Life Insurance Incontestability Clause in 2025 (Term Explained)

The life insurance incontestability clause typically provides protection after two years, with monthly insurance rates starting at $20. The incontestability clause in insurance ensures that companies cannot contest claims based on errors in the application once the policy is active for a specified period.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Ty Stewart

Licensed Life Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Licensed Life Insurance Agent

UPDATED: Sep 18, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Sep 18, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Monthly rates for life insurance start around $20, with the life insurance incontestability clause offering protection after two years. This clause helps secure your policy against disputes due to misstatements. In our life insurance center, you’ll discover that a permanent life insurance policy is a legal contract with key fine print to understand.

The incontestability clause in a life insurance policy is designed to protect rather than trap you. It prevents insurers from invalidating your contract by searching for errors in the original application once you’ve made a claim. This guide covers all aspects of the life insurance incontestability clause, including the application process, to help you avoid mistakes and ensure you understand your total insurable value.

Knowing that the coverage you buy is protected due to the incontestability clause, you can start comparing affordable life insurance rates today by using our free quote tool above.

- A life insurance incontestability clause protects benefits after 2 years

- Insurers can’t contest claims once the clause period ends

- Monthly insurance rates depend on coverage and personal details

Incontestability Clause Explained

Before we jump right into the incontestability clause life insurance definition, we need to answer a few vocabulary questions.

What does contestable mean in insurance?

Contestable means that an insurer is within its rights to investigate and deny a claim for a specific reason.

What does incontestable mean in insurance?

Incontestable means that an insurer doesn’t have the right to investigate and deny a claim for a specific reason.

Why is this important? According to the Insurance Information Institute, the life insurance industry pays out between $65 billion and $80 billion in life insurance claims every year. The following table shows the latest data on total death benefit payments.

Annual Life Insurance Death Benefits Paid (2014–2018)

| Year | Death Benefits Paid |

|---|---|

| 2014 | $65,960,933,000 |

| 2015 | $72,320,822,000 |

| 2016 | $73,996,171,000 |

| 2017 | $74,942,640,000 |

| 2018 | $77,430,727,000 |

Life insurance is a business. Despite all the positive impact life insurance coverage can have on families, the insurer’s priority is to make a profit. Without that profit, they wouldn’t have the money to honour their life insurance contracts in the first place.

In the earliest days of the industry, it wasn’t uncommon for some unscrupulous insurers to look for any reason they could to deny a life insurance claim to maximize their profit margins.

One common way they did so was by pouring through the original life insurance application, looking for errors on the part of the insured, and then claiming the contract was never valid because of them.

View this post on Instagram

Even if the error was a simple, inconsequential mistake, they argued that the applicant misrepresented themselves, and therefore the company wasn’t obligated to pay. What happens if you lie on your life insurance application? You will pay higher rates or be denied coverage outright.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Incontestability Clause Protects Life Insurance Buyers

The practice was so common in the earliest days of the industry that reputable insurers in the 1800s introduced the incontestability provision in life insurance as a way to show customers that they were trustworthy.

The clause states that a life insurance contract cannot be voided after a certain period due to a misstatement as long as the premiums are paid.

The incontestability clause was a marketing initiative long before it was a law. Since then, state governments have mandated that life insurance companies add the clause to every policy they issue.

Though the law can vary slightly from state to state, every policy contains the protection in some form.

The contestability period varies, but it’s typically two to three years. It’s up to the insurer to verify all of the insured’s information during that time. Once that period ends, the insured isn’t held responsible for any errors.

Exceptions to the Incontestability Clause

Most states do allow certain exceptions to the incontestability clause. There are still certain situations in which they can deny or adjust your claim.

So, the incontestable clause allows an insurance company to contest a life insurance policy but under what circumstances?

Incontestability Clause, Age and Gender

Age and gender are two of the most important factors in determining your rates. Most states allow insurers to adjust premiums at any time during the life of the policy if it’s discovered that the applicant misstated either of the two, but they can’t cancel the coverage completely.

If the insurer discovers a mistake in age or gender while reviewing a claim, they can’t deny the death benefit, but they can deduct the additional premium owed from the total death benefit payout.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Incontestability Clause and Intentional Insurance Fraud

An insurance company can contest a life insurance contract due to application fraud within. So, if the insurer discovers that the applicant intentionally provided false information to obtain a lower rate or higher face value, most states will allow them to deny a claim. (For more information, read our “Life Insurance Face Value (Terms Explained)“).

If intentional insurance fraud is discovered during the insured’s lifetime, not only can the insurer cancel the coverage, but that person could also face criminal charges.

Read more: What is life insurance fraud?

Incontestability Clause and Policy Lapse

If a policy lapses from missed payments, the contestability period may reset upon reinstatement, potentially affecting contestable claims and the death benefit in life insurance.

The life insurance incontestability clause ensures insurers can't dispute claims after two years, protecting your policy for just $50 to $100 a month.Ty Stewart Licensed Life Insurance Agent

So, even if someone was five years past their original insurance contestability period when the policy lapsed, they could have to wait another two years until they’re in the clear again.

What Happens if You Die During the Contestability Period

If you die during the contestability period, the insurance company will investigate to make sure all of your information is correct, as they are still within their legal timeframe to do so.

As long as your information is correct, the life insurer is obligated to pay the death benefit.

A life insurance contract is valid once you make your first payment, even if you die only a few hours later. If the insurer does find errors, they have two options depending on the severity of the mistake.

As long as the errors are minor, the insurer can calculate the additional premium you should have been paying based on the correct information and simply deduct that amount from the death benefit. If the error is significant, the insurer could deny the claim.

Also, if you die during the contestability period, the death benefit will likely be delayed because the insurance company will need more time to investigate the claim than they would outside of that period.

The Basics of Life Insurance

A life insurance policy is a contract between you and the insurer. In exchange for a regular fee, the insurance company promises to pay a guaranteed lump-sum payment to your beneficiary upon your death.

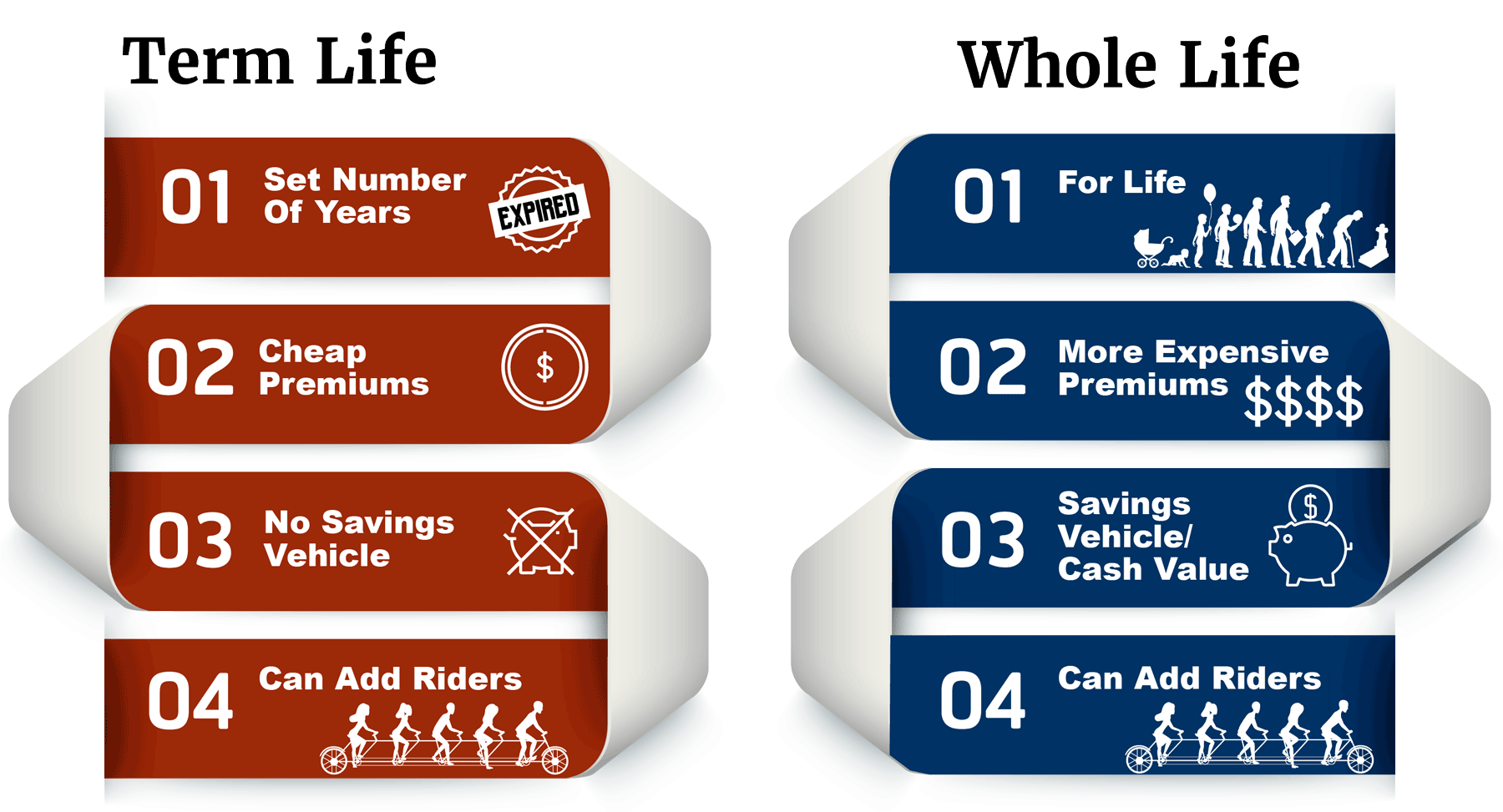

All life insurance policies fall into one of two general categories, term or whole.

Term life insurance provides temporary coverage for a specified period, usually between 10 and 30 years. Once that term expires, the insurer cancels the coverage unless you renew for a new term.

Permanent life insurance (often called whole insurance) provides coverage for as long as you live.

For example, if a 25-year-old man buys a $500,000, 30-year term policy, that coverage ends at age 55. If he dies any time before 55, the insurer pays his beneficiary $500,000. If he dies any time after, the insurer doesn’t pay anything.

If that man purchased a $500,000 whole life insurance policy, the coverage would never end. As long as he remembered to pay his life insurance premiums on time before his death, the insurer would pay his beneficiary $500,000, regardless of his age.

Alternatively, a late payment on life insurance may result in reduced or no payout. Figuring out how to remember to pay our life insurance premium on time will save you money and will likely keep your policy active.

Whole insurance is naturally the more expensive of the two options. With a term policy, there’s always a chance the insurer won’t have to pay a benefit.

With a whole policy, they’re guaranteed to pay. Therefore, they charge higher rates to minimize their losses when that time comes.

Whole policies also come with a built-in savings component. A portion of your premiums is placed in an interest-bearing account that either grows according to a fixed rate set by the insurer or according to market factors similar to a retirement savings account.

The money earned from the savings account is either added to the death benefit or used to pay future premiums.

It’s important to weigh the benefits and costs when choosing between term or whole life insurance.

How Life Insurance Works

The basic life insurance process consists of the following steps:

- The customer fills out a life insurance application and a medical questionnaire.

- The insurer sends the application to an underwriter.

- The underwriter reviews the application to determine the risk of insuring the customer.

- The underwriter may request the customer complete a full medical exam.

- The underwriter either approves or denies the applications.

- If approved, the underwriter assigns a risk classification, which determines the premium rate.

- The policy goes into effect and the customer begins making regular premium payments.

- If the premiums are current when the customer dies, the life insurer pays out the guaranteed face value of the policy.

Again, the insurer has two years from approval to find mistakes in the application and either cancel coverage or adjust premiums based on those findings.

Life Insurance Coverage

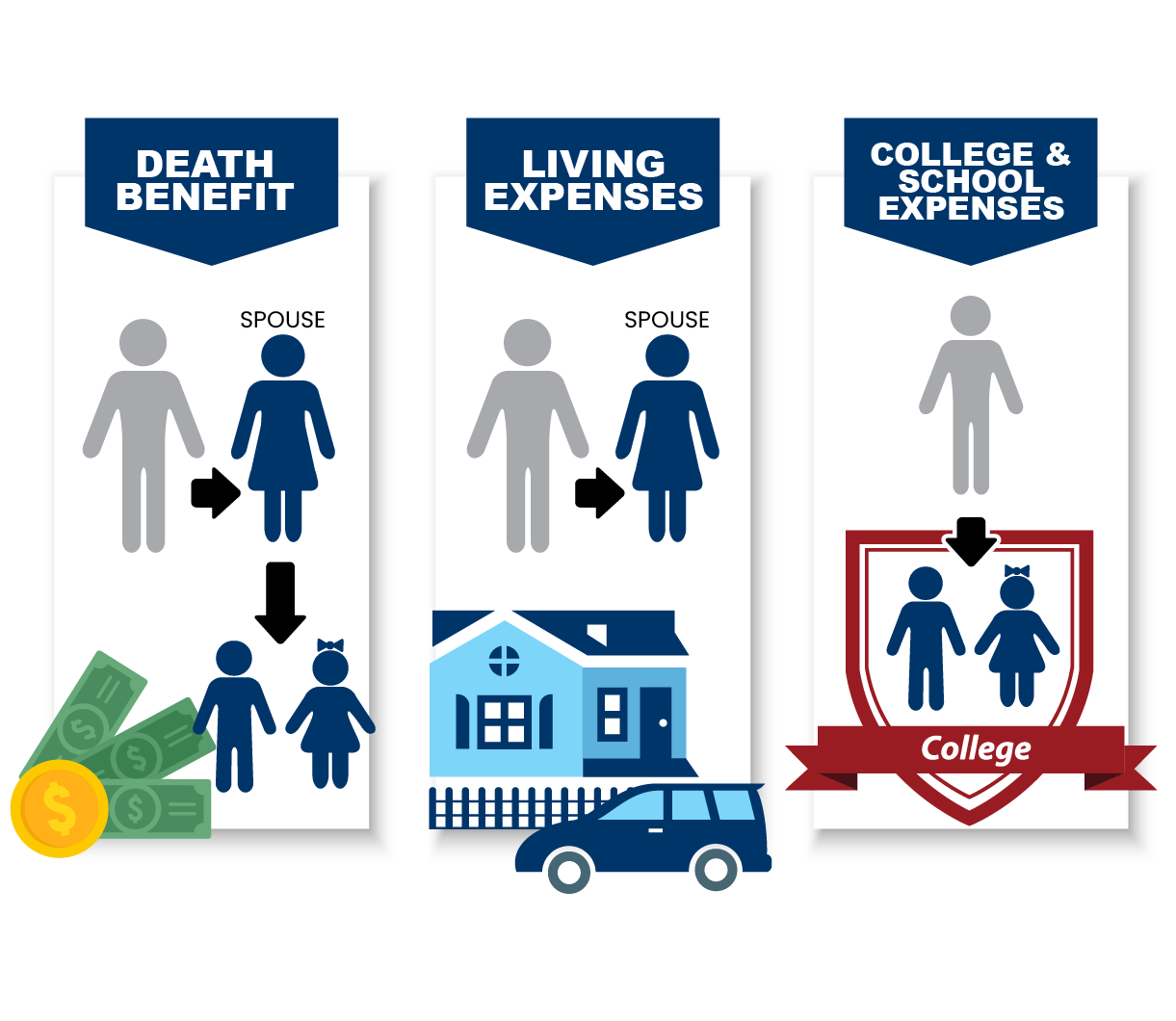

Life insurance is generally used to cover two types of obligations: immediate and future.

Immediate obligations are those expenses that need to be paid soon after your death. They include:

- Funeral costs

- Medical bills

- Mortgage balances

- Personal loans

- Credit card debt

Future obligations are expenses (some planned, some not) that need to be paid in the years following your death. They might include:

- Income replacement

- Spouse’s retirement

- Children’s college tuition

- Emergency savings fund

It’s important to choose a coverage amount that satisfies all obligations if you want life insurance to protect your family from a blowout of debt after your death.

Factors Affecting Your Life Insurance Rates

There is no industry-standard price for life insurance. Rates vary for everyone. Your premiums are determined by several factors, primarily the following.

- Age – Age is one of the most important factors in determining insurability. The older you are, the closer you are to death. The longer you wait to buy a policy, the higher your rate will be.

- Gender – Statistically, men have shorter life expectancies than women. Because of that, they typically pay lower premiums.

- Health history – Healthy people have longer life expectancies. Longer life expectancy translates to lower premiums. To determine your overall health, insurers may require a medical exam.

- Family medical history – Because many diseases are hereditary, most insurers will also inquire about the health of your family. For more info, read our article on how family history affects your term life insurance rates. Learn more about how family history and life insurance rates are connected.

- Occupation – Some jobs are more dangerous than others. If you have a job with a high risk of accidental death, you can expect higher premiums. For more info, read our list of jobs that could raise your life insurance premium.

- High-risk habits – Insurers will also inquire about high-risk habits such as flying, racing, mountain climbing, or any other regular activity with high injury risk.

- Tobacco use – The most common high-risk habit that insurers look for is tobacco use. Smokers pay higher rates than their non-smoking counterparts in every demographic.

These are all of the items that the insurer will research during the contestability period. A misstatement on any one of them could affect your coverage, so it’s important to be thorough and honest through every phase of the application and approval process.

Read more:

- Life Insurance vs. Accidental Death & Dismemberment (AD&D) Insurance: Which Is Better for You

- Does your job affect your life insurance?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Life Insurance Payouts Are Distributed According to Policy Terms and Beneficiaries

The death benefit is the lump sum of money paid to the beneficiary when the insured dies.

Death benefit claims are typically processed within 30 days of filing, though that payment could be delayed if the claim is filed during the contestability period.

Life insurance benefits are non-taxable when they are paid directly to a beneficiary, such as a spouse or a child. However, if you name your estate as the beneficiary, the benefits are subject to estate taxes.

Read more:

How the Life Insurance Death Benefit Works

The death benefit for a term policy is fairly straightforward. When you die, the insurer pays the beneficiary the total coverage amount for your policy. The death benefit for a whole policy is slightly more complicated. It has two separate components.

The first is the face value.

The face value is the guaranteed amount of coverage that you purchase. For example, on a $100,000 policy, your beneficiaries will be paid a minimum of $100,000.

The second component is the cash value. The cash value is the interest your premiums have earned through the policy’s built-in savings component.

Depending on the type of benefit you choose, any money in that cash account at your time of death could be paid to your beneficiaries along with the face value.

The amount of that cash value depends on both how well your investments have performed and whether or not you accessed any of those funds during your lifetime.

Most policies allow you to use your surplus cash value to pay your annual premiums. The more you’ve done that, the less there will be for your beneficiary upon your death.

Many policies also allow you to take out personal loans using your cash value as collateral. These loans operate similarly to home equity lines of credit. You must repay them with interest.

Any outstanding balance at the time of your death will be deducted from your cash account and your face value, which could significantly decrease your beneficiaries’ payout depending on the size of the loan and accumulated interest.

Types of Life Insurance Death Benefits

With many whole life policies, you have the option of choosing one of two insurance benefit types: fixed or increasing.

Fixed

With a fixed death benefit, the policy premiums decrease over time as the cash value increases so that the payout is always equal to the initial face value.

For example, if the cash value on your $250,000 policy grows to $25,000, the premiums will level out, so you’re only paying for $225,000 of coverage.

Once you die, that $25,000 cash value is added to the decreased $225,000 face value so your beneficiary receives the guaranteed $250,000.

With this option, the better your investments perform, the less you pay out of pocket for your coverage later.

Increasing

With an increasing death benefit, the premiums and face value remain the same over time.

As the cash value increases, the overall death benefit increases.

Using the previous example, if the cash value on your $250,000 policy grows to $25,000, the premiums will remain the same, so you’re still paying for the full coverage amount.

Once you die, the $25,000 cash value is added to the face value, meaning your beneficiary now receives a $275,000 death benefit instead of the $250,000.

An increasing benefit costs more over time, but also comes with the potential for a higher payout.

Determining the Amount of Life Insurance Coverage

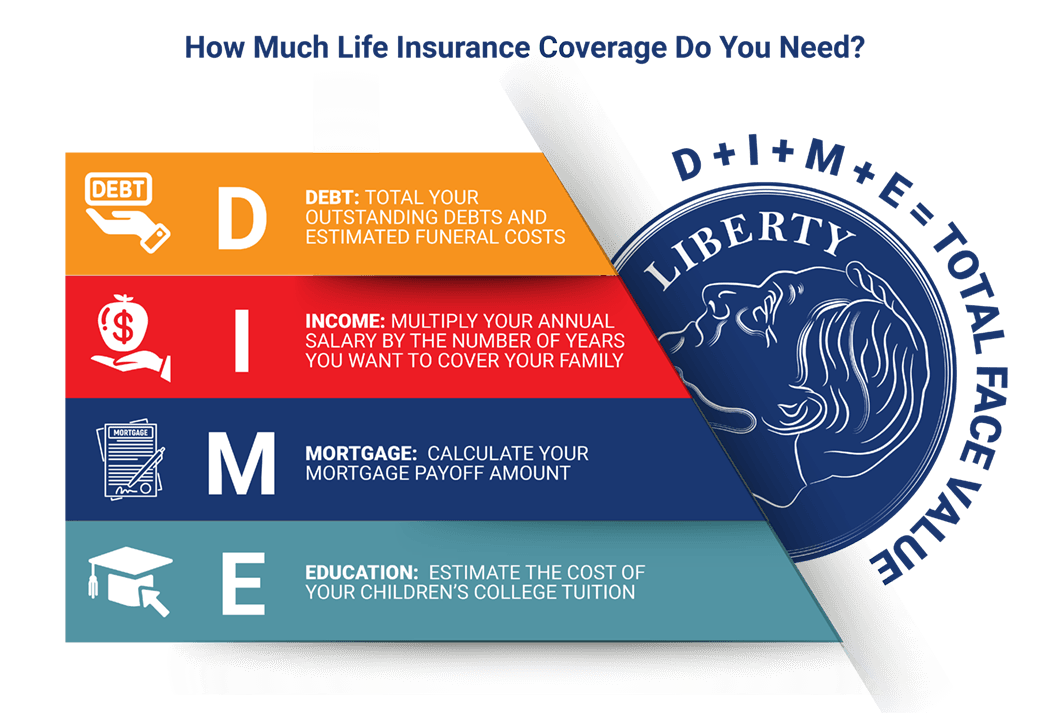

As discussed earlier, a life insurance policy needs to cover two types of obligations: immediate and future. The most common among those obligations are mortgage balances, income replacement for a spouse, tuition savings for a child, and credit debts. (For more information, read our “Is Tuition Insurance Worth It?“).

A life insurance agent or financial planner can help you determine exactly how much coverage you’ll need, but there are simple formulas you can use to give yourself a good estimate.

One popular method used by many online insurance calculators is the DIME method. DIME is an acronym that stands for the following:

- D – Debt

- I – Income

- M – Mortgage

- E – Education

Adding up your total obligations in those four categories will give you an idea of the minimum face value you’ll need.

Here is an example.

A husband who is a father of two is shopping for life insurance. He has an annual salary of $80,000. His wife also works full time. The family has a remaining mortgage balance of $100,000, $7,500 left on a car loan, and $5,000 in credit card debt.

They also plan to save $30,000 for each child to cover the average cost of four years of in-state tuition at a public university.

He plans to leave five years’ worth of his income for miscellaneous expenses and any unexpected future obligations. Once the mortgage is paid, his wife will have less need for his income and can live comfortably on hers alone.

After factoring in an average funeral cost of around $7,500 (according to the National Funeral Directors Association), the man’s insurance needs are as follows:

- Debt – $7,500 call loan + $5,000 credit card + $7,500 funeral costs = $20,000

- Income – $400,000

- Mortgage – $100,000

- Education – $60,000

- Total need – $580,000

To meet all of those obligations, he would need a life insurance policy with a face value of around $600,000.

In addition to calculating a face value, you also need to determine an appropriate term length.

If you purchase a whole policy, you don’t need to decide on a term length since you have lifelong coverage. However, if you choose a term policy, you need to choose a term long enough to cover all of your obligations.

For example, if you have 20 years left on a 30-year mortgage, you should choose a 20-year life insurance policy. If it will take you 30 years to reach all of your retirement savings goals, you should choose a 30-year term.

Here’s a list of things to consider when determining a term length:

- Number of years your spouse will depend on your income (years to retirement)

- Number of years dependent children will be living with you

- Number of years until co-signed or shared debts (like a mortgage) are paid in full

- Number of years until your assets or savings grow enough to cover your future obligations

You should choose a term that extends until your furthest milestones are reached. After you clear those hurdles, you’ll have much less need for insurance coverage.

Top Life Insurance Companies by Market Share

There are nearly 1,000 life insurance companies in the United States. Each of them has multiple policy types, different customization options, and varying prices.

Despite those differences, the policies from every insurer come with an incontestability clause, by law.

If you’re buying from a reputable company, you shouldn’t have to worry about that protection ever coming into play. The difficulty lies in sifting through all of your choices to find one.

If you’re looking for a reputable company, one of the best things to do is to start with the top-ranking insurers and then work your way down.

The following table shows the current top-20 overall companies of life insurance (which includes both individual and employer-sponsored group policies).

Top 10 Life Insurance Companies by Market Share

| Insurance Companies | Rank | Premiums Written | Market Share |

|---|---|---|---|

| #1 | $10.8 million | 6.7% | |

| #2 | $10.5 million | 6.5% | |

| #3 | $9.3 million | 5.8% |

| #4 | $9.1 million | 5.6% |

| #5 | $8.8 million | 5.4% | |

| #6 | $6.8 million | 4.2% | |

| #7 | $4.8 million | 3.0% | |

| #8 | $4.6 million | 2.9% |

| #9 | $4.6 million | 2.9% | |

| #10 | $4.4 million | 2.7% |

Read more: Securian Retirement Plans

Now that you know the top companies, let’s see some sample rates.

Life Insurance Costs

To give you an idea of how much life insurance coverage might cost you, here is a look at the sample premiums for a non-smoker from those top companies.

20-Year Term

Term Life Insurance Monthly Rate By Age & Gender

| Policyholder Age | Male Rates | Female Rates |

|---|---|---|

| 25 | $15 | $13 |

| 30 | $15 | $13 |

| 35 | $18 | $15 |

| 40 | $21 | $19 |

| 45 | $27 | $23 |

| 50 | $36 | $29 |

| 55 | $51 | $38 |

| 60 | $85 | $60 |

| 65 | $145 | $97 |

Whole

Whole Life Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 25 Female | $50 | $150 |

| Age: 25 Male | $55 | $160 |

| Age: 35 Female | $65 | $170 |

| Age: 35 Male | $70 | $180 |

| Age: 45 Female | $80 | $220 |

| Age: 45 Male | $85 | $230 |

| Age: 55 Female | $105 | $290 |

| Age: 55 Male | $115 | $310 |

| Age: 65 Female | $150 | $450 |

| Age: 65 Male | $160 | $470 |

In the past, should an insurer find a reason to contest a life insurance claim, rather than pay out the full death benefit, they’d have simply refunded all of the premiums paid to the deceased’s estate.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Case Studies: Illustrating the Incontestability Clause in Life Insurance Policies

Case Study 1: John’s Misrepresentation

John purchased a life insurance policy and filled out the application form. However, he mistakenly provided incorrect information about his health history, omitting a previous heart condition. After John’s passing, his beneficiaries filed a claim for the death benefit.

During the contestability period, the insurance company discovered the misrepresentation and contested the policy. The claim was denied, and John’s beneficiaries were not able to receive the death benefit.

Case Study 2: Sarah’s Accidental Omission

Sarah applied for a life insurance policy and honestly answered all the questions on the application. However, she accidentally omitted a minor surgery she had undergone five years ago. Unfortunately, Sarah passed away within the contestability period.

During the investigation, the insurance company discovered the omission.

Although it was an unintentional mistake, the insurer adjusted the death benefit to account for the additional premium Sarah would have paid if she had disclosed the surgery.

Case Study 3: Mark’s Intentional Fraud

Mark intentionally provided false information on his life insurance application to secure lower premiums. He concealed his smoking habit and exaggerated his income to obtain a higher coverage amount.

Unfortunately, Mark passed away within the contestability period, and the insurer launched an investigation.

The company uncovered Mark’s intentional misrepresentation and canceled the policy, refusing to pay the death benefit to his beneficiaries.

The Incontestability Clause: Understanding the Bottom Line

It’s important to be as honest as possible when filling out a life insurance application and medical questionnaire. At the same time, everyone knows that mistakes do happen.

Thanks to the incontestability clause, you can rest assured that your loved ones won’t be denied a death benefit because of a typo you made a decade earlier.

As long as you answer every question to the best of your ability, no life insurer can legally reject your claim after the contestability period ends.

This guide was designed to give you a comprehensive overview of the life insurance incontestability clause, as well as a brief look at the life insurance buying process so you understand the type of information reviewed during the contestability period.

We hope that, after reading it, you have all the information you need to get started shopping for a policy and know which items to pay the closest attention to when applying.

Did we leave any of your questions unanswered? If so, be sure to check out one of the many in-depth guides on this site for information on every aspect of the life insurance process.

If you’re ready to buy life insurance coverage that is protected by the incontestability clause, enter your ZIP code into our free online tool to start comparing life insurance rates from companies in your area.

Frequently Asked Questions

How does the incontestability clause protect the policyholder?

The incontestability clause protects the policyholder by providing them with a certain period of time, typically two years from the policy’s issuance, during which the insurance company cannot void the policy or deny a claim based on any misrepresentation or omission made by the policyholder in the application.

Can an insurance company contest a life insurance policy after the incontestability period ends?

Yes, although the incontestability clause generally provides a period of protection for the policyholder, it does not mean the insurance company loses all rights to contest the policy afterward. However, once the incontestability period expires, the insurer’s ability to contest a policy significantly diminishes, and they usually need to prove fraud or intentional misrepresentation to challenge the policy.

What are some common reasons an insurance company might contest a policy during the incontestability period?

During the incontestability period, insurance companies may contest a policy if they discover that the policyholder made intentional misrepresentations or omissions regarding their health, lifestyle, or other relevant information on the application. Fraudulent claims, such as faking one’s death or providing false documentation, can also lead to contestation.

Are there any exceptions to the incontestability clause?

Yes, there are a few exceptions to the incontestability clause. These typically include cases where fraud or intentional misrepresentation can be proven, or when the policyholder fails to pay the premiums. Additionally, if the policy includes a provision stating that certain conditions, such as suicide, are excluded during a specific waiting period, the insurer may contest claims related to those conditions within that period.

What is the comprehensive agreement with fairly straightforward clauses in life insurance?

A comprehensive agreement in life insurance refers to the policy’s terms that are clear and direct, covering the main aspects such as coverage limits, premiums, and benefits. These clauses ensure that both the insurer and the insured understand their rights and obligations.

Can a life insurance policy sold in Ohio be contested by the insurer after the first two years?

In Ohio, a life insurance policy can typically be contested by the insurer only within the first two years of the policy’s issuance. After this contestability period, the policy usually becomes incontestable, meaning the insurer cannot dispute it except for fraud.

Does a life insurance policy containing a guaranteed interest rate offer additional benefits?

Yes, a life insurance policy with a guaranteed interest rate often includes benefits such as stable cash value growth and predictable returns. This can be advantageous for policyholders seeking financial security and reliable investment growth.

What does an insurance company promise to pay in stated benefits?

An insurance company promises to pay out specified benefits, such as a death benefit or cash value, as outlined in the policy. These benefits are provided to the beneficiaries or the insured, depending on the policy terms.

What is a contestable life insurance claim?

A contestable life insurance claim is one that the insurer can challenge based on certain conditions, such as misrepresentation or fraud, within the contestability period, usually the first two years of the policy.

What is a contestable life insurance policy?

A contestable life insurance policy is one that allows the insurer to investigate and potentially deny claims based on misrepresentations or omissions made by the insured, but only within the initial contestability period.

How do contestable and non-contestable life insurance policies work?

Contestable life insurance policies allow insurers to review and potentially dispute claims within a specific period, typically the first two years. Non-contestable policies, after this period, are generally protected from such disputes, providing more stability for beneficiaries.

What is the significance of a two-year contestability period in life insurance?

The two-year contestability period allows insurers to investigate and challenge claims for any misrepresentations or omissions made in the policy application. After this period, the policy typically becomes incontestable, offering greater security to beneficiaries.

What is the indisputable clause in insurance?

The indisputable clause in insurance, also known as the incontestability clause, prevents insurers from contesting a policy’s validity after a specified period, usually two years, barring fraud. It provides protection for the insured and their beneficiaries.

What is the difference between the insured and the beneficiary?

The insured is the person whose life or health is covered by the insurance policy, while the beneficiary is the individual or entity designated to receive the policy’s benefits upon the insured’s death or other covered events.

What are the BBB reviews for Kin Insurance in Florida?

Kin Insurance has received various reviews on the Better Business Bureau (BBB) platform, reflecting customer experiences and feedback. Checking the BBB website can provide insights into the company’s reputation and customer service quality.

What is the contestability period for life insurance in Florida?

In Florida, the contestability period for life insurance is generally two years. During this time, insurers can challenge the policy based on misrepresentations or omissions. After this period, the policy typically becomes incontestable.

What should you know about life insurance in New Zealand?

Life insurance in New Zealand offers various policy types, including term life and whole life insurance, with features like flexible coverage options and cash value accumulation. It’s important to understand local regulations and benefits to choose the right policy.

What are the differences between life assurance and life insurance?

Life assurance typically refers to policies that provide coverage for the entire lifetime of the insured, with a guaranteed payout upon death. Life insurance often includes term policies with coverage for a specific period, with no payout if the insured outlives the term.

What happens when a misrepresentation is discovered on a life insurance policy?

If a misrepresentation is discovered on a life insurance policy, the insurer may have the right to deny a claim or void the policy, depending on when the misrepresentation occurred and its impact on the policy terms.

What are the basics of whole life insurance?

Whole life insurance provides lifelong coverage with a guaranteed death benefit and cash value accumulation. Premiums remain constant, and the policy can build cash value over time, which can be borrowed against or used for other purposes.

What do case studies about Transamerica say?

Case studies involving Transamerica often highlight the company’s insurance products, customer service, and financial performance. These studies can offer insights into how Transamerica handles various insurance scenarios and customer needs.

What are the elements of insurability?

The elements of insurability include factors like the applicant’s age, health, occupation, and lifestyle. Insurers use these factors to assess the risk and determine the terms and premiums of the insurance policy.

What does full insurable value mean?

Full insurable value refers to the total amount of coverage needed to fully protect an asset against loss or damage. It ensures that the insured can recover the full value of the asset without financial loss.

What are the implications of canceling decreasing term life insurance?

Canceling decreasing term life insurance means losing coverage that decreases over time, typically in alignment with a decreasing financial obligation, such as a mortgage. It may impact financial protection and leave gaps if not replaced with other coverage.

How does cash value life insurance compare to term life insurance?

Cash value life insurance builds savings over time, with premiums higher than term life insurance, which provides coverage for a specific period without accumulating cash value. Cash value policies offer long-term benefits but at a higher cost.

Do group policies include an incontestability period and how long does it last?

Yes, group life insurance policies typically include an incontestability period, usually lasting two years. During this time, the insurer can review and contest the policy, but after this period, the policy is generally considered incontestable.

What happens if an insured’s age was misstated on a life insurance contract?

If an insured’s age was misstated on a life insurance contract, the insurer may adjust the benefits or premiums based on the correct age. In some cases, this could affect the validity of the policy or the payout amount.

What is the DIME acronym in life insurance?

The DIME acronym in life insurance stands for Debt, Income, Mortgage, and Education. It is used to help calculate the amount of life insurance coverage needed to protect dependents financially.

What is a life insurance incontestability clause?

A life insurance incontestability clause is a provision included in most life insurance policies that sets a specific timeframe during which an insurer cannot contest or challenge the policyholder’s claims or statements made in the application, except in cases of fraud.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Ty Stewart

Licensed Life Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Licensed Life Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.