Best Life Insurance for Extreme Sports in 2025 (Top 10 Companies Ranked)

The best life insurance for extreme sports often includes companies like AIG, Allstate and State Farm, offering competitive rates starting at $47/month. These top picks provide optimal coverage for athletes involved in high-risk activities. Discover how these insurers stand out in providing tailored protection.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Mar 24, 2025

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Mar 24, 2025

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Extreme Sports

A.M. Best Rating

Complaint Level

11,638 reviews

11,638 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Extreme Sports

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviewsThe best life insurance for extreme sports is offered by AIG, Allstate, and State Farm, with rates starting as low as $47/month.

These top providers offer specialized coverage for high-risk activities, keeping you and your loved ones financially protected from unexpected accidents. Each company stands out for its competitive pricing and comprehensive policies, designed to meet the unique needs of extreme sports enthusiasts.

Our Top 10 Company Picks: Best Life Insurance for Extreme Sports

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 8% | A | High-Risk Coverage | AIG |

| #2 | 5% | A+ | Comprehensive Protection | Allstate | |

| #3 | 7% | B | Local Agents | State Farm | |

| #4 | 6% | A+ | Customer Service | AXA |

| #5 | 5% | A | Risk Management | Generali |

| #6 | 7% | A- | Customizable Policies | Bupa |

| #8 | 4% | A+ | Specialized Plans | Zurich | |

| #7 | 6% | A | Extensive Coverage | Cigna | |

| #9 | 5% | A+ | High-Risk Endorsements | The Hartford |

| #10 | 3% | A | International Support | Kaiser |

Explore how these top companies provide optimal protection, allowing you to pursue your passions confidently with coverage tailored to your adventurous lifestyle. To expand your knowledge, refer to our handbook titled, “What are the benefits of buying life insurance?“

Protecting your family financially doesn’t have to be expensive. Enter your ZIP code in our free comparison tool above to find affordable life insurance.

- AIG offers top life insurance for extreme sports enthusiasts.

- Coverage tailored for high-risk, adventurous lifestyles.

- Policies protect families of extreme sports participants

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#1 – AIG: Overall Top Pick

Pros:

- Tailored Extreme Sports Policies: AIG offers some of the best life insurance for extreme sports with policies specifically designed to cover high-risk activities. Discover more in our AIG life insurance review.

- Flexible Coverage Options: The company provides extensive coverage options, making it ideal for those involved in various extreme sports.

- Competitive Rates: AIG delivers competitive premiums for the best life insurance for extreme sports.

Cons:

- Higher Premiums for Certain Activities: While offering excellent coverage, the best life insurance for extreme sports from AIG might come with higher premiums for the most hazardous activities.

- Complex Application Process: The process to secure the best life insurance for extreme sports can be lengthy due to detailed risk assessments.

#2 – Allstate: Best for Comprehensive Protection

Pros:

- Broad Coverage Range: Allstate provides comprehensive protection that qualifies as some of the best life insurance for extreme sports, covering a wide array of high-risk activities.

- Additional Riders Available: The insurer offers various riders, enhancing coverage for extreme sports enthusiasts. Find additional details in our Allstate life insurance review.

- Robust Customer Support: Known for strong customer service, Allstate helps clients navigate the complexities of obtaining the best life insurance for extreme sports.

Cons:

- Potentially Higher Costs: The extensive coverage might result in higher costs compared to other providers of the best life insurance for extreme sports.

- Limited Local Agent Availability: Not all areas have easy access to Allstate’s local agents, which can be a drawback for some seeking the best life insurance for extreme sports.

#3 – State Farm: Best for Local Agents

Pros:

- Personalized Service: State Farm’s local agents offer personalized advice, which is valuable for finding the best life insurance for extreme sports.

- Flexible Coverage Options: They provide various coverage options that cater to different extreme sports needs.

- Strong Community Presence: With a strong local presence, State Farm ensures that clients receive tailored support for the best life insurance for extreme sports. Dive into our State Farm life insurance review for insights.

Cons:

- Potential for Higher Premiums: The personalized service might come with higher premiums compared to other insurers in the best life insurance for extreme sports category.

- Coverage Limitations in Some Areas: Coverage options for extreme sports might be limited depending on the region.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#4 – AXA: Best for Customer Service

Pros:

- Exceptional Support: AXA is renowned for providing top-notch customer service, making it a strong contender for the best life insurance for extreme sports.

- Comprehensive Assistance: They offer detailed guidance throughout the insurance process, crucial for securing the best life insurance for extreme sports.

- High Satisfaction Rates: AXA’s high customer satisfaction rates reflect its commitment to offering the best life insurance for extreme sports.

Cons:

- Potentially Higher Costs: The high level of customer service may be accompanied by higher premiums for the best life insurance for extreme sports. To gain further insights, consult our guide titled, “Life Insurance Premiums: What are they and how do they work?“

- Limited Customization Options: AXA may offer less flexibility in policy customization compared to other providers of the best life insurance for extreme sports.

#5 – Generali: Best for Risk Management

Pros:

- Advanced Risk Assessment: Generali excels in risk management, making it a top choice for the best life insurance for extreme sports.

- Specialized Coverage Options: They offer policies tailored to high-risk activities, ensuring adequate protection for extreme sports enthusiasts.

- Proactive Claims Handling: Generali’s proactive approach to claims aligns well with the best life insurance for extreme sports. To delve deeper, refer to our in-depth report titled, “How to File a Life Insurance Claim.”

Cons:

- Higher Premiums for High Risks: Their focus on risk management may result in higher premiums for the best life insurance for extreme sports.

- Limited Availability: Generali’s specialized coverage might not be available in all regions, impacting access to the best life insurance for extreme sports.

#6 – Bupa: Best for Customizable Policies

Pros:

- Highly Customizable Plans: Bupa offers flexible policies that can be tailored to fit specific extreme sport’s needs, making it a top choice for the best life insurance for extreme sports.

- Wide Range of Options: Their extensive range of options ensures comprehensive coverage for a variety of high-risk activities.

- Personalized Coverage: Bupa provides personalized coverage solutions, enhancing its position as a provider of the best life insurance for extreme sports.

Cons:

- Potentially Higher Premiums: Customizable policies may come with higher costs for the best life insurance for extreme sports.

- Complex Policy Details: The extensive customization options can lead to a more complex policy structure. Check out our resource titled, “How does life insurance work?” for more information.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#7 – Zurich: Best for Specialized Plans

Pros:

- Focused Specialized Plans: Zurich offers highly specialized plans designed for extreme sports, making it a leading choice for the best life insurance for extreme sports.

- Tailored Coverage: Their plans are specifically crafted to address the unique risks associated with extreme sports activities.

- Strong Industry Reputation: Zurich’s reputation for handling specialized insurance needs reinforces its status as a provider of the best life insurance for extreme sports.

Cons:

- Higher Costs for Specialized Coverage: Specialized plans can be more expensive compared to standard options for the best life insurance for extreme sports. Get a complete view in our resource titled, “How much does life insurance cost?“

- Limited Coverage Options for Non-Extreme Sports: Zurich’s focus on extreme sports might mean fewer options for non-extreme activities.

#8 – Cigna: Best for Extensive Coverage

Pros:

- Broad Coverage Options: Cigna offers extensive coverage that includes a variety of extreme sports, making it a top provider for the best life insurance for extreme sports.

- Comprehensive Policies: Their policies provide a high level of coverage, suitable for those involved in high-risk activities.

- Reliable Customer Service: Cigna’s customer service is robust, supporting clients through the process of obtaining the best life insurance for extreme sports.

Cons:

- Potential for Higher Premiums: Extensive coverage options might come with higher premiums compared to other providers of the best life insurance for extreme sports.

- Complex Coverage Details: The broad range of coverage might result in complex policy details. Check our guide titled, “What is the minimum coverage amount for life insurance?” for a complete overview.

#9 – The Hartford: Best for High-Risk Endorsements

Pros:

- Strong High-Risk Endorsements: The Hartford provides excellent endorsements for high-risk activities, making it a top choice for the best life insurance for extreme sports.

- Comprehensive High-Risk Coverage: Their policies cover a wide range of high-risk sports and activities. To gain in-depth knowledge, consult our comprehensive resource titled, “Life Insurance Terms and Definitions.”

- Experienced in Handling Claims: The Hartford’s experience in high-risk insurance ensures efficient claims handling for the best life insurance for extreme sports.

Cons:

- Higher Premiums for High-Risk Coverage: The focus on high-risk endorsements can lead to higher premiums.

- Availability Issues: Coverage options might be limited in some areas, affecting access to the best life insurance for extreme sports.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#10 – Kaiser: Best for International Support

Pros:

- Excellent International Coverage: Kaiser offers strong international support, making it ideal for those involved in extreme sports worldwide.

- Global Network of Support: Their global presence ensures access to extensive resources and support for the best life insurance for extreme sports.

- Comprehensive Policies: Kaiser provides comprehensive policies that cover extreme sports activities abroad.

Cons:

- Higher Costs for International Coverage: The focus on international support might result in higher premiums for the best life insurance for extreme sports.

- Complex Policy Details: International coverage policies can be complex and may require thorough understanding. For a comprehensive analysis, refer to our guide titled, “What happens when my term life insurance policy ends?“

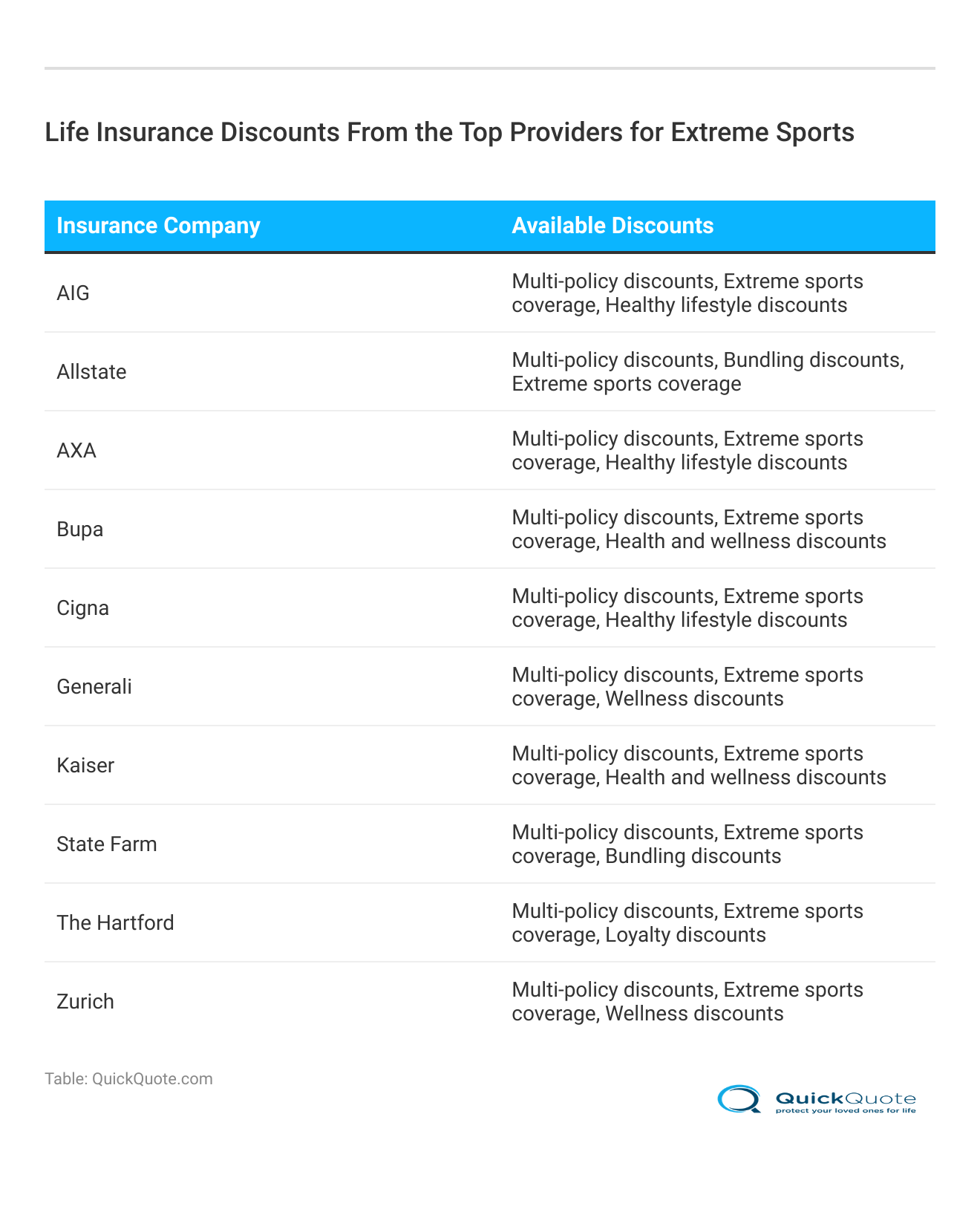

Extreme Sports Top Life Insurance Providers: Monthly Rate & Discounts Comparison

Securing life insurance for extreme sports requires balancing coverage and affordability. Whether you’re a thrill-seeker or engaging in high-risk activities, understanding monthly rates and discounts from providers like AIG, Allstate, and State Farm can help you make an informed choice.

Extreme Sports Life Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AIG | $55 | $165 |

| Allstate | $52 | $160 |

| AXA | $53 | $157 |

| Bupa | $50 | $150 |

| Cigna | $49 | $148 |

| Generali | $51 | $155 |

| Kaiser | $47 | $140 |

| State Farm | $54 | $162 |

| The Hartford | $52 | $160 |

| Zurich | $56 | $168 |

This guide details the minimum and full coverage rates from top insurance companies and highlights discounts like multi-policy, bundling, and healthy lifestyle. These discounts can help reduce costs for extreme sports enthusiasts.

Remember, securing the right coverage not only protects you but also ensures peace of mind for your loved ones. Take advantage of these insights to make the best choice for your unique needs. To learn more, explore our comprehensive resource titled, “How long should life insurance coverage last?“

Understanding Life Insurance for Extreme Sports

Life insurance for extreme sports is a specialized form of coverage designed to protect individuals who engage in high-risk activities. Unlike standard life insurance policies, which often exclude these dangerous pursuits, this tailored coverage addresses the unique risks associated with extreme sports.

To secure this type of insurance, applicants must provide detailed information about their activities to ensure accurate coverage. Ultimately, life insurance for extreme sports provides crucial financial protection, offering peace of mind to those who embrace high-adrenaline lifestyles.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Key Factors Influencing Life Insurance Premiums for Extreme Sports

Life insurance for extreme sports is tailored to accommodate the heightened risks associated with high-adrenaline activities. Given the inherent dangers of these pursuits, premiums for this type of insurance are typically higher compared to standard life insurance. The cost and terms of coverage are influenced by several key factors:

- Type of Sport: Risk levels vary; skydiving and rock climbing have different pricing.

- Dangers Associated with the Sport: Higher risks from certain activities lead to higher premiums.

- Frequency of Participation: More frequent participation increases risk and costs.

- Level of Experience: Experienced athletes may face lower premiums than novices.

- Type of Equipment Used: Better safety and quality of gear can reduce premiums.

When applying for life insurance for extreme sports, applicants must provide a detailed list of their activities. Accurate disclosure is essential, as failure to do so may result in coverage cancellation or claim denial. Find more information in our detailed resource titled, “What happens if I lie on my life insurance application?“

Activities Considered High Risk for Life Insurance Coverage

Life insurance companies carefully evaluate the risks associated with various activities to minimize their exposure to potential claims. As a result, they often avoid offering coverage for the most hazardous lifestyles.

AIG offers the most comprehensive life insurance for extreme sports, ensuring tailored coverage that meets the unique needs of high-risk athletes.Chris Abrams Licensed Life Insurance Agent

While some extreme sports may only slightly increase your premiums, others might lead to outright rejection of coverage. To learn more, explore our comprehensive resource titled, “Reasons Why Life Insurance Won’t Pay Out.” Insurers typically scrutinize the following high-risk activities:

- Flying & Parachuting: Includes private piloting, aerobatic flying, and all forms of skydiving.

- Motorsports & Extreme Biking: Covers motorcycle/car racing, and high-risk biking or skateboarding stunts.

- Water Sports: Scuba diving, canoeing, kayaking, and surfing in challenging or hazardous environments.

- Aerial & Gliding Sports: Hang gliding, paragliding, and BASE jumping from fixed objects.

- Climbing & Snow Sports: Mountain/rock climbing, and snowboarding/skiing in extreme or off-piste conditions.

Disclosing all activities is crucial for accurate coverage, as insurers have varying criteria for high-risk activities. This transparency helps avoid complications and ensures your policy’s terms and premiums are correctly assessed.

Types of Life Insurance for Extreme Sports

Participating in extreme sports can complicate the process of securing life insurance, as traditional policies often exclude high-risk activities. However, there are specialized insurance options tailored specifically for high-adrenaline enthusiasts, offering coverage that accounts for the unique dangers these sports present.

- Term Life Insurance: Provides a death benefit if the insured passes away during the term. Generally, more affordable.

- Whole Life Insurance: Offers lifetime coverage with a death benefit and accumulates cash value over time. Higher premiums but includes investment options.

- Accidental Death and Dismemberment (AD&D) Insurance: Covers deaths or injuries from accidents. Provides extra protection for extreme sports enthusiasts beyond standard policies.

- Specialized Extreme Sports Insurance: Tailored for high-risk activities like skydiving and rock climbing. Provides coverage specific to the risks of extreme sports.

Understanding the types of life insurance available for extreme sports participants is crucial for ensuring adequate protection while managing costs. These tailored policies cover activities like skydiving, rock climbing, and motorsports, enabling individuals to pursue their passions while maintaining financial security.

Additionally, it’s essential to carefully compare premiums, coverage limits, and exclusions to ensure that the chosen policy meets both the individual’s needs and budget. By doing so, extreme sports enthusiasts can secure comprehensive coverage that provides peace of mind for both themselves and their loved ones.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Alternative Life Insurance Options for Extreme Sports Participants

While most individuals involved in extreme sports can secure life insurance coverage, some may face challenges due to the high risks associated with their activities. If you find yourself unable to obtain traditional coverage, there are alternative options worth considering:

- Group Life Insurance: Offered through employers, this plan provides basic coverage as part of a larger group and can be a practical solution if personal policies are unavailable.

- Guaranteed Issue Life Insurance: This option is suitable for high-risk individuals as it is accessible without medical underwriting, although it does carry higher premiums, making it a form of guaranteed issue life insurance.

- Graded Benefit Whole Life Insurance: Provides a gradual payout over two years, which may be less appealing but still offers coverage for extreme sports participants.

Some may consider self-insuring by setting aside savings or investments to cover potential risks. Each option has its pros and cons, so it’s important to evaluate which best aligns with your financial situation and coverage requirements.

View this post on Instagram

Exploring these alternative options can help extreme sports enthusiasts find suitable life insurance coverage. A thorough assessment helps individuals select the best protection to secure their financial future and handle the risks of their high-adrenaline activities.

Case Studies: Life Insurance for Extreme Sports

Case Study 1: John – The Adventurous Climber

John is an experienced rock climber who loves pushing his limits on challenging cliffs and mountains. However, when he applied for traditional life insurance, he was denied coverage due to the perceived risks associated with his hobby.

Determined to secure his family’s future, John found life insurance for extreme sports, which gave him the financial protection needed to continue his passion worry-free. For a comprehensive analysis, refer to our detailed guide titled, “How Term Life Insurance Rates Are Calculated.”

Case Study 2: Sarah – The Fearless Skydiver

Sarah is a thrill-seeker who finds immense joy in skydiving. She wanted to ensure her family would be financially secure if anything were to happen to her during one of her jumps.

Sarah found that many insurers deemed skydiving too risky for coverage. Undeterred, she secured specialized life insurance for extreme sports, ensuring her loved ones would be protected in case of an accident. To gain further insights, consult our comprehensive guide titled, “No-Waiting-Period Life Insurance.”

Case Study 3: Mike – The Extreme Snowboarder

Mike is an avid snowboarder who regularly tackles challenging terrains and performs daring tricks. He wanted to protect his family’s financial future but faced difficulties obtaining traditional life insurance due to the perceived high risks associated with extreme snow sports.

Fortunately, Mike found life insurance tailored for extreme sports, allowing him to pursue his passion while ensuring financial protection for his loved ones. For additional details, explore our comprehensive resource titled, “Life Insurance Savings Account: What You Need To Know.”

Life Insurance for Extreme Sports: The Bottom Line

The article highlights top life insurance options for extreme sports, featuring providers like AIG, Allstate, and State Farm, with specialized coverage starting at $47/month for high-risk activities. To gain in-depth knowledge, consult our resource titled, “Should you pay life insurance premiums monthly or annually?“

It highlights that premiums are influenced by activity risk levels and the accuracy of disclosures. The article includes case studies demonstrating successful coverage for individuals involved in extreme sports, urging readers to compare quotes to find the best insurance solutions for their needs.

Don’t settle for high life insurance rates. Shop for low rates and ensure your loved ones are protected by entering your ZIP code below.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Frequently Asked Questions

What is life insurance for extreme sports?

Life insurance for extreme sports provides financial protection for those involved in high-risk activities often excluded from standard policies.

Uncover key details in our guide titled, “How much term life insurance can you buy?”

What activities are considered high risk?

High-risk activities include skydiving, rock climbing, scuba diving, base jumping, and extreme snow sports. Coverage varies by insurer.

Why are extreme sports not covered by standard life insurance?

Standard life insurance often excludes extreme sports due to their high-risk nature, which increases the likelihood of accidents and claims.

How does life insurance for extreme sports work?

It assesses the risk of your activities, with premiums typically higher due to the increased likelihood of accidents or injuries.

Find additional info in our guide titled, “Flexible Premium Adjustable Life Insurance.”

How do you buy life insurance for extreme sports?

To buy life insurance for extreme sports, get recommendations from fellow athletes, be honest about your activities, and compare quotes from specialized insurers.

Simplify your life insurance shopping by entering your ZIP code into our free quote comparison tool below and find coverage that fits your budget and needs.

Do you need life insurance for extreme sports?

If you participate in extreme sports, it is advisable to consider life insurance for financial protection. While some sports may be automatically covered under traditional policies, others may require additional coverage or higher premiums.

What qualifies as an extreme sport?

Extreme sports involve high risk and physical challenge, such as skydiving, rock climbing, base jumping, scuba diving, and extreme snowboarding.

Is life insurance for extreme sports worth it?

Yes, it provides crucial financial protection for families in case of accidents, offering peace of mind despite higher premiums.

See our resource titled, “Is life insurance worth it or not?” for further exploration.

What are the disadvantages of extreme sports?

Disadvantages include higher risk of injury or death, increased insurance premiums, and potential financial or legal issues from accidents.

What qualifies for extreme sport life insurance?

Applicants must provide detailed information about their activities. Insurers assess the risk and may require extra documentation or endorsements to cover high-adrenaline sports.

Don’t settle for high life insurance rates. Shop for low rates and ensure your loved ones are protected by entering your ZIP code below.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.