Best Life Insurance for Non-US Citizens in 2025 (Top 10 Companies Ranked)

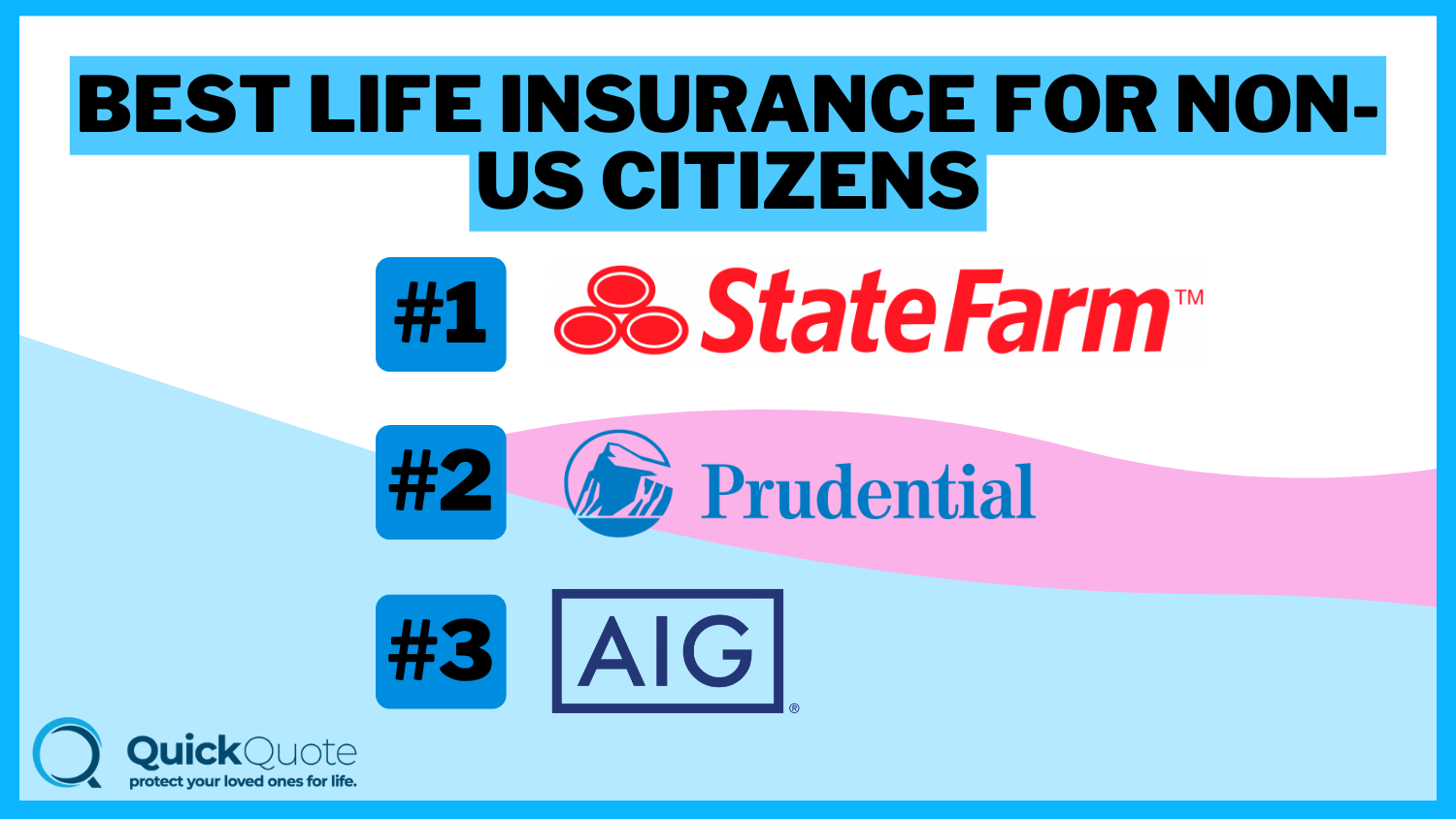

State Farm, Prudential, and AIG provide the best life insurance for non-U.S. citizens, with rates starting at $47 per month. State Farm offers global coverage, Prudential provides flexible policies, and AIG delivers strong international support, making them top choices for comprehensive life insurance.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Dec 15, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Dec 15, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

0 reviews

0 reviewsCompany Facts

Full Coverage for Non-US Citizens

A.M. Best Rating

Complaint Level

0 reviews

0 reviews 163 reviews

163 reviewsCompany Facts

Full Coverage for Non-US Citizens

A.M. Best Rating

Complaint Level

Pros & Cons

163 reviews

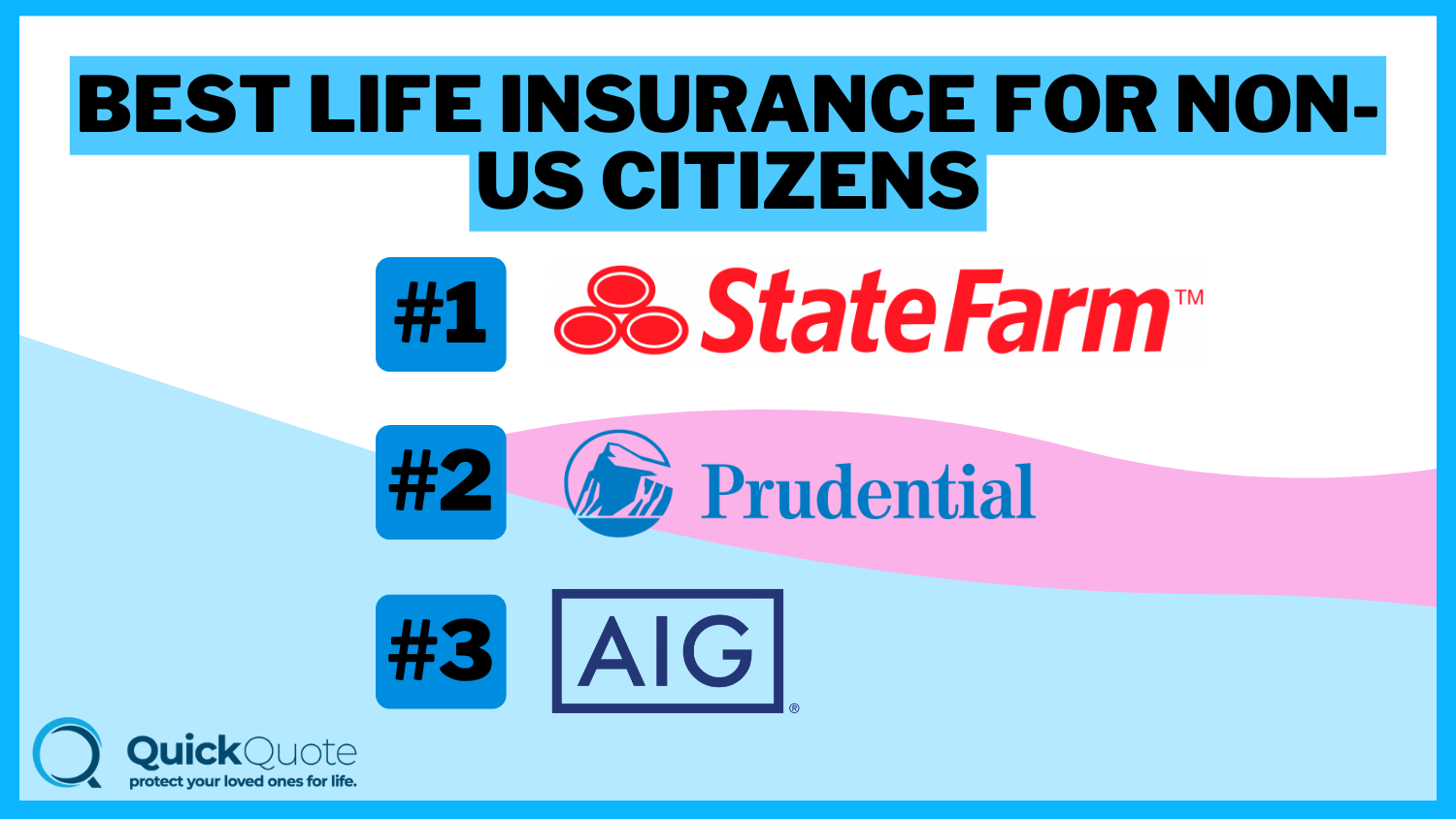

163 reviewsState Farm, Prudential, and AIG are the top choices for the best life insurance for non-U.S. citizens. State Farm stands out with its exceptional international coverage and robust policy options, making it the top pick overall.

Prudential offers flexible plans specifically designed for expatriates, ensuring adaptable solutions. AIG is known for its extensive global reach and strong financial stability, providing reliable coverage for foreigners.

Our Top 10 Company Picks: Best Life Insurance for Non-US Citizens

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 7% | B | Reliable Service | State Farm | |

| #2 | 8% | A+ | Established Network | Prudential | |

| #3 | 6% | A | Global Coverage | AIG |

| #4 | 7% | A+ | Worldwide Coverage | AXA |

| #5 | 5% | A | Expat-Friendly | Generali |

| #6 | 6% | A- | International Coverage | Bupa |

| #8 | 4% | A+ | Global Solutions | Zurich | |

| #7 | 5% | A | Global Support | Cigna | |

| #9 | 5% | A+ | Flexible Coverage | The Hartford |

| #10 | 3% | A | Expat Focused | Kaiser |

Together, these providers offer top insurance options for those living abroad, ensuring coverage for health and expatriate life. Their global expertise guarantees peace of mind wherever you are. To gain further insights, consult our comprehensive guide titled “Best Life Insurance for Expats.”

Enter your ZIP code into our free quote comparison tool above to instantly compare life insurance quotes from trusted insurers near you.

- State Farm leads the best life insurance for non-U.S. citizens

- Prudential and AIG provide reliable policies for non-U.S. citizens

- Global policies offer diverse benefits for international residents

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Wide Accessibility: With our State Farm life insurance review, you can see how their extensive network supports ease of access to life insurance for non-U.S. citizens in the U.S.

- Simple Policy Management: The online platform and app make it straightforward for non-U.S. citizens to manage their life insurance policies.

- Reliable Customer Service: Dependable customer support ensures non-U.S. citizens have access to the best life insurance for non-U.S. citizens.

Cons

- Limited Coverage Abroad: May not offer extensive coverage options for non-U.S. citizens living outside the U.S.

- Basic Policy Options: The range of life insurance policies available might be less varied compared to some competitors.

#2 – Prudential: Best for Established Network

Pros

- Varied Policy Choices: Offers a wide range of tailored policies, making it one of the best life insurance for non-U.S. citizens by addressing their specific needs effectively.

- Global Access: Based on our Prudential life insurance review, their international presence ensures that non-U.S. citizens have easy access to life insurance coverage.

- Comprehensive Coverage: Robust offerings make it a strong candidate for the best life insurance for non-U.S. citizens.

Cons

- Complex Application Process: The application process may be intricate, involving detailed paperwork for non-U.S. citizens.

- Higher Costs: Some policies, including the best life insurance for non residents, might come with higher costs.

#3 – AIG: Best for Global Coverage

Pros

- Extensive Global Coverage: Provides the best life insurance for non-U.S. citizens with comprehensive solutions that cater to individuals worldwide.

- Flexible Policy Options: Policies are customizable to meet the varied needs of non-U.S. citizens, ensuring each individual’s unique circumstances are addressed.

- Strong Reputation: View our AIG life insurance review to learn why the company is well-regarded for providing the best life insurance for non-U.S. citizens with its extensive experience.

Cons

- Higher Premiums: The international focus may result in higher premiums for life insurance for non residents.

- Complex Underwriting: The underwriting process can be detailed and challenging for non-U.S. citizens.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#4 – AXA: Best for Worldwide Coverage

Pros

- Global Coverage: Offers best life insurance to non-U.S. citizens in numerous countries, ensuring broad protection and qualifying it as the best.

- Customizable Policies: Explore our AXA life insurance review to see how their policies offer the flexibility needed for non-U.S. citizens to tailor their coverage to specific needs.

- Solid Financial Standing: Provides strong financial stability offers reassurance and confidence in obtaining the best life insurance for non-U.S. citizens.

Cons

- Potentially Expensive: Comprehensive international coverage can lead to higher premiums.

- Limited Local Support: Some regions may have less available support compared to other providers.

#5 – Generali: Best for Expat-Friendly Policies

Pros

- Expat-Friendly Coverage: Policies are crafted to meet the needs of non-U.S. citizens and expatriates, ideal for the best life insurance for non-U.S. citizens.

- Multilingual Service: In our Generali life insurance review, discover how offering support in multiple languages helps non-U.S. citizens communicate more easily.

- Tailored Solutions: Provides specialized life insurance options, making it a strong contender for the best life insurance for non-U.S. citizens.

Cons

- Regional Limitations: Policy availability may be restricted in certain regions, affecting access to coverage.

- Higher Costs: Expat-friendly features can lead to higher policy costs compared to standard life insurance plans.

#6 – Bupa: Best for International Coverage

Pros

- Integrated Health Coverage: Combines life insurance with health benefits, ideal for non-U.S. citizens seeking the best life insurance for non-U.S. citizens.

- Global Reach: View our Bupa life insurance review to learn how their extensive network aids non-U.S. citizens across the globe.

- Focused Service: Policies are tailored to the needs of non-U.S. citizens, representing the best life insurance for non-U.S. citizens.

Cons

- Specialized Focus: The emphasis on health integration might limit other life insurance options.

- Higher Premiums: Comprehensive international and health coverage can lead to increased premiums.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#7 – Zurich: Best for Global Solutions

Pros

- Wide International Reach: Offers global coverage for the best life insurance for non-U.S. citizens, providing extensive solutions.

- Customizable Coverage: Allows non-U.S. citizens to tailor their life insurance policies according to their needs.

- Financial Stability: See our Zurich life insurance review to find out how its strong financial standing enhances its reputation as a leading provider for non-U.S. citizens.

Cons

- Potentially Higher Premiums: Global coverage options might come with higher premiums.

- Complex Policy Terms: Non-U.S. citizens may find policy terms more intricate.

#8 – Cigna: Best for Global Support

Pros

- International Network: Offers extensive support for non-U.S. citizens around the globe, making it a leading choice for the best life insurance for non-U.S. citizens.

- Adaptable Policies: Discover our Cigna life insurance review to explore how their customizable plans meet the diverse needs of non-U.S. citizens.

- Comprehensive Assistance: Robust support system ensures non-U.S. citizens receive the best life insurance for non-U.S. citizens.

Cons

- Policy Variety: The range of policy options may be more limited compared to some other providers.

- Claims Process Complexity: Navigating the claims process can be complex for those seeking life insurance for non-citizens

#9 – The Hartford: Best for Flexible Coverage

Pros

- Adaptable Life Insurance: In our The Hartford life insurance review, see how their flexible policies are designed to accommodate the specific needs of non-U.S. citizens.

- Customer-Centric Service: Personalized support and service enhance the experience for non-U.S. citizens.

- Comprehensive Coverage: Provides a range of options suitable for the best life insurance for non-U.S. citizens.

Cons

- Limited Global Options: Coverage may be more restricted outside the U.S.

- Potential Cost Variability: Premiums might vary significantly, impacting affordability for non-U.S. citizens.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#10 – Kaiser: Best for Expat Focus

Pros

- Expatriate-Friendly Coverage: Policies are tailored specifically for non-U.S. citizens living abroad, ensuring they receive the best life insurance for non-U.S. citizens.

- Integrated Care: Approach combines life insurance with health coverage, offering holistic protection.

- Tailored Solutions: Explore our Kaiser life insurance review to understand how they provide specialized support and solutions for non-U.S. citizens seeking the best life insurance options

Cons

- Geographical Limitations: Services might be limited to certain regions.

- Fewer Policy Options: There may be fewer choices in life insurance policies compared to other global providers.

Comparing Life Insurance Non-US Citizens

Choosing the best life insurance for non-US citizens involves considering the affordability and reliability of insurance providers. Examining the table of monthly life insurance rates for non-US citizens reveals a range of options across various providers.

Non-US Citizens Life Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $55 | $165 |

| $53 | $157 |

| $50 | $150 |

| $49 | $148 | |

| $51 | $155 |

| $47 | $140 | |

| $56 | $168 | |

| $54 | $162 | |

| $52 | $160 |

| $56 | $168 |

State Farm is particularly noteworthy for its balance of competitive rates and excellent service. On the higher end, Prudential and Zurich provide more extensive coverage but at a higher cost.

AIG provides a good balance of cost and coverage, which could appeal to those seeking a reasonable premium along with robust protection options. To find the types of life insurance that fits your needs and budget, it’s essential to compare quotes from different providers.

State Farm excels in offering tailored life insurance solutions for non-U.S. citizens with its robust policy options and reliable support.

Jeff Root Licensed Insurance Agent

This approach ensures that you choose a plan that offers both the right level of protection and the most competitive pricing for life insurance for foreign nationals.

Saving on Life Insurance for Non-US Citizens

Evaluating life insurance options for non-US citizens, discounts from top providers can play a significant role in reducing costs and enhancing value. The table reveals several beneficial discounts from top providers:

State Farm provides bundling, safe driving, and loyalty discounts, rewarding multiple policies, good driving records, and long-term commitment. AIG offers discounts for multi-policy, health and wellness, and long-term savings.

Multi-policy discounts reward bundling, while health and wellness discounts benefit those with a healthy lifestyle. Here are effective strategies to secure discounts on life insurance:

- Bundle Policies: Combine life insurance with other coverage, like auto or home, with the same provider to earn multi-policy discounts.

- Maintain a Healthy Lifestyle: Engage in regular exercise and avoid smoking to qualify for health and wellness discounts.

- Stay Loyal: Sticking with the same insurance provider for several years can lead to significant loyalty discounts.

- Keep a Clean Driving Record: Maintaining a good driving record can qualify you for safe driver discounts.

Leveraging these discounts can lead to significant savings on life insurance premiums. Comparing discount options across providers helps non-US citizens find a policy that offers the best balance of coverage and cost savings.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Top Life Insurance Providers for Non-U.S. Citizens

Searching for the best life insurance for non-U.S. citizens, it’s essential to consider the market presence and reliability of leading insurers. Analyzing the market share of top life insurance companies helps identify those with a strong industry footprint and diverse coverage options.

Top 10 Life Insurance Companies by Market Share

| Insurance Companies | Rank | Premiums Written | Market Share |

|---|---|---|---|

| #1 | $10.8 million | 6.7% | |

| #2 | $10.5 million | 6.5% | |

| #3 | $9.3 million | 5.8% |

| #4 | $9.1 million | 5.6% |

| #5 | $8.8 million | 5.4% | |

| #6 | $6.8 million | 4.2% | |

| #7 | $4.8 million | 3.0% | |

| #8 | $4.6 million | 2.9% |

| #9 | $4.6 million | 2.9% | |

| #10 | $4.4 million | 2.7% |

MetLife and Northwestern Mutual are well-regarded for their extensive experience and comprehensive policy options. New York Life and Prudential also provide robust coverage with a global perspective.

State Farm is noted for its strong market presence and customer-centric approach, offering a range of discounts and benefits. For non-U.S. citizens, it is possible to find a suitable life insurance policy by considering these options.

Can a non-citizen get life insurance in the USA? Absolutely, with careful evaluation and the right provider, non-citizens can secure effective coverage that meets their needs. To learn more, explore our comprehensive resource on insurance titled “Best Life Insurance Companies.”

Term and Whole Life Insurance for Non-U.S. Citizens

For non-U.S. citizens looking to secure life insurance, understanding the potential costs and specific requirements is crucial. The cost of life insurance can vary based on the type of policy and several factors, including age and gender.

Term Life Insurance provides coverage for a specified period, such as 20 years, and is typically more affordable than whole life insurance. The premiums for term life insurance increase with age, reflecting the higher risk associated with older policyholders.

The following tables provide sample premiums for term and whole life insurance policies:

Term Life Insurance Monthly Rate By Age & Gender

| Policyholder Age | Male Rates | Female Rates |

|---|---|---|

| 25 | $15 | $13 |

| 30 | $15 | $13 |

| 35 | $18 | $15 |

| 40 | $21 | $19 |

| 45 | $27 | $23 |

| 50 | $36 | $29 |

| 55 | $51 | $38 |

| 60 | $85 | $60 |

| 65 | $145 | $97 |

Whole Life Insurance, on the other hand, offers lifelong coverage and includes a savings component that builds cash value over time. This type generally comes with higher premiums compared to term life insurance.

Whole Life Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 25 Female | $50 | $150 |

| Age: 25 Male | $55 | $160 |

| Age: 35 Female | $65 | $170 |

| Age: 35 Male | $70 | $180 |

| Age: 45 Female | $80 | $220 |

| Age: 45 Male | $85 | $230 |

| Age: 55 Female | $105 | $290 |

| Age: 55 Male | $115 | $310 |

| Age: 65 Female | $150 | $450 |

| Age: 65 Male | $160 | $470 |

Term life insurance is cost-effective for temporary needs, while whole life provides permanent coverage. Non-U.S. citizens should evaluate these options to find the best life insurance for non-citizens.

Understanding Life Insurance for Foreign Nationals

When exploring life insurance, understanding foreign national life insurance is crucial. It’s a contract where, in exchange for regular premiums, the insurer guarantees a lump-sum payment to your beneficiary upon your death.

Can foreigners buy life insurance in USA? The answer is yes; foreign nationals can purchase life insurance in the U.S. For foreign nationals, life insurance for non-residents offers vital financial protection for loved ones, covering final expenses like funeral costs and debts.

This ensures that beneficiaries receive the needed support without additional burdens. Here is a quick glossary of the most common to help you better understand the process:

Common Life Insurance Terms and Definitions

| Term | Definition |

|---|---|

| Agent | An authorized insurance representative who sells and services policies |

| Beneficiary | The person designated by the policyholder to receive the proceeds from a life insurance policy |

| Death Benefit | A tax-free lump sum of money paid to the beneficiary upon the death of the insured |

| Face Amount | The amount of coverage provided by a life insurance policy |

| Final Expenses | Expenses incurred at the time of a person's death such as funeral costs, current liabilities, and taxes |

| Policy | The legal document stating the terms of the life insurance contract |

| Policyholder | The owner of the policy, typically the insured |

| Premium | The money paid to the insurance company in exchange for coverage |

| Risk Classification | The process that determines the risk associated with an applicant, which decides how much the insured’s premiums differ from the standard |

| Underwriter | The person who reviews the life insurance application, assigns a risk classification, decides if the applicant is acceptable, and determines the premium rate |

Life insurance policies generally fall into two types: term life insurance and whole life insurance. Term life insurance covers a specified period (10 to 30 years) and pays out if the insured dies during that time.

Coverage ends after the term unless renewed. Whole life insurance offers permanent coverage with a built-in savings component. Although more costly, it guarantees a payout and builds cash value over time through an interest-bearing account, similar to an IRA or 401(k).

State Farm simplifies the process for non-U.S. citizens with its streamlined application and exceptional support, making life insurance accessible and straightforward.

Kristen Gryglik Licensed Insurance Agent

State Farm and AIG are highly recommended for their expertise in foreign life insurance policies, ensuring effective and reliable coverage for expatriates.

When selecting the best life insurance for expats, choose a policy that suits your needs and is managed by providers experienced with international clients. For additional details, explore our comprehensive resource titled “The Cost of End of Life Care: 48 Facts for Families and Caregivers.”

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Ideal Life Insurance for Foreign National

Non-U.S. citizens, including those seeking the best life insurance for undocumented immigrants, it’s crucial to select providers who understand and accommodate international and residency complexities. State Farm, AIG, and Prudential emerge as the top choices for foreign nationals seeking comprehensive coverage.

State Farm stands out with its tailored policies and exceptional customer support designed specifically for non-residents, offering a seamless experience for those living abroad.

AIG is renowned for its flexible policy options that cater to various residency and citizenship statuses, ensuring a broad range of coverage solutions.

Prudential complements these options with its competitive plans and expertise in handling the unique needs of foreign nationals, providing reliable and extensive insurance coverage.

Together, these top providers offer robust, adaptable insurance solutions, making them the best choices for non-U.S. citizens looking to secure dependable life insurance coverage. For a thorough understanding, refer to our detailed analysis titled “What are the benefits of buying life insurance?”

Shop around for personalized life insurance quotes that fit your needs and budget by entering your ZIP code below.

Frequently Asked Questions

Can a non-U.S. citizen be a beneficiary for life insurance?

Yes, non-U.S. citizens can be named beneficiaries on a life insurance policy, but there may be specific regulations or tax implications. To delve deeper, refer to our in-depth report titled “How To Choose a Life Insurance Beneficiary.”

Can you get life insurance if you are not a U.S. citizen?

Yes, non-U.S. citizens can obtain life insurance in the U.S., though the process may vary based on residency status and insurer policies.

Free instant life insurance quotes are just a click away. Enter your ZIP code above to get started.

Can a non-U.S. citizen get a life insurance license?

In most cases, non-U.S. citizens can obtain a life insurance license if they meet state requirements, such as legal residency or work authorization.

What is an example of a foreign national?

A foreign national refers to individuals who are citizens of a country other than the U.S. For instance, a French citizen living in the U.S. would be considered a foreign national.

Can I get insurance if I am not a U.S. citizen?

Yes, non-U.S. citizens can obtain insurance in the U.S., but availability and terms may vary based on residency status and the type of insurance.

How to apply for life insurance in the U.S.?

To apply for life insurance in the U.S., you generally need to choose an insurer, complete an application, provide documentation, and undergo a medical exam if required. To gain profound insights, consult our extensive guide titled “How to Buy Life Insurance.”

Can foreigners get life insurance in the USA?

Yes, foreigners can purchase life insurance in the USA, although the requirements and policy terms for life insurance in USA for foreigners might differ from those for U.S. citizens.

Can life insurance for non U.S citizen be given to anyone?

Yes, non-U.S. citizens can obtain life insurance, but eligibility depends on factors like residency and documentation. Each insurer has specific requirements.

Is there an age limit for life insurance in the USA?

While there isn’t a universal age limit for life insurance in the USA, insurers typically have age limits for issuing new policies or may offer different terms for older applicants. For detailed information, refer to our comprehensive report titled “Life Insurance Rates by Age & Gender.”

Who has the best life insurance for non-U.S. citizens?

For non-U.S. citizens, top providers include State Farm and AIG, known for their flexible policies and strong financial stability, making them ideal choices for those seeking life insurance for non-U.S. residents.

If you need life insurance coverage, enter your ZIP code into our free tool below to save time and money.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.