | $115 | $310 |

| Age: 65 Female | $150 | $450 |

| Age: 65 Male | $160 | $470 |

As illustrated, life insurance costs increase with age and are often higher for men than for women. Whole life insurance, with its lifelong coverage and cash value component, is typically more expensive than term life insurance.

For many families, term life insurance for couples offers a more cost-effective solution, especially when considering the nonworking spouse method. This affordability makes spouse term life insurance an attractive option for securing spouse life insurance coverage, especially for a non-working spouse.

MassMutual excels in providing life insurance for non-working spouses, offering comprehensive coverage that safeguards your loved ones' future.

Jeffrey Manola Licensed Insurance Agent

Providers like MassMutual and Northwestern Mutual offer competitive rates and benefits, helping you find the best life insurance policy for spouse while managing expenses effectively.

When balancing costs with comprehensive coverage, married life insurance plans that include health insurance for non-working spouse benefits can further enhance the protection offered.

Case Studies: Life Insurance for Non-Working Spouse

Here are three case studies illustrating how leading life insurance providers offer tailored solutions to families seeking the best life insurance for a non-working spouse.

- Case Study #1 – Long-Term Coverage with Cash Value Benefits: Sarah, a non-working spouse in Boston, chose MassMutual for its reliable protection and cash value growth. The policy provided long-term security and financial benefits, aligning with her family’s needs.

- Case Study #2 – Affordable Premiums with Flexible Terms: John and Emily from Denver selected Banner Life for its affordable premiums and flexible terms. Banner Life’s policy fit their budget while ensuring comprehensive coverage for Emily. This allowed them to buy life insurance for spouse without compromising their financial goals.

- Case Study #3 – Customizable Policies with Comprehensive Benefits: Olivia in Seattle opted for Transamerica due to its customizable policies and extensive riders. The plan allowed her to buy life insurance for a spouse with adaptable features as her family’s needs changed.

These case studies showcase how various insurance providers deliver customized solutions for purchasing life insurance for a non-working spouse.

They highlight the diverse strategies and benefits offered by top companies in life insurance for families Answering the question, “how much spouse life insurance do I need?” to ensure proper coverage and protection.

Optimal Life Insurance for Non-Working Spouses

Securing the best life insurance for a non-working spouse involves a thorough evaluation of several key factors to ensure that the policy provides both comprehensive coverage and cost-effectiveness.

When planning for a non-working spouse’s financial security, consider their unique needs and the family’s long-term goals. Leading providers like MassMutual offer competitive discounts and policies specifically tailored for non-working spouses, ensuring excellent protection and value.

Banner Life provides affordable term life insurance quotes with flexible coverage, perfect for budget-conscious families, while Transamerica offers customizable policies with spouse riders, known for its financial stability and strong service.

Ultimately, the goal is to choose a life insurance policy that provides strong protection for your family’s needs, ensuring financial stability and peace of mind for both partners. Explore how to get life insurance on your spouse to ensure comprehensive coverage.

To instantly compare life insurance quotes from the top providers, simply enter your ZIP code into ourfree quote comparison tool below.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Frequently Asked Questions

What are the three main types of best life insurance for a non-working spouse?

The three main types of life insurance are term life insurance, whole life insurance, and universal life insurance. To find the best option, consider how spouse life insurance works and choose the type that offers the most suitable coverage and benefits.

Can you take out a life insurance policy on your spouse?

Yes, you can. To determine how much life insurance do I need for my spouse, choose a policy that reflects their role and contributions. For the best coverage for a non-working spouse, ensure the policy meets their value in your life.

When you’re ready to look at life insurance quotes, enter your ZIP code below into our free comparison tool.

What is the difference between life insurance and non-working spouse life insurance?

Life insurance generally refers to coverage for any individual, while non-working spouse life insurance specifically addresses policies tailored to protect a non-working spouse, ensuring their unique needs are met.

What happens if the owner of a life insurance for a non-working spouse policy dies before the insured?

If the owner of a life insurance policy dies before the insured, the policy typically remains in force. Ensuring the best life insurance for a non-working spouse means making sure the policy is structured to provide continued benefits and protection.

What type of best life insurance for a non-working spouse covers a husband and wife? Should both spouses have life insurance?

Joint life insurance policies, such as joint term or modified whole life insurance, cover both spouses, making them ideal for non-working spouse life insurance and addressing the question of whether both spouses should have coverage.

Does my husband need to be the beneficiary for the best life insurance for a non-working spouse?

No, your husband does not need to be the beneficiary, but naming him could be beneficial. For the best life insurance for a non-working spouse, consider how beneficiary designations impact the policy’s effectiveness and benefits.

How much will my spouse get with the best life insurance for a non-working spouse?

The amount your spouse will receive depends on the coverage amount of the policy. To ensure you have the best life insurance for a non-working spouse, choose a policy that provides sufficient financial support based on your family’s needs.

Can I put the best life insurance for a non-working spouse on my wife?

Yes, you can purchase the best life insurance for a non-working spouse for your wife. If you’re wondering, “does my wife need life insurance?” it’s important to choose a policy that offers appropriate coverage and benefits for her role in the household.

What is the non-working spouse method for best life insurance?

The nonworking spouse method for the best life insurance involves assessing the economic value of a non-working spouse’s contributions to the household to determine the minimum coverage amount for life insurance.

What is the easy method for the best life insurance for a non-working spouse?

The easy method involves using a simple formula to estimate coverage needs. This ensures adequate coverage based on a non-working spouse’s contributions and financial needs. Can you get life insurance on your spouse? Yes, and this method helps secure the right policy for your family.

Compare rates with as many companies as possible using our free comparison tool. Simply enter your ZIP code below to get immediate quotes.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Life Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Licensed Life Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.