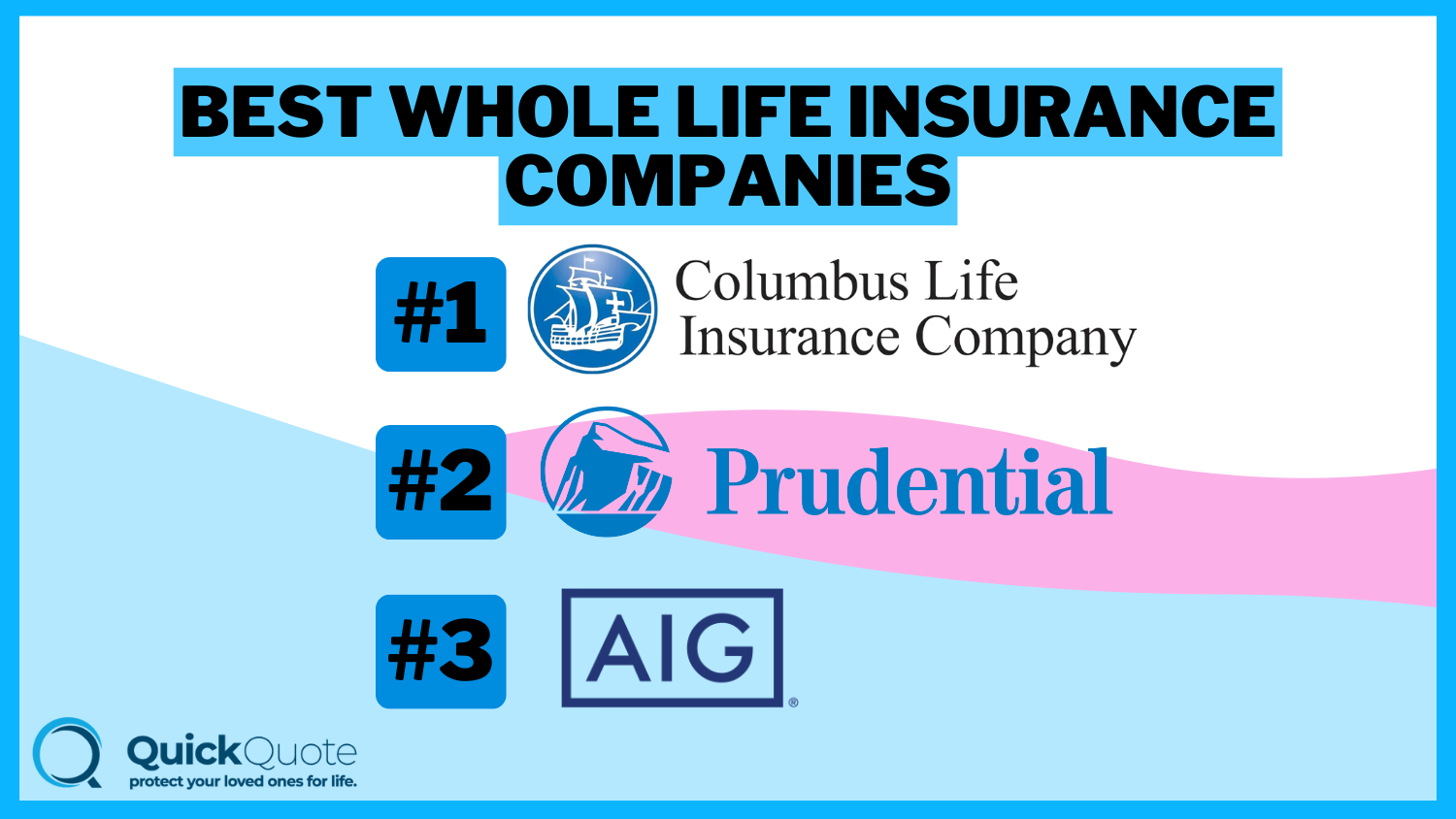

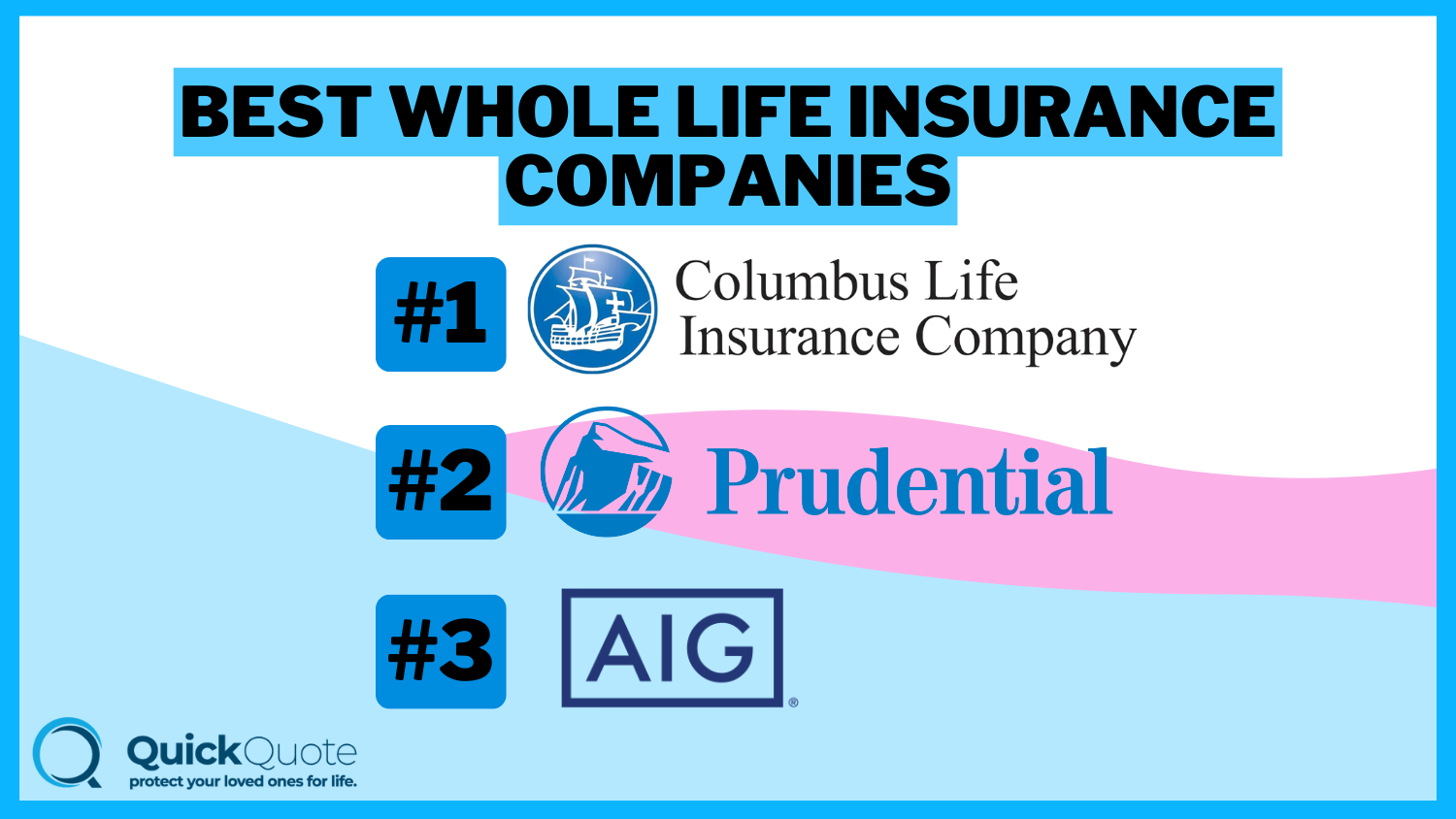

10 Best Whole Life Insurance Companies in 2025 (Find the Top 10 Providers Here!)

Let's delve into the best whole life insurance companies where Columbus, Prudential, and AIG offer competitive rates with up to 25% discount. These top providers are known for their strong financial stability and customer satisfaction. Compare quotes today to find the best coverage for your needs.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Dec 15, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Dec 15, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Whole Life Insurance Companies

A.M. Best Rating

Complaint Level

Company Facts

Full Coverage for Whole Life Insurance Companies

A.M. Best Rating

Complaint Level

Pros & Cons

The best whole life insurance companies include Columbus, Prudential, and AIG, known for competitive rates and comprehensive coverage, offering rates up to 25% off. Columbus stands out as the top choice overall, offering affordable rates and reliable coverage.

Whole life policies offer permanent life insurance coverage with cash value accumulation. Though not the cheapest, the savings component justifies the price. Research is crucial to find the best whole life company. Start by looking for companies with better ratings.

Our Top 10 Picks: Best Whole Life Insurance Companies

Company Rank Multi Vehicle-Discount A.M. Best Best For Jump to Pros/Cons

#1 8% A+ Customer Service Columbus

#2 12% A+ Policy Options Prudential

#3 15% A Comprehensive Plans AIG

#4 25% A Financial Stability Liberty Mutual

#5 25% A+ Reliable Coverage Allstate

#6 10% A+ Affordable Rates Erie

#7 25% A Member Benefits AAA

#8 20% B Trusted Brand State Farm

#9 15% A++ Long History New York Life

#10 20% A+ Extensive Network Nationwide

Compare quotes to find your best policy. If you want to explore your life insurance options, enter your ZIP code above in our free tool to get started.

- Columbus offer competitive rates and comprehensive coverage

- Whole life policies offer permanent coverage with cash value

- Compare quotes from top insurers for the best policy

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#1 – Columbus: Top Overall Pick

Pros

- Competitive Rates: Columbus offers competitive rates, making it an attractive option for cost-conscious consumers.

- Strong Financial Stability: The company has a strong financial stability rating, ensuring reliability and ability to pay out claims.

- Comprehensive Coverage Options: Columbus provides a range of comprehensive coverage options to meet various needs, including whole life insurance with cash value accumulation.

Cons

- Limited Policy Customization: As mentioned in our Columbus life insurance review, some customers may find the policy customization options to be limited compared to other providers.

- Mixed Customer Service Reviews: While Columbus generally receives positive feedback, there are occasional mixed reviews regarding customer service responsiveness and satisfaction.

#2 – Prudential: Best for Policy Options

Pros

- Wide Range of Policy Options: Prudential offers a variety of whole life insurance policies, allowing customers to choose the one that best fits their needs.

- Strong Financial Ratings (a+ from A.M. Best): Prudential has excellent financial stability ratings, which provides peace of mind to policyholders. Learn more details in our Prudential life insurance company review.

- Excellent Customer Service Reputation: The company is well-regarded for its customer service, offering prompt and helpful assistance.

Cons

- Higher Premiums Compared to Some Competitors: Prudential’s premiums may be higher than other companies offering similar coverage.

- Can Be Stricter with Underwriting Criteria: Prudential may have stricter underwriting criteria, making it more challenging for some individuals to qualify.

#3 – AIG: Best for Comprehensive Plans

Pros

- Comprehensive Plans: AIG offers comprehensive whole life insurance plans that include options for cash value accumulation and various riders.

- Flexible Policy Options: As mentioned in our AIG life insurance review, the company provides flexibility in policy terms and coverage amounts to suit different customer needs.

- Good Financial Stability: AIG has a strong financial stability rating, ensuring reliability in paying out claims.

Cons

- Higher Premiums for Certain Age Groups: AIG may have higher premiums for older applicants compared to other providers.

- Some Policy Restrictions for Older Applicants: There may be more restrictions on policy options and coverage for older individuals.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#4 – Liberty Mutual: Best for Financial Stability

Pros

- Excellent Financial Stability: Liberty Mutual has excellent financial stability ratings, ensuring policyholders that their claims will be paid out.

- Good Customer Service Ratings: The company is known for its strong customer service, providing reliable support to its customers.

- Offers a Variety of Riders and Options: Liberty Mutual offers a range of riders and options, allowing customers to customize their policies to their needs. Access insights into our Liberty Mutual life insurance review.

Cons

- Higher Premiums for Certain Demographics: Some customers may find that Liberty Mutual’s premiums are higher than other providers.

- Limited Policy Customization Options: Compared to other providers, Liberty Mutual may offer fewer options for customizing policies.

#5 – Allstate: Best for Reliable Coverage

Pros

- Reliable coverage: Allstate is known for its reliable coverage options, providing peace of mind to policyholders. Learn more in our Allstate life insurance review.

- Strong Customer Service: The company offers strong customer service support, making it easy to manage policies and claims.

- Competitive Rates: Allstate offers competitive rates, making it a good option for budget-conscious consumers.

Cons

- Limited Policy Options: Allstate may have fewer policy options compared to other providers, limiting choice for customers.

- Mixed Customer Reviews: Some customers report mixed experiences with customer service and claims processing.

#6 – Erie: Best for Affordable Rates

Pros

- Affordable Rates: Erie offers competitive and affordable rates, making it a popular choice for cost-conscious consumers.

- Strong Customer Service: The company is known for its excellent customer service, providing prompt and reliable assistance.

- Solid Financial Stability: Erie has a strong financial stability rating, ensuring reliability in paying out claims. See more details on our Erie life insurance review.

Cons

- Limited Availability: Erie’s insurance products may not be available in all states, which can limit accessibility for some customers.

- Fewer Policy Customization Options: Erie may offer fewer options for customizing policies compared to larger insurance provider

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#7 – AAA: Best for Member Benefits

Pros

- Member Benefits: AAA offers member benefits, which can include discounts and additional perks for policyholders.

- Good Customer Service: In our AAA life insurance review, the company provides strong customer service support, ensuring satisfaction among policyholders.

- Competitive Rates: AAA offers competitive rates for its insurance products, making it a good choice for budget-conscious consumers.

Cons

- Limited Availability: AAA’s insurance products may only be available to members in certain regions, limiting accessibility.

- Membership Required: To access AAA’s insurance products, customers must be AAA members, which may not be desirable for everyone.

#8 – State Farm: Best for Policy Options

Pros

- Wide Range of Policy Options: State Farm offers a wide range of whole life insurance policies, providing flexibility to customers.

- Excellent Customer Service: The company is known for its excellent customer service, providing reliable support to policyholders. More information is available in our State Farm life insurance review.

- Customizable Coverage: Flexible insurance options to meet individual needs.

Cons

- Higher Premiums: State Farm’s premiums may be higher than other providers, particularly for certain demographics.

- Limited Online Tools: Some customers may find that State Farm’s online tools and resources for managing policies are limited.

#9 – New York Life: Best for Long History

Pros

- Long History and Experience: New York Life has a long history and extensive experience in providing whole life insurance, making it a trusted provider.

- Customization Options: As mentioned in our New York Life insurance company review, the company offers a wide range of customization options, allowing customers to tailor policies to their needs.

- Strong Financial Stability: New York Life has excellent financial stability ratings, ensuring reliability in paying out claims.

Cons

- Higher Premiums for Older Applicants: New York Life may have higher premiums for older applicants compared to other providers.

- Complex Policies: Some customers may find New York Life’s policies and options to be complex or overwhelming.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#10 – Nationwide: Best for Extensive Network

Pros

- Product Variety: Nationwide offers a variety of whole life insurance products, providing options to suit different customer needs.

- Strong Financial Stability: The company has strong financial stability ratings, ensuring reliability in paying out claims.

- Competitive Rates: Nationwide offers competitive rates, making it a good choice for budget-conscious consumers. Explore our Nationwide life insurance review for more information.

Cons

- Limited Policy Options in Some Areas: Nationwide’s insurance products and policy options may vary by region, limiting availability.

- Mixed Customer Reviews: Some customers report mixed experiences with Nationwide’s customer service and claims processing.

Comparing Life Insurance Companies

Comparing life insurance companies is essential to buying life insurance. A great way to compare companies is by looking at A.M. Best ratings.

A.M. Best ranks companies on their financial strength, which is especially important for your long-term investment in whole life insurance coverage. Companies with strong financial stability will be able to pay any future claim your beneficiary needs to make.

Whole Life Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $71 $145

AIG $78 $160

Allstate $77 $152

Columbus $70 $150

Erie $74 $149

Liberty Mutual $72 $148

Nationwide $73 $147

New York Life $79 $161

Prudential $75 $155

State Farm $76 $154

You can also look at J.D. Power’s customer satisfaction study or ratings from the Better Business Bureau (BBB) to get a sense of how a company treats its customers.

However, the best company for you depends on your situation, on what types of life insurance they offer and that fits your need. You’ll find that some companies offer much better coverage and rates than others. Comparing companies is vital to find the perfect fit for your situation.

Companies With the Best Whole Life Insurance Policies

Insurance companies look at a variety of factors to craft your whole life insurance quotes. While they all typically look at the same things, companies put different emphases on certain aspects, meaning you can see vastly different rates.

Additionally, companies specialize in selling different types of whole life insurance. For example, Nationwide isn’t the company for you if you’re looking for the best burial insurance. You’re better off with Mutual of Omaha.

As you can see, each company specializes in providing coverage for different needs. That’s why we recommend researching your options before signing up for a policy to ensure you’re shopping at the right place.

Whole life — sometimes called permanent life — insurance is a type of policy that covers you for the rest of your life. With whole life insurance, you make continuous monthly payments and never run out of coverage.

You choose a beneficiary to receive a set amount upon your death, and the policy also accumulates cash value over time. This cash value can be used for emergencies, collateral for loans, or medical expenses.

Whole life policies are generally split into three types of plans based on how you pay for them. These are:

- Single Premium: In the standard type of whole life insurance, you’ll pay the same amount each month, and your coverage continues until you stop paying.

- Limited Payment: Your monthly rates will start higher at the beginning of the policy and drop off in later years. This is a good option for people who don’t want to worry about insurance payments during retirement.

- Modified Premium: Your monthly rates start lower, then gradually raise to a predetermined amount. Modified premium plans are a good choice for young people who want to lock in rates and anticipate making more money in the future.

Whole life is also called traditional life insurance since it was the first type of plan sold. However, it’s no longer the only permanent plan on the market — you can buy universal life, indexed universal life, and variable universal life insurance.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Whole Life Insurance Cost

Whole life generally costs more than its counterpart term life insurance, but cash value accumulation and having a permanent plan might be worth the increase.

Insurance companies look at a variety of factors when crafting your rates. These factors include:

- Level of coverage

- Your age and gender

- Your height and weight

- Where you live

- Your medical history

- The medical history of your family

- Your tobacco use

- Your occupation and hobbies

You can get an idea of how much you might pay for whole life insurance below.

Whole Life Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 25 Female | $50 | $150 |

| Age: 25 Male | $55 | $160 |

| Age: 35 Female | $65 | $170 |

| Age: 35 Male | $70 | $180 |

| Age: 45 Female | $80 | $220 |

| Age: 45 Male | $85 | $230 |

| Age: 55 Female | $105 | $290 |

| Age: 55 Male | $115 | $310 |

| Age: 65 Female | $150 | $450 |

| Age: 65 Male | $160 | $470 |

Companies look at the same factors when they craft your rates but weigh each differently. That’s why it’s vital to compare quotes with as many companies as possible before you sign up for insurance — if you go with your first pick, you’ll probably overpay.

Modified Whole Life Insurance

Modified whole life insurance is a type of permanent life insurance that combines features of traditional whole life insurance with certain adjustments during the initial years of the policy.

In this policy, the premiums start off at a lower rate for a specific period, usually a few years, and then increase to a higher fixed amount for the remainder of the policy’s duration.

This initial lower premium period may be attractive to individuals seeking more affordable coverage at the outset, but it’s essential to be aware of the future premium increase.

If you want to know more about this type of insurance, feel free to check out our guide, “Modified Whole Life Insurance Explained.”

Whole Life Insurance as an Investment

In general, life insurance is always a good investment. Whether you buy a small no-exam policy or a whole life plan worth millions, leaving something for your loved ones after your death is never a bad idea.

As an investment, whole life insurance offers a steady accumulation of value with a set interest rate. Your accumulated value is tax-free as long as it’s in your account. You can also borrow against your cash value without worrying about paying it back — any outstanding balance will be subtracted from the death benefit when you die.

While it’s not suitable for everyone, whole life might be a good investment if any of the following situations apply to you:

- You’ve Maxed out Your Retirement Funds: Once you’ve made all the allowable contributions to your retirement accounts, whole life insurance can be used to maximize your tax-deferred savings. You can cancel your plan and collect the savings when you no longer need coverage.

- You’re Ready to Diversify: While it doesn’t offer the largest possible returns, whole life insurance has steady growth and dependable rates unaffected by the ups and downs of the economy.

- You Have Lifelong Dependents: Parents or guardians who expect a child to remain financially dependent on them for life can get peace of mind knowing they’ll always be covered.

- You Want to Help Pay Estate Taxes: If your estate is worth $12.6 million or more, your loved ones might have to pay an estate tax. Whole life insurance can help pay those taxes through the policy’s cash savings or death benefit.

Of course, there are alternatives to whole life that might make a different type of policy better suited for you. If you’re unsure of where to start, an insurance representative or financial advisor can help.

Alternatives to Whole Life Insurance Coverage

There are more policies than whole life when you’re in the market for life insurance. In fact, most people are better served by a different type of life insurance. Term life insurance lasts for a predetermined term, usually 10 to 30 years, and is popular for its affordability.

Universal life insurance offers flexible payments. Variable universal plans invest savings for faster growth, while indexed universal plans tie cash value to a stock index for reliable gains. No-exam policies, which skip medical exams, have lower limits and higher costs but suit those often rejected for standard plans.

The right type of life insurance for you depends on your unique situation. However, insurance experts usually agree that a term life policy is the right option for most. Unless you’re set on a permanent plan, you should consider term life insurance quotes.

Whole Life vs. Term Life Insurance

Today, most people looking to get life insurance buy either a term or a whole life policy. There are two main differences between term and whole life insurance — the length of the policy and accumulated cash value. Whole life lasts as long as you keep paying your bills — usually for the rest of your life.

Available terms vary by company, but most let you buy between 10 and 30 years of coverage. Unlike whole life, term life insurance does not accumulate value. If you outlive your policy and don’t have a return of premium life insurance add-on, you and your beneficiaries get nothing.

There are other factors to consider when trying to choose between term and whole life. For example, term life is generally easier to understand because the policy is straightforward.

Term life is meant to protect you for a period of time when dying would leave behind unpaid debts and bills for your dependents.Kristen Gryglik LICENSED INSURANCE AGENT

Another important factor is cost. Since there’s a higher chance that the insurance company won’t have to make a payment to your beneficiary, your rates are lower with term life.

So, which is better? It depends on your needs. Term life is an excellent option for new parents, business owners, people with large, unpaid debts and newlyweds, check on life insurance for newlyweds for more information.

On the other hand, whole life allows you to lock in a rate for the rest of your life, builds wealth, and eliminates the need to renew insurance later.

Find the Best Whole Life Insurance Company Today

Whether you’re looking for no-exam insurance or a multi-million dollar policy that will help you grow wealth, there’s a whole life insurance plan that can work for anyone. As you saw above, researching your options and selecting the right company is integral to finding the perfect whole life insurance quote.

Read more: How much does a million dollar life insurance policy cost?

Now that you may have an idea of which companies offer the best insurance for your specific needs, your next step should be to compare whole life insurance quotes. Looking at as many companies as possible will help you find the best coverage for the perfect price.

Free instant life insurance quotes are just a click away. Enter your ZIP code below to get started.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Frequently Asked Questions

How much is whole life insurance?

The amount you’ll pay for whole life insurance depends on various factors, including your age, gender, and how much coverage you want. Life insurance rates by age & gender vary, but the average 25-year-old woman might pay around $400 a month, while the same woman at 45 will pay over $1,000.

What is whole life insurance?

Whole life insurance, also known as permanent life insurance, is a type of policy that provides coverage for the rest of your life. With whole life insurance, you make continuous monthly payments and select a beneficiary to receive a set amount upon your death.

It also has a savings component that accumulates cash value over time, which can be used for various purposes.

What are the best whole life insurance companies?

Comparing life insurance companies is essential to finding the best whole life insurance coverage. Consider factors such as A.M. Best ratings for financial strength, customer satisfaction ratings from J.D. Power, and ratings from the Better Business Bureau. Some top whole life insurance companies include Nationwide, MassMutual, and New York Life.

Free instant life insurance quotes are just a click away. Enter your ZIP code below to get started.

Is whole life insurance worth it?

In general, life insurance is a worthwhile investment to financially protect your loved ones after your death. Whole life insurance might be right for you if you want to avoid losing your coverage later in life or to lock in the lowest possible rates.

Of course, whole life insurance is more expensive than term, so you should also ensure it fits your budget.

What is modified whole life insurance?

Modified whole life insurance works the same as a standard plan, but your rates start lower and gradually rise. When rates are lower, you won’t accumulate any cash value. This is an excellent option for young people who want to lock in lower rates and anticipate making more money in the future.

Read more: Modified Whole Life Insurance Explained

What are some key factors to consider when choosing the best whole life insurance company?

When choosing the best whole life insurance company, consider factors such as financial stability ratings (e.g., from a.m. best), customer service reputation, coverage options, policy customization, and premium rates.

Companies like New York Life and Prudential often rank highly due to their strong financial stability, extensive policy options, and excellent customer service.

How can I determine the financial stability of a whole life insurance company?

You can determine the financial stability of a whole life insurance company by reviewing its financial strength ratings from independent agencies like a.m. best, moody’s, or standard & poor’s.

Ratings of a or higher typically indicate strong financial stability, ensuring the company has the ability to meet its financial obligations, including paying out claims.

What are some common riders available with whole life insurance policies?

Common life insurance riders available with whole life insurance policies include accelerated death benefit riders, which allow you to access a portion of the death benefit early if you are diagnosed with a terminal illness.

Other riders may include waiver of premium riders, which waive premiums if you become disabled, and policy loan riders, allowing you to borrow against the cash value of the policy.

Are there any downsides to whole life insurance compared to term life insurance?

Yes, there are some downsides to whole life insurance compared to term life insurance. whole life insurance typically has higher premiums, as it provides coverage for your entire life rather than a set term.

Additionally, the cash value component of whole life insurance policies may take several years to accumulate significant value. However, whole life insurance offers guaranteed death benefits and can build cash value over time, which may make it a more attractive option for long-term financial planning.

How does policy customization work with whole life insurance?

Policy customization with whole life insurance allows you to tailor your policy to your specific needs. This may include choosing the coverage amount, selecting additional riders (such as those mentioned above), adjusting premium payment schedules, and opting for dividend-paying policies.

Companies like state farm and nationwide offer extensive customization options to meet various financial and personal needs. Shop around for personalized life insurance quotes that fit your needs and budget by entering your ZIP code below

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.