Best Life Insurance for Undocumented Immigrants (Top 10 Companies in 2025 )

The best life insurance for undocumented immigrants comes from Prudential, Banner Life, and AIG, with rates starting at $45 per month. Prudential leads with broad coverage options tailored for undocumented immigrants, ensuring access to comprehensive protection through flexible plans designed for diverse needs.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Jan 27, 2025

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 27, 2025

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

0 reviews

0 reviewsCompany Facts

Full Coverage for Undocumented Immigrants

A.M. Best Rating

Complaint Level

Pros & Cons

0 reviews

0 reviews 163 reviews

163 reviewsCompany Facts

Full Coverage for Undocumented Immigrants

A.M. Best Rating

Complaint Level

Pros & Cons

163 reviews

163 reviewsPrudential, BannerLife, and AIG stand out as the best life insurance for undocumented immigrants, with Prudential emerging as the top choice due to its tailored coverage and exceptional benefits.

These companies provide exceptional protection and flexibility for undocumented immigrants, with Prudential’s specialized plans offering the most comprehensive and accessible coverage.

Our Top 10 Company Picks: Best Life Insurance for Undocumented Immigrants

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 5% A+ Broad Coverage Prudential

#2 6% A+ Competitive Rates Banner Life

#3 6% A Extensive Network AIG

#4 5% A+ Global Coverage Nationwide

#5 6% A++ Comprehensive Policies Northwestern Mutual

#6 5% A+ Flexible Terms Transamerica

#7 4% A+ Accessible Service Mutual of Omaha

#8 7% A+ Customizable Plans John Hancock

#9 5% A- Affordable Rates Globe Life

#10 4% A+ Flexible Coverage Lincoln

For reliable and affordable life insurance, these providers deliver the best options on the market. Gain insights from our guide titled, “Compare Types of Life Insurance Coverage.”

You can get free quotes for life insurance and secure financial protection for your loved ones by entering your ZIP code into our tool above.

- Prudential is the top pick for life insurance coverage

- Policies are designed specifically for undocumented immigrants

- These plans offer accessible, flexible coverage options

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#1 – Prudential: Top Overall Pick

Pros

- Multi-Policy Deals for Undocumented Individuals: Prudential provides a 5% discount for bundling multiple insurance types, including for undocumented immigrants, offering substantial savings on health, life, and auto coverage. Uncover details in our guide titled, “Prudential Life Insurance Company Review.”

- Top-Tier Financial Stability (A+ Rating): Prudential’s impressive A+ score from A.M. Best underscores its strong financial resilience, providing reassurance to undocumented immigrants seeking reliable coverage options that can withstand economic shifts.

- Diverse Coverage Range: Offering a vast array of coverage options, Prudential allows undocumented immigrants to tailor their plans to meet various life stages and financial needs, ensuring a more customized and secure insurance experience.

Cons

- Smaller Bundling Savings: While Prudential’s multi-policy discount is advantageous, it may not compete with higher savings provided by other companies, leaving some undocumented immigrants hoping for greater discounts somewhat underwhelmed.

- Complex Application Process: The extensive coverage options may come with a slightly more intricate application procedure, which could be daunting for undocumented immigrants unfamiliar with the insurance landscape.

#2 – Banner Life: Best for Competitive Rates

Pros

- Competitive Premiums for Undocumented Immigrants: Banner Life offers highly competitive pricing, even for undocumented immigrants, making it a great choice for affordable essential protection. Learn more about the offerings in our guide titled, “Banner Life Insurance Company Review.”

- Discount on Bundled Policies: For undocumented individuals looking to consolidate their insurance under one umbrella, Banner Life provides a 6% reduction on bundled policies, allowing them to save across multiple areas of coverage, including life and auto insurance.

- Strong Financial Position (A+ Rating): Banner Life’s A+ ranking from A.M. Best assures clients, including undocumented immigrants, of the company’s ability to cover claims reliably, providing added peace of mind for those wary of financial instability.

Cons

- Limited Network for Undocumented Immigrants: Banner Life’s smaller network of agents might pose a challenge for undocumented immigrants in certain areas, potentially requiring more effort to access personalized help or consultations.

- Niche Focus on Life Insurance: While the company excels in life insurance, undocumented immigrants needing a broader range of policies—like home or health—might find Banner Life’s offerings to be somewhat limited.

#3 – AIG: Best for Extensive Network

Pros

- Discount for Undocumented Immigrants Across Policies: AIG offers a significant 6% discount on bundled insurance options, making it an appealing choice for undocumented immigrants seeking comprehensive protection that covers different facets of their lives.

- Broad International Reach: With AIG’s extensive global presence, undocumented immigrants living in or frequently traveling across multiple countries can benefit from consistent coverage across borders, a crucial factor for those needing international mobility.

- Financial Strength (A Rating): Although rated slightly lower than its competitors, AIG’s A rating still reflects solid financial security, reassuring undocumented immigrants that the company can meet claims without difficulty. Access detailed insights in our guide titled, “AIG Life Insurance Review.”

Cons

- Moderate Premium Costs for Undocumented Immigrants: AIG’s insurance packages may come with slightly higher premium prices than some of its competitors, especially for undocumented immigrants looking for more budget-conscious options.

- Complexity in Policy Structure: The intricate structure of AIG’s policies might confuse some undocumented immigrants unfamiliar with the finer points of insurance, leading to potential misunderstandings during the enrollment process.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#4 – Nationwide: Best for Global Coverage

Pros

- Global Coverage for Undocumented Immigrants: Nationwide offers exceptional international coverage, perfect for undocumented immigrants needing insurance that covers both domestic and overseas needs.

- Bundling Discount: A 5% discount for bundled plans helps reduce overall costs, making insurance more affordable for undocumented immigrants.

- Top Financial Rating: With an A+ rating from A.M. Best, Nationwide provides reliable financial stability for those seeking trustworthy insurance. Dive into our article called, “Nationwide Life Insurance Review.”

Cons

- Lower Savings for Undocumented Immigrants Compared to Competitors: While the bundling discount is advantageous, other providers may offer higher savings, which could limit Nationwide’s attractiveness for undocumented immigrants focused on maximizing financial benefits.

- More Limited Coverage for Specialized Policies: Despite its global presence, Nationwide may offer fewer specialized policies for undocumented immigrants seeking niche coverage types, such as those tailored to unique living situations or travel needs.

#5 – Northwestern Mutual: Best for Comprehensive Policies

Pros

- Inclusive Coverage for Undocumented Immigrants: Northwestern Mutual offers extensive policies for undocumented immigrants with an A++ A.M. Best rating, ensuring strong financial stability.

- Attractive Bundling Savings: Enjoy a 6% discount on bundled plans, making it cost-effective for undocumented immigrants to secure comprehensive coverage.

- Diverse Policy Options: Access a wide range of insurance types, including life and disability protection, all from a single provider. Uncover details in our guide titled, “Northwestern Mutual Life Insurance Review.”

Cons

- Relative Discount Limits: While the 6% bundling discount is beneficial, it may not be as competitive as those from other insurers, potentially limiting the financial advantages for undocumented immigrants.

- Premium Variability: Despite the discount, the overall costs of Northwestern Mutual’s premiums might remain relatively high. This could be a hurdle for undocumented immigrants who are also cost-conscious, as the expense of coverage may still be considerable.

#6 – Transamerica: Best for Flexible Terms

Pros

- Access for Undocumented Immigrants: Transamerica offers flexible insurance options for undocumented immigrants, with an A+ rating from A.M. Best underscoring its strong financial stability and customer service. Learn more in our “Transamerica Life Insurance Review.

- Valuable Bundling Savings: Transamerica provides a 5% discount on bundled policies, giving significant savings and financial relief for undocumented immigrants. Gain insights from our guide titled, “Transamerica Life Insurance Review.”

- Flexible Coverage Solutions: With adaptable policy terms, Transamerica allows undocumented immigrants to adjust their coverage as needed, ensuring it remains relevant and effective.

Cons

- Moderate Discount Level: The 5% bundling discount, while beneficial, may not be as substantial as those provided by other companies. This could result in fewer overall savings for undocumented immigrants compared to other insurance providers.

- Possible Coverage Restrictions: Some of Transamerica’s policies might have limitations or restrictions that could affect the overall adequacy of coverage. Undocumented immigrants might find certain options less comprehensive than those offered by competitors.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#7 – Mutual of Omaha: Best for Accessible Service

Pros

- Service Availability for Undocumented Immigrants: Mutual of Omaha is known for its accessible service to undocumented immigrants and holds an A+ rating from A.M. Best, highlighting its strong customer service and reliability. To discover more about the company, visit our guide titled, “Mutual of Omaha Life Insurance Review.”

- Beneficial Bundling Savings: Offering a 4% discount on bundled policies, Mutual of Omaha helps reduce insurance costs, making coverage more affordable for undocumented immigrants. This discount can contribute to budget-friendly insurance solutions.

- Excellent Customer Assistance: Mutual of Omaha’s dedication to high-quality customer service ensures that undocumented immigrants receive prompt and effective support. The company’s focus on accessibility aids clients in navigating their insurance options smoothly.

Cons

- Lower Discount Rate: The 4% bundling discount, though useful, may be less competitive compared to higher discounts available from other insurers. This could mean reduced savings potential for undocumented immigrants.

- Variable Premium Costs: Even with the discount, some policies from Mutual of Omaha might have higher premiums. This could pose a challenge for undocumented immigrants who are looking for more affordable insurance alternatives.

#8 – John Hancock: Best for Customizable Plans

Pros

- Customizable Plans for Undocumented Immigrants: John Hancock provides flexible insurance plans tailored for undocumented immigrants, backed by an A+ A.M. Best rating for reliability. For details, see our full guide titled, “John Hancock Life Insurance Company Review.”

- Generous Bundling Savings: The 7% discount on combined insurance policies is among the most competitive in the market, providing significant cost savings for undocumented immigrants. This discount can notably decrease the total expense of multiple insurance types.

- Flexible Coverage Options: John Hancock’s emphasis on customizable plans allows undocumented immigrants to tailor their coverage to suit their changing needs. This flexibility ensures that insurance remains relevant and effective as personal or financial situations evolve.

Cons

- Potential for Higher Premiums: Although the 7% bundling discount is advantageous, overall premium costs might still be relatively high. This could present an obstacle for undocumented immigrants seeking more affordable insurance options.

- Complex Policy Structures: The extensive customization options may lead to more intricate policy structures. This complexity could be overwhelming for some undocumented immigrants, making it harder to fully comprehend and manage their insurance coverage.

#9 – Globe Life: Best for Affordable Rates

Pros

- Affordability for Undocumented Immigrants: Globe Life offers affordable insurance rates, ideal for undocumented immigrants seeking budget-friendly coverage. Its A- rating from A.M. Best reflects its strong financial stability and commitment to cost-effective solutions. For more details, see our guide titled, “Global Life Insurance Company Review.”

- Cost-Saving Bundling Discounts: The 5% discount on bundled policies helps to lower insurance expenses, offering additional savings for undocumented immigrants looking to maximize their budget while securing essential coverage.

- Simple and Accessible Coverage: Globe Life’s straightforward policy structures make it easy for undocumented immigrants to understand and obtain insurance coverage without encountering complex terms or conditions.

Cons

- Moderate Discount Amount: The 5% bundling discount, while beneficial, may not be as substantial as those provided by other insurers. This could limit the overall savings for undocumented immigrants compared to alternative options.

- Potential Coverage Gaps: Globe Life’s policies might not offer as many options or as comprehensive coverage as some competitors. This could result in fewer choices for undocumented immigrants, potentially restricting their ability to find the optimal insurance plan.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#10 – Lincoln Financial: Best for Flexible Coverage

Pros

- Undocumented Immigrants Included: Lincoln Financial provides versatile insurance coverage options for undocumented immigrants, supported by an A+ rating from A.M. Best. This flexibility allows for a range of policy modifications to suit various needs.

- Valuable Bundling Savings: The 4% discount on bundled policies offers financial savings, making insurance more accessible for undocumented immigrants who require flexible coverage solutions.

- Adaptable Coverage Solutions: Lincoln Financial’s policies are designed to be flexible, enabling undocumented immigrants to adjust their coverage based on changing circumstances and personal needs. Discover more by exploring our in-depth guide titled, “Lincoln National Life Insurance Review.”

Cons

- Smaller Discount Rate: The 4% bundling discount may not be as impactful as those offered by other insurers, potentially resulting in less overall savings for undocumented immigrants.

- Possibly Higher Premiums: Despite the flexibility, some policies from Lincoln Financial might come with higher premiums. This could be a consideration for undocumented immigrants seeking more cost-effective insurance solutions.

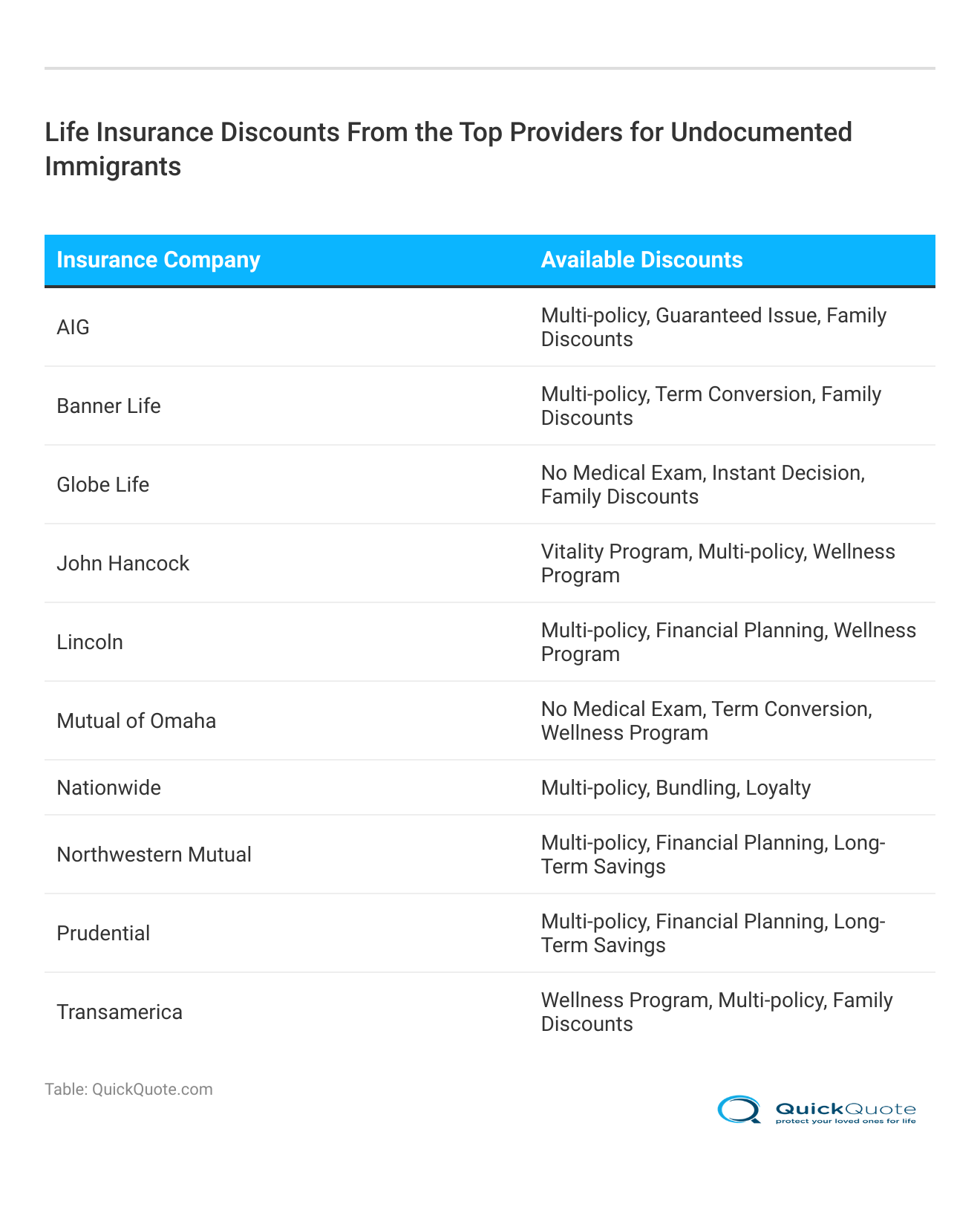

Comparative Life Insurance Rates for Undocumented Immigrants

The table below provides a comparative overview of life insurance monthly rates based on coverage levels from various insurance companies, focusing on policies available for undocumented immigrants.

For minimum coverage, Globe Life offers the most economical option at $45 per month, while Northwestern Mutual presents the highest rate at $52.

Undocumented Immigrants

Life Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AIG $50 $148

Banner Life $47 $140

Globe Life $45 $135

John Hancock $51 $150

Lincoln $49 $144

Mutual of Omaha $46 $140

Nationwide $49 $146

Northwestern Mutual $52 $155

Prudential $48 $142

Transamerica $49 $145

When considering full coverage, Globe Life remains the most affordable at $135, whereas John Hancock leads with the highest rate at $150. This range highlights significant variation in cost, reflecting differing policy structures and coverage levels among providers.

This detailed comparison aids in understanding the cost implications of different coverage levels, allowing undocumented immigrants to make informed decisions based on their financial situation and coverage needs. Read our guide titled “Life Insurance Rates by State” for more information.

Options for Life Insurance for Undocumented Immigrants

The Social Security Administration has assigned a Social Security number to nearly every legal resident of the United States. Both the government and private sector uses SSNs as a way of identifying and gathering information about an individual. Typically, natural-born U.S. citizens must present their SSN to qualify for life insurance.

The identification process required for undocumented immigrant life insurance looks slightly different than that of citizens with SSNs. To qualify for life insurance coverage as an undocumented person, you will need to present the following items:

- A United States residency address

- Your Individual Taxpayer Identification Number

- A functioning checking account in your name

By providing a valid U.S. residency address, an Individual Taxpayer Identification Number, and a functioning checking account, undocumented immigrants can navigate the insurance application process.

Understanding these requirements can help ensure that you secure the necessary coverage to protect yourself and your loved ones effectively.

Read more: Do you need a Social Security Number to get life insurance?

Understanding Life Insurance with an ITIN

The Internal Revenue Service explains the details of an Individual Taxpayer Identification Number. In short, an ITIN functions similarly to a natural-born citizen’s SSN. Both the SSN and ITIN consist of a unique set of numbers applied to you to identify you with government agencies.

You may locate your ITIN on a paystub assuming you have been employed in the United States. Otherwise, you may fill out a W-7 request form. After you send the form, the IRS may provide you with an ITIN.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Steps for Undocumented Immigrants to Obtain Life Insurance

Whether you are working in the United States on a visa or in the process of applying for a green card, you may still get life insurance as an undocumented person. Assuming you have already undergone the process of obtaining an ITIN, you may start seeking life insurance by researching life insurance companies.

Typically, you do not have to worry about authorities finding out about your undocumented status through your company. Unless a warrant mandates your information be turned over, most life insurance companies will not share your details with authorities.

Read more:

Discover a Preferred Insurance Provider

As an undocumented immigrant, you may start applying for life insurance after all your information is in place. You will have many options to choose from while deciding on a life insurance company. Consider the following while deciding which is right for you:

- Allstate

- State Farm

- Guardian Life

- MassMutual

- Northwestern Mutual

Remember, life insurance companies categorize applicants by risk. Your rates will rise as you age, or if you regularly ingest nicotine or other substances. If you live a healthier lifestyle, you should not have to worry about overly high insurance rates. Obtain detailed insights by reading our guide titled, “Life Insurance Rate Factors.”

Select an Appropriate Life Insurance Coverage Plan

After you settle on a company you feel comfortable with, you must decide which coverage plan suits your needs best. Each life insurance policy comes with a unique set of benefits and policy rates. The standard life insurance policies available include term, permanent, and guaranteed issue life insurance.

The Most Common Life Insurance Policy

Term life insurance is the most common and cost-efficient out of the three typical life insurance plans. This policy comes with designated coverage costs and generally lasts for a decade.

To illustrate, with term life insurance, if you invest in a plan with a $10,000 coverage cost, your policy will last up to a decade with a $10,000 amount in the event of unexpected death.

Permanent Life Insurance

As the name implies, permanent life insurance remains in effect for as long as you are alive. Permanent life insurance can incorporate retirement and investment factors on top of similar packages displayed in term life insurance.

Other Life Insurance Policies

Guaranteed issue life insurance policies also are known as non-medical or no exam insurance policies. These life coverage plans are ideal for undocumented individuals who do not wish to be examined by a medical professional, which is typically required before qualifying for life insurance.

However, this type of coverage plan tends to be less cost-efficient despite providing the same benefits as term life insurance.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Visit a Medical Facility for an Exam

You must be examined by a medical professional if you wish for something other than guaranteed issue life coverage plans. Medical exams allow insurance companies to determine the risk associated with your health.

Using the results of your medical appointment, your life insurance company will determine your insurance rates. Typically, there are four categories of statuses that apply to applicants for insurance coverage:

- The least amount of coverage or substandard

- The next coverage upgrade, or standard

- A decent amount of coverage, or the preferred category

- The most amount of coverage, or super preferred (preferred plus)

If you are placed in the preferred or preferred plus categories, your life insurance company identifies you as an individual living a healthy lifestyle. Those with less healthy lifestyles, such as those who regularly consume addictive substances, will be put into the remaining categories.

Read the article called “Types of Life Insurance” for additional insights.

Purchase the Right Insurance Coverage Plan for You

Upon completing all necessary steps and deciding on a life insurance company, you may officially purchase a life insurance policy. If you are curious, you may compare policies between several companies by receiving a quote.

A quote will not require you to commit to a coverage plan with that company. To discover more about the company, visit our guide titled, “How long should life insurance coverage last?”

Understanding Insurance as an Undocumented Immigrant

Just because your citizenship status is undocumented does not mean that you cannot obtain some type of life insurance. There are plenty of insurance companies that offer life insurance for undocumented immigrants.

Just remember that you will be required to present a U.S. residential address, ITIN, and a valid checking account. For more information, check out our complete guide titled, “Best Life Insurance.”

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Case Studies: Life Insurance for Undocumented Immigrants

Selecting the right life insurance is vital for securing your family’s future, particularly for undocumented immigrants who face unique challenges. The following fictional case studies highlight how AIG, Globe Life, and John Hancock cater to the needs of their clients effectively.

- Case Study #1 – Maria’s Story: Maria, an undocumented immigrant in the U.S., seeks life insurance to safeguard her family financially in case of her death. After getting an ITIN, Maria chooses a term life policy with $100,000 coverage to secure her family’s finances for 20 years.

- Case Study #2 – Carlos and Sofia’s Journey:Carlos and Sofia, an undocumented married couple living in the U.S., seek to secure their children’s future. They obtain ITINs and select a reputable life insurance policy with retirement and investment benefits for long-term family security.

- Case Study #3 – Juan’s Experience: Juan, an undocumented immigrant, prefers not to go through a medical exam to obtain life insurance coverage. He values privacy and seeks a simple application process, leading Juan to choose guaranteed issue life insurance without a medical exam.

These scenarios illustrate the importance of choosing a life insurance provider that understands and meets the specific needs of undocumented immigrants, offering them peace of mind and financial stability. For further details, see our guide titled, “Calculate Your Term Life Insurance Needs.”

Safeguard your family’s future while saving on coverage — enter your ZIP code below to compare life insurance quotes with our free tool today.

Frequently Asked Questions

Can undocumented immigrants obtain life insurance in the United States?

Yes, it is possible for undocumented immigrants to get life insurance in the U.S. They need to follow a specific process and provide certain documents, such as an Individual Taxpayer Identification Number (ITIN) and a valid U.S. residential address.

For additional details, explore our comprehensive resource titled, “How to Buy Life Insurance.”

How does life insurance work with an ITIN?

An ITIN functions similarly to a Social Security number (SSN) for natural-born citizens. Undocumented immigrants can obtain an ITIN, which allows them to apply for life insurance coverage. They can find their ITIN on a paystub or by filling out a W-7 request form with the Internal Revenue Service (IRS).

What steps do undocumented immigrants seeking life insurance need to take?

Undocumented immigrants can start seeking life insurance by researching life insurance companies once they have obtained an ITIN. They should choose a reputable insurance company and select a coverage plan that suits their needs, such as term life insurance, permanent life insurance, or guaranteed issue life insurance.

Do undocumented immigrants need to undergo a medical exam for life insurance?

If undocumented immigrants opt for a coverage plan other than guaranteed issue life insurance, they will need to undergo a medical exam. The results of the exam will determine their insurance rates. Insurance companies categorize applicants based on their health status, with preferred or preferred plus categories for healthier individuals.

Can undocumented immigrants understand insurance options and purchase a policy?

Undocumented immigrants can understand and purchase life insurance policies. They need to provide the necessary documents and meet the requirements set by insurance companies. It’s important to have a valid U.S. residential address, an ITIN, and a valid checking account. Comparing quotes from different companies can help in making an informed decision.

To find out more, explore our guide titled, “Comparing Term Life Insurance Quotes.”

Can undocumented immigrants get life insurance?

Undocumented immigrants can secure life insurance, although options may be limited and vary by provider. Companies such as Globe Life and John Hancock offer policies that might be available to undocumented immigrants, but it’s crucial to review each insurer’s specific criteria.

Which life insurance companies accept ITIN numbers for undocumented immigrants?

Several life insurance companies accept ITIN numbers for undocumented immigrants, including Prudential, Mutual of Omaha, and Transamerica. These companies allow individuals with an ITIN to apply for life insurance, though additional documentation might be required.

Is there life insurance available for green card holders who are undocumented immigrants?

Yes, green card holders, even if considered undocumented immigrants due to visa status, can access life insurance in the U.S. Providers like AIG and Northwestern Mutual offer policies suited to green card holders’ needs.

Can non-U.S. citizens who are undocumented immigrants get life insurance?

Non-U.S. citizens, including undocumented immigrants, can obtain life insurance, though the process may be more complicated and premiums might be higher. Insurers such as Lincoln Financial and Nationwide offer policies for non-citizens, but applicants generally need to provide proof of residency and a valid visa.

For further details, see our guide titled, “Best Life Insurance for Non-US Citizens.”

Is life insurance available for permanent residents who are undocumented immigrants?

Yes, permanent residents, even if they are undocumented immigrants due to specific visa statuses, can purchase life insurance with options similar to those available to U.S. citizens. Providers like Banner Life and Globe Life offer policies designed for permanent residents.

Can foreigners who are undocumented immigrants purchase life insurance in the USA?

Foreigners, including undocumented immigrants, can acquire life insurance in the USA, though this may involve more documentation and potentially higher premiums. Insurers such as Prudential and Transamerica offer policies for foreigners, but applicants must usually show proof of residency and a valid visa.

Give your loved ones the gift of financial security by entering your ZIP code below to find life insurance that doesn’t break the bank.

Can I get life insurance with an ITIN number if I am an undocumented immigrant?

Yes, undocumented immigrants can obtain life insurance using an ITIN number through insurers like Prudential and Mutual of Omaha. Applicants will need to meet the insurer’s documentation requirements and provide proof of identity.

Can undocumented immigrants get life insurance in the USA?

Undocumented immigrants can purchase life insurance in the USA, though they may face additional challenges and higher premiums. Insurers such as John Hancock and Globe Life may provide options tailored to undocumented immigrants, but specific requirements and coverage details should be reviewed directly with the insurance providers.

Learn more by reading our guide titled, “Best Life Insurance Companies that Offer 10-Year Term Policies.”

What are the options for life insurance for undocumented immigrants with an ITIN number?

Undocumented immigrants with an ITIN number have various life insurance options available, including plans from companies like Prudential and Transamerica. These insurers typically accept ITINs and offer coverage, though applicants must meet other documentation and eligibility criteria.

Are there life insurance policies available for undocumented immigrants who are permanent residents?

Yes, permanent residents who are also undocumented immigrants can obtain life insurance. Providers such as AIG and Lincoln Financial offer policies suitable for these individuals, but eligibility may depend on the specific residency and visa conditions.

Can undocumented immigrants who are non-U.S. citizens purchase life insurance?

Undocumented immigrants who are non-U.S. citizens can purchase life insurance, though they may need to navigate additional requirements. Insurers like Nationwide and Banner Life provide policies for non-U.S. citizens, but applicants must be prepared to provide proof of their status and residency.

Is life insurance available for undocumented immigrants who are foreigners in the USA?

Undocumented immigrants who are foreigners can acquire life insurance in the USA, although it might involve more stringent requirements and potentially higher costs. Companies such as Mutual of Omaha and Prudential offer life insurance options for foreigners, but applicants must provide adequate documentation.

Access comprehensive insights into our guide titled, “How to Find Out if Someone Has Life Insurance.”

Can undocumented immigrants get life insurance with an ITIN number?

Yes, undocumented immigrants can obtain life insurance with an ITIN number through insurers like Globe Life and Transamerica. These companies accept ITINs, though additional documentation and proof of identity are usually required to complete the application process.

Is there an age limit for life insurance for undocumented immigrants in the USA?

For undocumented immigrants in the USA, life insurance policies vary in terms of age limits. Term life insurance generally has age limits between 75 and 86 years. Whole life, universal life, and variable life insurance often have no maximum age limit. Final expense insurance and guaranteed issue insurance typically have age limits around 85 years.

Can undocumented immigrants enter the USA without insurance?

Travel insurance is not a requirement for entering the USA, including for undocumented immigrants. However, it is advisable for all travelers, including undocumented immigrants, to obtain insurance to cover potential health or travel-related issues during their stay.

Stop overspending on life insurance. Use our tool below to compare rates from top providers near you.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.