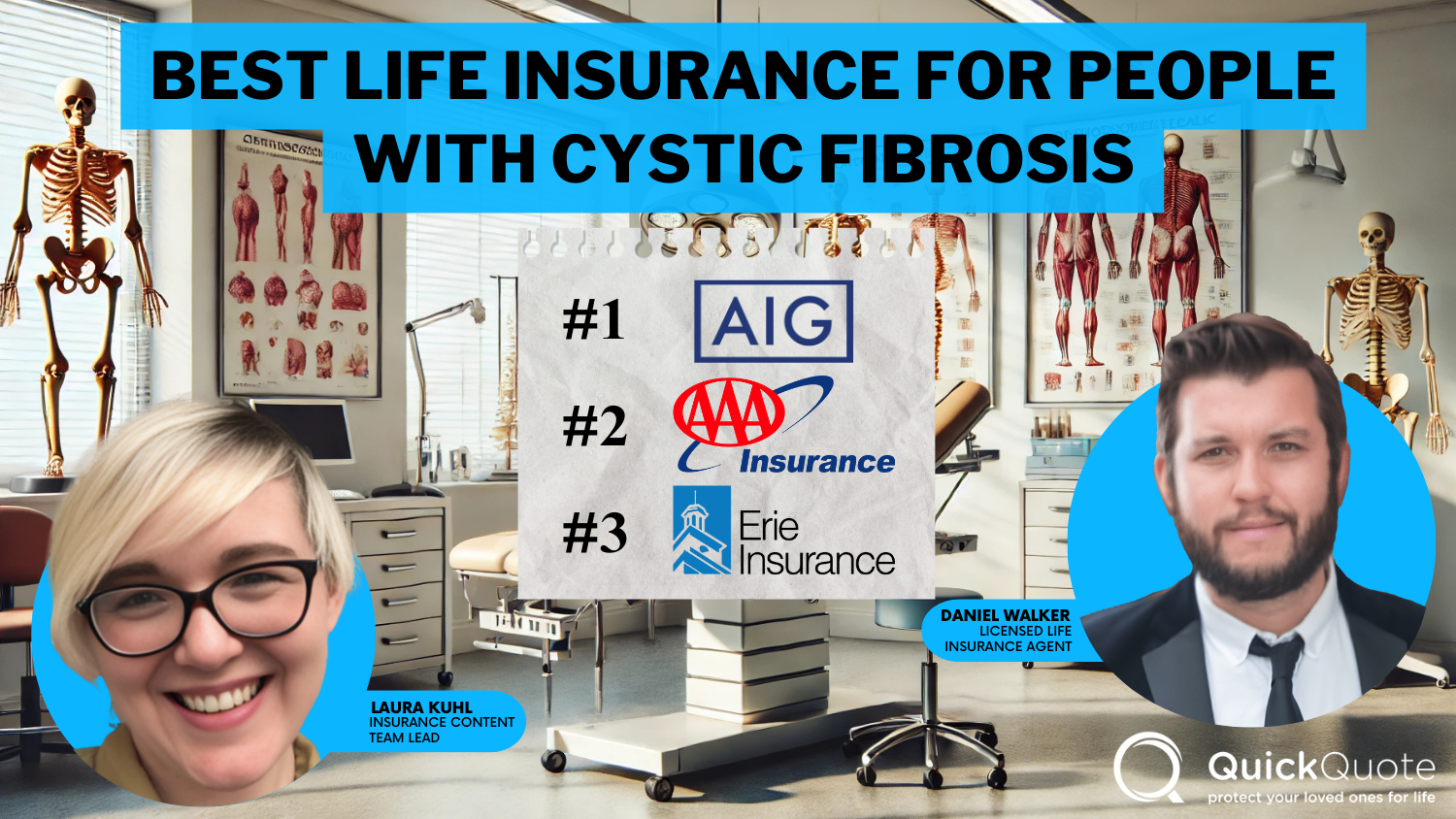

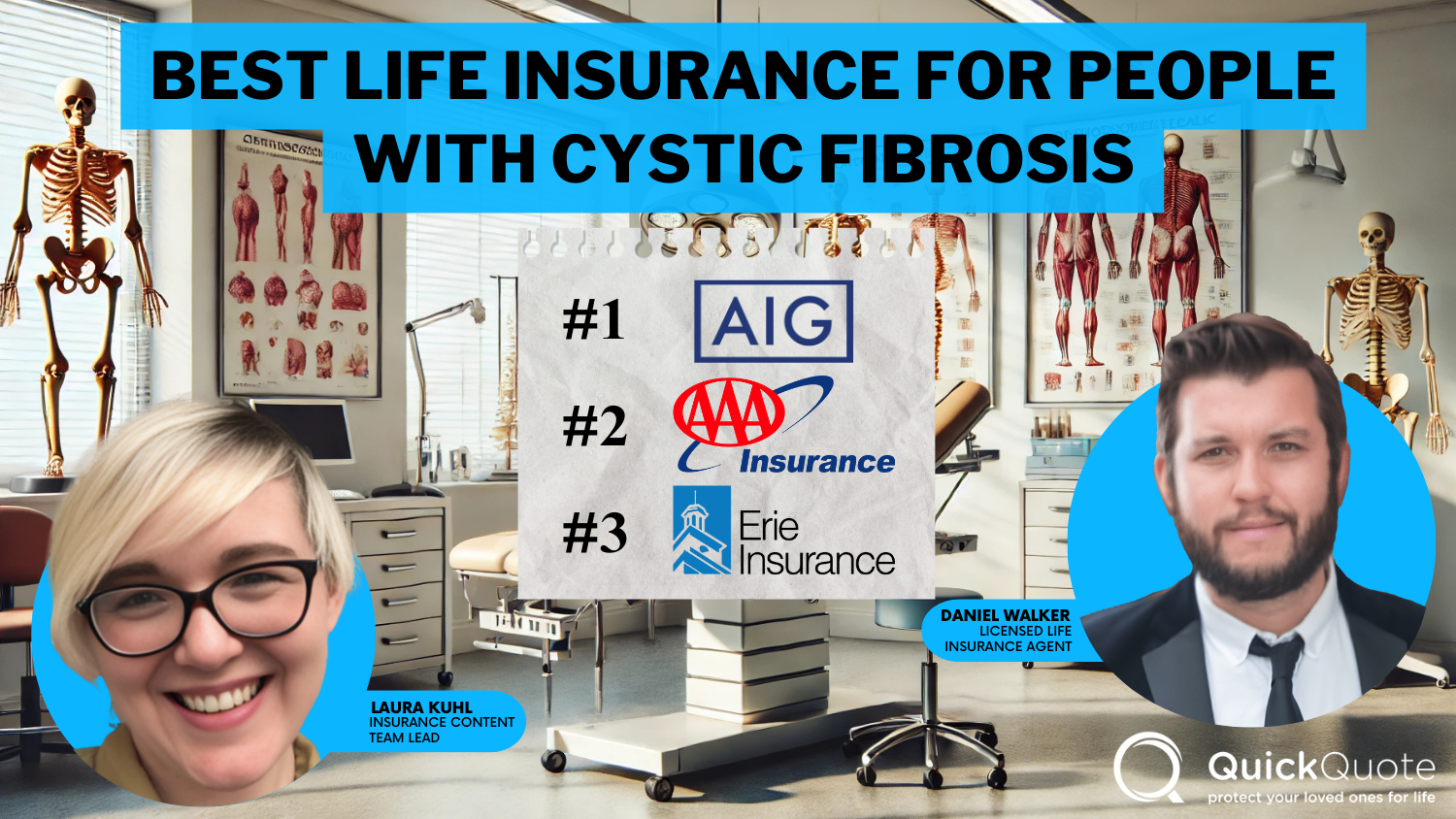

Best Life Insurance for People With Cystic Fibrosis in 2025 (10 Standout Companies)

AIG, AAA, and Erie offer the best life insurance for people with cystic fibrosis, with starting rates as low as $140 per month. These providers offer personalized policies, bundling options, and flexible coverage. Choose the best cystic fibrosis life insurance to fit your needs today.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Mar 25, 2025

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Mar 25, 2025

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,027 reviews

3,027 reviewsCompany Facts

Whole Policy for Cystic Fibrosis People

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 1,883 reviews

1,883 reviewsCompany Facts

Whole Policy for Cystic Fibrosis People

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviewsAIG, AAA, and Erie have the best life insurance for people with cystic fibrosis, with monthly rates starting at $140. They provide affordable rates, good coverage options, and plans for specific health needs.

These companies understand how to work with unique health conditions and offer flexible policies that make sense for people managing this illness.

Our Top 10 Company Picks: Best Life Insurance for People With Cystic Fibrosis

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $80 | A | Flexible Policies | AIG |

| #2 | $75 | A | Bundling Option | AAA |

| #3 | $78 | A+ | Filing Claims | Erie |

| #4 | $70 | A+ | Exceptional Support | Amica | |

| #5 | $85 | A | Personalized Service | American Family | |

| #6 | $90 | A | Policy Variety | Farmers | |

| #7 | $95 | A | Comprehensive Discounts | Liberty Mutual |

| #8 | $86 | A+ | Adaptive Benefits | Nationwide |

| #9 | $88 | B | Reliable Reputation | State Farm | |

| #10 | $72 | A++ | Member Loyalty | USAA |

Whether you’re looking for term life insurance or whole life policies that build cash value, these providers have you covered.

Free instant term life insurance quotes about cystic fibrosis are just a click away. Enter your ZIP code to get started.

- Get cystic fibrosis life insurance at $140 monthly

- AIG is the top pick for life insurance for people with cystic fibrosis

- AAA and Erie offer strong bundling options and tailored plans

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#1 – AIG: Top Overall Pick

Pros

- Comprehensive Coverage: According to our AIG life insurance review, AIG offers robust insurance plans for people with cystic fibrosis, starting at $180 per month.

- High Coverage Limits: AIG also provides flexible options for higher coverage limits to meet the needs of people with cystic fibrosis.

- Specialized Riders: Unique add-ons, including critical illness riders, enhance protection for people with cystic fibrosis.

Cons

- Higher Premiums: AIG’s whole life coverage starts at $350 per month, which is higher than other providers.

- Limited Online Tools: Digital tools and resources for people with cystic fibrosis may lag behind competitors.

#2 – AAA: Best for Bundling Options

Pros

- Affordable Rates: AAA offers the best life insurance for people with cystic fibrosis, starting at $150 per month for term life coverage.

- No-Exam Options: Guaranteed issue policies for people with cystic fibrosis are available without medical exams, making it easy to obtain coverage.

- Discounts: AAA members with cystic fibrosis can save money through membership perks and discounts. Learn more in our AAA life insurance review.

Cons

- Limited Customization: Policies for people with cystic fibrosis might not include extra features like critical illness riders.

- Membership Requirement: You need an active AAA membership to get some benefits. People with cystic fibrosis should also consider a AAA traditional term life quote to see what works best.

#3 – Erie: Best for Tailored Coverage

Pros

- Competitive Rates: Erie offers affordable life insurance for people with cystic fibrosis, with term life coverage starting at $175 per month.

- Policy Flexibility: Erie provides customizable plans for people with cystic fibrosis, meeting different needs. Read more in our Erie life insurance review.

- Critical Illness Coverage: Optional add-ons for critical illness coverage give extra protection for people with cystic fibrosis.

Cons

- Regional Availability: Erie life insurance may not be available in all states for people with cystic fibrosis.

- Limited Online Tools: Digital resources and tools could improve to enhance convenience for people with cystic fibrosis.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#4 – Amica: Best for Exceptional Support

Pros

- Affordable Premiums: Amica’s term life insurance is one of the best options for people with cystic fibrosis, offering affordable monthly rates starting at $145.

- High Customer Satisfaction: Amica ranks high in customer satisfaction, making it a popular choice for people with cystic fibrosis.

- Flexible Coverage: Amica offers customizable plans tailored to the unique needs of people with cystic fibrosis. Learn what cash value life insurance is.

Cons

- Limited Features: Some policies may not include advanced add-ons, which could concern people with cystic fibrosis looking for more specialized options.

- Higher Approval Criteria: Amica’s strict underwriting process may exclude some people with cystic fibrosis from qualifying for coverage.

#5 – American Family: Best for Personalized Service

Pros

- Tailored Plans: American Family offers the best life insurance for people with cystic fibrosis, with term life coverage starting at $160 per month.

- Bundling Discounts: People with cystic fibrosis can combine policies for significant savings. Read up about life insurance for families for insights.

- Strong Support: Exceptional customer service for people with cystic fibrosis policyholders.

Cons

- Higher Rates: People with cystic fibrosis may find whole life coverage rates of $320 per month less competitive for budget-conscious applicants.

- Limited Availability: Policies for cystic fibrosis are not accessible in all states.

#6 – Farmers: Best for Policy Variety

Pros

- Family Discounts: Farmers offer discounts for families with cystic fibrosis people, starting at $185 a month for term life coverage.

- Flexible Policies: They offer flexible plans to meet the needs of people with cystic fibrosis (Learn more: Permanent Life Insurance).

- Extensive Network: You’ll have access to knowledgeable agents who specialize in helping people with cystic fibrosis, providing personalized support.

Cons

- Higher Premiums: Whole life coverage can cost $360 a month or more, which might be too expensive for some people with cystic fibrosis.

- Limited Digital Features: The online tools for managing accounts could be better for people with cystic fibrosis.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Comprehensive Discounts

Pros

- Robust Plans: As per Liberty Mutual review, it highlights the term life coverage rates for people with cystic fibrosis starting at $165 per month.

- Add-On Options: Critical illness riders and other features enhance coverage for people with cystic fibrosis.

- Financial Strength: Liberty Mutual is a stable and reliable company, ensuring your coverage will last long-term for people with cystic fibrosis.

Cons

- Premium Costs: Whole life coverage can be pricey, starting at $330 a month for people with cystic fibrosis, which is higher than some competitors.

- Limited Discounts: Liberty Mutual offers fewer bundling discounts for people with cystic fibrosis than other insurance companies.

#8 – Nationwide: Best for Adaptive Benefits

Pros

- Balanced Plans: Nationwide offers great life insurance for people with cystic fibrosis, starting at $170 per month for term life coverage.

- Customization: As per Nationwide life insurance review, its policies are highly adaptable for people with cystic fibrosis and cater to diverse needs.

- Online Resources: Nationwide provides helpful online tools to manage your policy easily.

Cons

- Higher Rates: Whole life coverage starts at $355 per month, which might be too expensive for some people with cystic fibrosis.

- Approval Challenges: Getting coverage can be tougher due to stricter approval guidelines for cystic fibrosis.

#9 – State Farm: Best for Reliable Reputation

Pros

- Extensive Options: State Farm offers the best life insurance for people with cystic fibrosis, with rates starting at $155 per month for term life coverage.

- Bundling Savings: Discounts for combining policies make life insurance more affordable for people with cystic fibrosis.

- Agent Network: People with cystic fibrosis can access a wide network of knowledgeable agents (Read our: State Farm Life Insurance Review).

Cons

- Limited Add-Ons: Life insurance policies for people with cystic fibrosis might not include extra features like critical illness riders.

- Slightly Higher Rates: Whole life coverage at $320 per month for people with cystic fibrosis could be a bit pricey for some buyers.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#10 – USAA: Best for Member Loyalty

Pros

- Affordable Rates: USAA offers the best life insurance for people with cystic fibrosis, with rates starting at $140 per month for term life coverage.

- Military Focus: USAA offers special benefits for people with cystic fibrosis who are military members or part of military families.

- Simplified Enrollment: Easy application process for people with cystic fibrosis. Get full details about the benefits of buying life insurance.

Cons

- Membership Restriction: USAA policies are only available to military members with cystic fibrosis and their families.

- Limited Rider Options: The number of add-ons available for people with cystic fibrosis may be fewer than other companies offer.

Cystic Fibrosis Life Insurance Rates: Term Life vs Whole Life Coverage Comparison

Cystic fibrosis life insurance rates vary by provider and coverage level. Term life rates range from $140 per month with USAA to $185 per month with Farmers.

USAA offers the most affordable term coverage at $140 per month, followed by Amica at $145 and State Farm at $155. Farmers and AIG have the highest term premiums, at $185 and $180 per month, respectively.

Cystic Fibrosis Life Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Term Policy | Whole Policy |

|---|---|---|

| $150 | $300 |

| $180 | $350 |

| $160 | $320 | |

| $145 | $310 | |

| $175 | $340 |

| $185 | $360 | |

| $165 | $330 |

| $170 | $335 |

| $155 | $325 | |

| $140 | $310 |

Premiums for whole life coverage are higher but also vary significantly. USAA and Amica offer the most affordable whole life coverage at $310 per month, while Farmers and AIG offer the most expensive coverage at $360 and $350 per month, respectively.

Balancing cost and coverage is key when choosing life insurance for cystic fibrosis. USAA and Amica are ideal for budget-conscious shoppers, while AIG and American Family may appeal more to those who want broader or higher-limit policies.

Use tools like CF Compass to compare rates and find the best insurance for cystic fibrosis based on your specific health needs and budget.

Learn More: What is the minimum coverage amount for life insurance?

Life Insurance With Cystic Fibrosis Coverage

Life insurance for people with cystic fibrosis (CF) can be hard to get, but it’s not impossible. CF insurance is often considered high-risk because it affects breathing and digestion and can shorten cystic fibrosis life expectancy.

However, better treatments have helped people with CF live longer, and some insurance companies now offer coverage designed for them. Those with mild symptoms, good health, and consistent treatment may qualify, but the rates are often higher.

To find coverage, people with CF should consider working with brokers who specialize in high-risk conditions. Options like guaranteed issue or simplified issue policies don’t need medical exams, but they usually cost more and have lower coverage limits.

People With Cystic Fibrosis Life Insurance Available Coverage by Provider

| Insurance Company | Term Life | Whole Life | Universal Life | Final Expense | No-Medical-Exam |

|---|---|---|---|---|---|

| ✅ | ✅ | ✅ | ❌ | ✅ |

| ✅ | ✅ | ✅ | ✅ | ✅ |

| ✅ | ✅ | ✅ | ❌ | ✅ | |

| ✅ | ✅ | ✅ | ❌ | ❌ | |

| ✅ | ❌ | ✅ | ❌ | ❌ |

| ✅ | ✅ | ✅ | ✅ | ✅ | |

| ✅ | ✅ | ✅ | ❌ | ✅ |

| ✅ | ✅ | ✅ | ✅ | ✅ |

| ✅ | ✅ | ✅ | ✅ | ✅ | |

| ✅ | ✅ | ✅ | ✅ | ✅ |

Traditional policies may be available for those with mild CF or stable health. Insurers look at medical history, lung function, and hospital stays to decide eligibility.

Read More: Best Life Insurance Companies

Being prepared helps. Gather your medical records, show proof of stable health, and highlight positive care results. Some insurers offer graded death benefit policies with limited payouts early on.

Shop for life insurance, compare options and read the terms carefully to find the right policy for your needs and budget. Find the best travel insurance for cystic fibrosis with tailored coverage for medical needs.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Top Insurance Providers With Discounts for People With Cystic Fibrosis

Several top insurance providers offer great discounts for people with cystic fibrosis. AAA gives bundling discounts for auto and life insurance, plus a loyalty discount for long-term policyholders.

AIG offers an accelerated death benefit rider and no-exam policies for certain products, making it easier to qualify for coverage. American Family provides multi-policy discounts and no-medical-exam options for select policies.

Life Insurance Discounts From the Top Providers for Cystic Fibrosis People

| Insurance Company | Non-Smoker | Healthy Lifestyle | Bundling | Loyalty | AutoPay |

|---|---|---|---|---|---|

| 8% | 6% | 4% | 3% | 2% |

| 10% | 5% | 5% | 4% | 5% |

| 9% | 7% | 5% | 4% | 3% | |

| 7% | 5% | 6% | 3% | 4% | |

| 8% | 6% | 7% | 5% | 2% |

| 8% | 7% | 5% | 3% | 2% | |

| 10% | 6% | 5% | 3% | 4% |

| 12% | 7% | 8% | 3% | 2% |

| 8% | 10% | 6% | 4% | 3% | |

| 10% | 7% | 5% | 2% | 3% |

Amica has a loyalty discount, a paperless billing discount, and a claim-free discount, encouraging long-term customers and promoting eco-friendly options. Erie offers multi-policy bundling and flexible policy terms, helpful for those with cystic fibrosis.

Farmers give multi-line discounts and rewards for managing policies electronically, making coverage more affordable. Liberty Mutual offers discounts for bundling policies, electronic management, and paying premiums in full.

Nationwide features its SmartRide program, multi-policy bundling, and paperless policy discounts, helping policyholders save on life insurance. State Farm offers bundling and loyalty discounts, plus a reward for maintaining good health, while USAA provides member loyalty discounts and bundling options with auto or home insurance.

Life Insurance Policy for Cystic Fibrosis

Life insurance for people with cystic fibrosis (CF) can be tough to get because CF is a serious, lifelong condition. Many insurance companies see CF as high-risk, meaning fewer choices and higher costs.

Companies consider factors such as the severity of the condition, age, overall health, lung function, and hospital visits. People with mild symptoms and good health might get better options than those with severe CF.

Some insurance providers focus on helping people with pre-existing conditions, including CF. Guaranteed-issue life insurance, which doesn’t require a medical exam, might be an option, but it often has lower coverage and higher premiums. Group life insurance from employers might also work since it usually doesn’t require health details.

It is important to research and compare providers to find the best fit. An insurance broker with CF experience can help you find coverage. Staying healthy and following your cystic fibrosis treatment plan can also improve your chances of getting better terms. Review our in-depth guide, “What is an instant life insurance policy?”

Understanding Life Insurance Options for People With Cystic Fibrosis (CF)

Life insurance for people with cystic fibrosis (CF) can be difficult to obtain due to health concerns, but coverage is still available. There are two main types: term life, which is cheaper and covers a set period, and whole life, which is more expensive and provides lifelong coverage with cash value.

People with cystic fibrosis may still qualify for life insurance, but eligibility and rates depend on the severity of their condition.Jeff Root Licensed Life Insurance Agent

When applying, expect a detailed medical review, including medical records, lab results, and a doctor’s statement. Based on the severity of the CF, some insurers may offer policies with exclusions or limits.

If traditional insurance is not an option, guaranteed-issue life insurance may be considered, though it has lower coverage, higher premiums, and a waiting period. Working with a broker specializing in high-risk cases can help find better options.

Learn More: How To Find a Lower-Term Life Insurance Premium

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Life Insurance Options for Individuals With Cystic Fibrosis

Life insurance for people with cystic fibrosis (CF) can be difficult to obtain because of the health risks. Many insurers consider CF high-risk, which can mean higher premiums or even denial of coverage. However, with better treatments and longer life expectancy, some insurers now offer policies under certain conditions.

Coverage depends on age, overall health, and severity of the condition. Guaranteed-issue life insurance is a good option for people with CF because it doesn’t require a medical exam. These plans usually have higher premiums and lower coverage, but they provide financial security without health checks.

Group life insurance from work can also be helpful since it often skips medical reviews. These choices work well for people who have trouble getting regular policies.

Read More: How To Get Life Insurance With a Medical Condition

For those needing quick coverage, last-minute life insurance can be an option to explore. Working with a broker who knows about high-risk cases can help find the right coverage. They can connect you with insurers that understand CF.

Comparing cystic fibrosis quotes and looking at other options, like extra insurance or savings plans, can help you get full financial protection.

Get Burial Insurance With Cystic Fibrosis

You can get burial insurance with cystic fibrosis (CF), but there are a few things to consider. CF is a pre-existing condition that can affect your eligibility and premiums. You may need to apply for a guaranteed issue policy, which doesn’t require a medical exam but often comes with higher rates, such as AAA burial insurance.

From updating beneficiaries to finding forms, it’s easy to manage your life insurance and annuity needs online. Learn more at https://t.co/2Q1wOHt8xv. pic.twitter.com/p2iwwyOBRm

— USAA (@USAA) April 7, 2020

When applying for burial insurance, some companies may decline coverage. Underwriters evaluate the severity of CF, current health, and treatment history. If CF is well-managed, you might still qualify, though premiums could be higher, there may be a waiting period for full benefits, especially with guaranteed issue policies.

Securing burial insurance for cystic fibrosis can be difficult, yet possible, particularly for young adults. Compare Progressive burial insurance and consult an experienced agent for the best policy. Note that premiums may be higher, with potential limitations or restrictions on coverage.

Get Long-Term Care Insurance With Cystic Fibrosis

Obtaining long-term care insurance with cystic fibrosis (CF) can be tough but not impossible. CF is a disease that gets worse over time and needs continuous medical care, so insurers often consider it high-risk.

This can lead to higher premiums or exclusions on certain types of care. Still, some insurers focus on covering people with pre-existing conditions.

When you apply, provide clear medical records showing how severe the condition is and what treatments you’re getting. Insurers may want to know how well you’re managing the disease and if there have been any complications.

Some may offer coverage with certain exclusions, such as not covering CF-related care but including other healthcare needs. Being upfront and working with an experienced agent can help you.

It’s important to start looking for coverage early if you have CF. As the disease gets worse, it can be harder to get coverage. You should also check out government assistance programs and plans designed specifically for people with CF. Consulting a financial planner who knows health insurance can help you find the best options.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Case Studies: Life Insurance for People With Cystic Fibrosis

Cystic fibrosis can make it difficult to secure life and long-term care insurance due to health risks. However, there are insurance options available for financial protection. Below, we share three stories of people with cystic fibrosis securing coverage for their future and loved ones.

- Case Study 1: John’s Journey: John, 30, with cystic fibrosis, chose a guaranteed issue policy with a $25,000 death benefit. Though premiums were higher, he felt secure knowing his family would be financially protected.

- Case Study 2: Sarah’s Alternative Approach: Sarah, 35, unable to get regular life insurance due to cystic fibrosis, opted for burial insurance to cover funeral costs. While it was more expensive and had limits, she saw it as an important choice for her family’s peace of mind.

- Case Study 3: Mark’s Long-Term Care Protection: Mark, 40, got a long-term care policy to help with nursing home expenses, reaching up to $80,000 monthly. By making this decision now, he ensures his family will have the money they need for his care later.

These stories highlight that while insurance for cystic fibrosis can be challenging and costly, options like guaranteed issue policies, burial insurance, and long-term care plans are available.

Applying for life insurance with cystic fibrosis can be challenging, but comparing multiple providers is key to finding affordable life insurance.Justin Wright Licensed Insurance Agent

They show that with the right provider and plan, people with cystic fibrosis can still secure meaningful coverage. Learn more about the different types of life insurance.

Choosing the Best Life Insurance for People With Cystic Fibrosis

Finding the best life insurance for people with cystic fibrosis means comparing policies, understanding underwriting rules, and choosing insurers with flexible options. While rates may be higher, many people still qualify for affordable coverage based on their health.

Read more: Private Health Insurance

AIG, Prudential, and State Farm are top providers, offering strong underwriting support, disability benefits, and customizable plans. These companies help meet the unique needs of individuals with cystic fibrosis and provide peace of mind for families.

See how much you can save on whole life insurance by entering your ZIP code into our free comparison tool. Get life insurance today.

Frequently Asked Questions

What is the best life insurance for people with cystic fibrosis?

AIG, AAA, and Erie offer the best life insurance for people with cystic fibrosis diagnosis, with rates starting at $140 per month and comprehensive coverage tailored to individual needs. To learn more, check our guide, “Does your job affect your life insurance?”

Can people with cystic fibrosis qualify for life insurance?

Yes, individuals can get cystic fibrosis insurance, but rates and coverage depend on condition severity and insurer guidelines. Explore affordable life insurance options by entering your ZIP code into our free comparison tool today.

How does cystic fibrosis affect life insurance premiums?

Cystic fibrosis typically increases life insurance premiums due to higher health risks, but insurers like AIG and Erie offer competitive options with tailored coverage.

Are medical exams required for life insurance with cystic fibrosis?

Most insurers require a medical exam and a detailed health history, but some offer guaranteed-issue policies that waive these requirements.

Why is AIG a top choice for life insurance for cystic fibrosis?

AIG provides competitive rates, flexible terms, and coverage tailored to meet the unique needs of individuals with cystic fibrosis.

What types of life insurance policies are available for cystic fibrosis?

Options include term life, whole life, and guaranteed issue policies, each offering different benefits and eligibility criteria. Learn how to get term life insurance quotes now.

Are there any no-exam life insurance options for people with cystic fibrosis?

Yes, some companies, like AAA, offer guaranteed issue policies that don’t require a medical exam, though premiums may be higher.

Can life insurance for cystic fibrosis individuals be customized?

Yes, many insurers, including Erie, allow policies to be customized to include benefits like critical illness riders or higher coverage limits.

What factors do insurers consider for cystic fibrosis coverage?

Insurers evaluate age, overall health, severity of the condition, and medical history when determining coverage and rates. Compare term life insurance vs. whole life insurance.

What should I look for in a life insurance policy for cystic fibrosis?

Focus on coverage amount, premium costs, policy flexibility, and additional benefits like critical illness riders or accelerated death benefits. To instantly compare life insurance quotes from the top providers, simply enter your ZIP code into our free quote comparison tool.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.