The Cost of End of Life Care: 48 Facts for Families and Caregivers [2025]

End of life care costs and statistics show a high cost of care in the last few months of life. The cost of hospital care, palliative care, and hospice care are part of end-of-life costs for most people. In the last month of life, hospital costs can add up to $32,379 and hospice care up to $17,845. In addition to medical care, the average funeral cost ranges from $750 for a cremation with no service to $15,500 for a burial with a service.

Read moreReady to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Sep 19, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Sep 19, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- End of life care can be costly and take many people by surprise

- Long-term-care and life insurance can help ease the financial burdens of end-of-life care

- End-of-life costs can include hospital bills, home care, and long-term care facilities in addition to final expenses

Preparing for the end of life for a loved one is an emotional, turbulent time. From preparing funeral arrangements and legacy care to the uncertainty that comes with the end of life this can be a stressful time for all involved — whether you’re family, a friend, or a caregiver.

What can make an uncertain time even more difficult is not knowing the cost of certain parts of end-of-life care. Without a solid life insurance plan, some families may be left in a difficult position when it comes to saving for hospice care, hospital costs, burial and interment expenses, and other parts of end-of-life care. From living benefits life insurance to final expense policies, there are a lot of options that can ease the burden.

We’ve got you covered with recent statistics on end-of-life care costs, covering all the details you’ll need when planning how much to save for your loved one. Rest assured that though this may be a high-stress time, you can breathe easier by having a term life insurance plan in place that can help ease the financial stress.

Make sure end -of life care and final expenses are taken care of with life insurance. Enter your ZIP code now for free quotes.

End-of-Life Healthcare Statistics

End-of-life healthcare involves all necessary medical procedures and care your loved one may require, including hospital care, hospice, and palliative care. To better help you understand how much these types of care may cost you out-of-pocket, we’ve compiled the following statistics on end-of-life healthcare, including the average costs.

Read more: 10 Common Body Parts You Can Insure

Hospital Care Costs

1. Hospital care costs in the last year of life average $4,731 (National Bureau of Economic Research).

2. In the last month of life, hospital care costs can total up to $32,379 (Arcadia Healthcare Solutions).

3. In the U.S., only 1 percent of hospital care at the end of life is paid for out of pocket (Federal Reserve Bank of Richmond).

4. A 2016 study found that in the 90 days prior to death, Medicare spending at inpatient facilities totaled $5,400 (National Institute of Health).

5. The same study found that 180 days prior to death, Medicare spending at inpatient facilities totaled $3,440 (National Institute of Health).

6. Around 30 percent of adults die in hospitals (Reuters).

7. In the last 12 months of life, the United States spends an average of $35,300 on hospital care (Federal Reserve Bank of Richmond).

8. In the final 3 months of life, the average spending on hospital care increases to $56,300 (Federal Reserve Bank of Richmond).

9. Over 60 percent of Americans die in acute care hospitals (Stanford University School of Medicine).

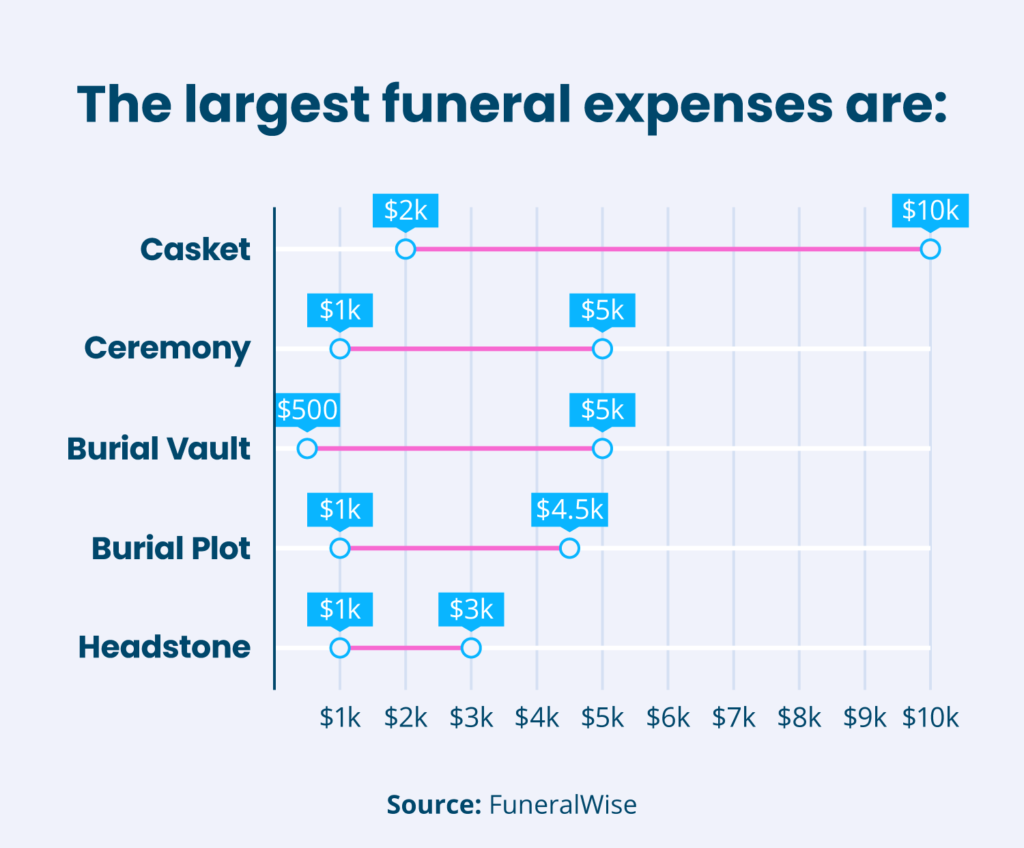

10. Inpatient hospital spending makes up the majority of medical expenses in the final two years of life (Federal Reserve Bank of Richmond).

Palliative Care Costs

11. An estimated 40 million people are in need of palliative care each year (World Health Organization).

12. Over 89,600 individuals classified as “seriously ill” were helped by palliative care in 2019 (National Hospice and Palliative Care Organization).

13. Only 14 percent of people who need palliative care receive it worldwide (World Health Organization).

14. Savings could total up to $6 billion per year if palliative care was fully adopted by hospitals in the United States (Center to Advance Palliative Care).

15. Around 68 percent of Medicare costs are attributed to people with four or more chronic conditions, which comprises the typical palliative care patient (Center to Advance Palliative Care).

16. 72 percent of hospitals with 50 or more beds report having offering on-staff palliative care teams (Center to Advance Palliative Care).

17. On average, the total cost per hospital admission for a patient who received palliative care was $32,643 (National Institute of Health).

18. Palliative care consultations lead to an average reduction in direct hospital costs of around $3,000 per admission (Center to Advance Palliative Care).

19. For patients with four or more diagnoses, palliative care consultations lead to a hospital cost reduction of $4,800 per admission (Center to Advance Palliative Care).

20. Cancer patients who receive palliative care can see a hospital cost reduction of $4,200 per admission (Center to Advance Palliative Care).

Hospice Care Costs

Hospice care can be very expensive. Statistics below were gathered from

21. In 2018, 1.55 million Medicare beneficiaries enrolled in hospice care for one day or longer (National Hospice and Palliative Care Organization).

22. Based on claims data, the number of Medicare-certified hospice care centers increased 13.4 percent from 2014 to 2018, increasing from 4,092 to 4,639 (National Hospice and Palliative Care Organization).

23. Approximately 80 percent of Americans would prefer to die at home, but only around 20 percent actually do (Stanford University School of Medicine).

24. Of the 4,300 hospice care agencies in the U.S., 63 percent are for-profit agencies (Centers for Disease Control and Prevention).

25. Patients with a primary diagnosis of dementia led Medicare hospice spending in 2018, at 25.3 percent (National Hospice and Palliative Care Organization).

26. The average cost for home hospice care is $150 per day (Auburn Crest Hospice).

27. In the final month of life, hospice care costs can total up to $17,845 (Arcadia Healthcare Solutions).

28. Depending on patient characteristics and length of stay, the Medicare hospice benefit can save hospice users anywhere from $2,309 to $17,903 (National Hospice and Palliative Care Organization).

29. In 2018, $12,200 was the average spending per Medicare hospice patient (National Hospice and Palliative Care Organization).

30. 89.8 percent of Medicare spending for hospice care goes to Routine Home Care, where individuals receive care from their homes (National Hospice and Palliative Care Organization).

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Funeral and Burial Costs

One of the final areas of end-of-life preparation is deciding on funeral, burial and interment arrangements. Many families and caregivers are caught off guard by how expensive a funeral with viewing can be, so prepare yourself with the following statistics on funeral and burial costs, and keep in mind that a life insurance policy can help offset these costs.

31. From 1986 to 2017, funeral expenses rose 227.1 percent, and prices for all items (caskets, burial, etc.) rose 123.4 percent (United States Bureau of Labor Statistics).

32. The median cost of an adult funeral with viewing and burial in 2019 was $7,640 (National Funeral Directors Association).

33. If a burial vault is required by the cemetery, the median cost of an adult funeral with burial and viewing increases to $9,135 (National Funeral Directors Association).

34. In 2019, the median cost of a funeral with viewing and cremation was $5,150 (National Funeral Directors Association).

35. A cremation without a funeral or burial service ranges from $750 to $4,500 (FuneralWise).

36. A burial with a memorial service, but no casket or visitation, on average costs from $11,500 to $15,500 (FuneralWise).

37. A cremation with a memorial service, but without a visitation costs an average of $400 to $6,000 (FuneralWise).

38. Caskets can cost over $2,000 on average (United States Federal Trade Commission).

39. A grave marker or headstone ranges from $1,000 to $3,000 or more (FuneralWise).

40. On average, the most expensive element of a funeral is the casket, followed by the ceremony, burial vault and burial plot (FuneralWise).

41. A burial tends to cost more than a cremation due to the quality of the casket, burial vault and other burial requirements (FuneralWise).

42. The Funeral Rule, enforced by the Federal Trade Commission, allows funeral providers to charge a basic services fee that consumers must pay (United States Federal Trade Commission).

43. The Funeral Rule’s basic services fee covers the costs of funeral items that aren’t specific to a particular arrangement, including planning, securing permits and death certificates, sheltering the remains, and coordinating arrangements with the cemetery or crematorium (United States Federal Trade Commission).

44. The projected burial rate for 2020 is 37.5 percent, while the projected cremation rate is 56 percent (National Funeral Directors Association).

45. The burial rate in the United States is expected to continue to decrease to around 16 percent by 2040 (Statista).

46. Similarly, the cremation rate in the United States is expected to increase, forecasted to grow to 79 percent by 2035 (Statista).

47. In 2019, 42 percent of ashes were returned to the family after cremation, while 39 percent were returned to the family in 2017 (Statista).

48. There are over 19,100 funeral homes operating in the U.S., and approximately 89 percent of those are privately owned by individuals or families (National Funeral Directors Association).

When it comes to actually paying for end-of-life care, the options can be overwhelming. Here are some additional tips and resources to help you leverage the care your loved one deserves.

- Comparing End-of-Life Care Options

- Late Stage and End-of-Life Care

- Paying for Hospice Care

- What are Palliative Care and Hospice Care?

- Your Medicare Coverage

Caring for a loved one at the end of their life comes with many uncertainties, including the costs of end-of-life healthcare, burial expenses, and more. These statistics help clear up any uncertainty so you can know exactly what to expect for end-of-life care costs.

Keep in mind that a life insurance policy, such as term or permanent, may help offset these costs and additional stressors at the end of life, so you can focus on what matters most: spending time with your loved ones.

Protect your family from high end-of-life expenses with a life insurance policy. Enter your ZIP code today for quotes.

Case Studies: Understanding the Cost of End-of-Life Care

Case Study 1: Hospital Care Costs

Mr. Johnson, a 75-year-old man, was diagnosed with a terminal illness and required extensive hospital care during his final months of life. The total cost of hospital care in the last month amounted to $32,379. This case highlights the significant financial burden that hospital care can impose on individuals and their families.

Case Study 2: Palliative Care Costs

Mrs. Thompson, a 68-year-old woman with multiple chronic conditions, sought palliative care to manage her symptoms and improve her quality of life. The average cost per hospital admission for a patient who received palliative care was $32,643. Palliative care consults cut costs.

Case Study 3: Hospice Care Costs

Ms. Rodriguez, a 82-year-old woman, opted for hospice care during her final month of life. The expenses associated with hospice care in that period totaled up to $17,845. This case illustrates the financial considerations involved in providing comprehensive end-of-life care through hospice services.

Case Study 4: Funeral and Burial Costs

The Smith family had to make arrangements for the funeral and burial of their loved one, Mr. Smith. Burial and memorial service: $11.5k to $15.5k. Importance of financial planning for funeral expenses.

Read more: Death by Falling Coconut: What are the chances it happens to you?

Frequently Asked Questions

What is end-of-life care?

End-of-life care refers to the medical, emotional, and practical support provided to individuals who are approaching the end of their lives. It focuses on ensuring comfort, dignity, and quality of life for patients during their final stages.

Why is the cost of end-of-life care significant?

The cost of end-of-life care can be substantial due to the range of services involved, including medical treatments, hospital stays, medications, hospice care, and funeral expenses. Understanding these costs is crucial for families and caregivers to plan for financial responsibilities.

Does insurance cover end-of-life care?

Insurance coverage for end-of-life care can vary depending on the type of insurance you have. Most health insurance plans cover medical treatments, while some include hospice care. Medicare and Medicaid also provide coverage for certain end-of-life services.

What are the typical expenses associated with end-of-life care?

Common expenses related to end-of-life care include hospital stays, doctor visits, medical procedures, medications, home health care, nursing home care, hospice care, and funeral or burial costs.

Does Medicare cover end-of-life care?

Yes, Medicare covers certain aspects of end-of-life care. Medicare Part A covers inpatient hospital stays and hospice care, while Medicare Part B covers doctor visits and outpatient services. It’s important to review your specific Medicare plan to understand the coverage details.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.