Voluntary Life Insurance vs. Basic Life Insurance: Which Is Better for You

When it comes to voluntary life insurance vs. basic life insurance it’s important to know that voluntary life insurance is often called group life insurance, and is a low-cost type of term insurance offered through an employer.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Life Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Licensed Life Insurance Agent

UPDATED: Dec 15, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Dec 15, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Learning about voluntary life insurance vs. basic life insurance will make things easier when you begin to look for the best quotes.

Here we’ll explain why both voluntary term life insurance and basic life insurance don’t normally allow you to get a policy with no medical exam term life insurance. We’ll also discuss some key differences between voluntary and basic life insurance that you should know, like how voluntary life insurance can sometimes include accidental death life insurance riders.

Before you dive in to learn more about what is voluntary life insurance vs. basic life insurance, use our FREE life insurance quote tool above to instantly compare quotes for basic and voluntary life insurance. Get started now.

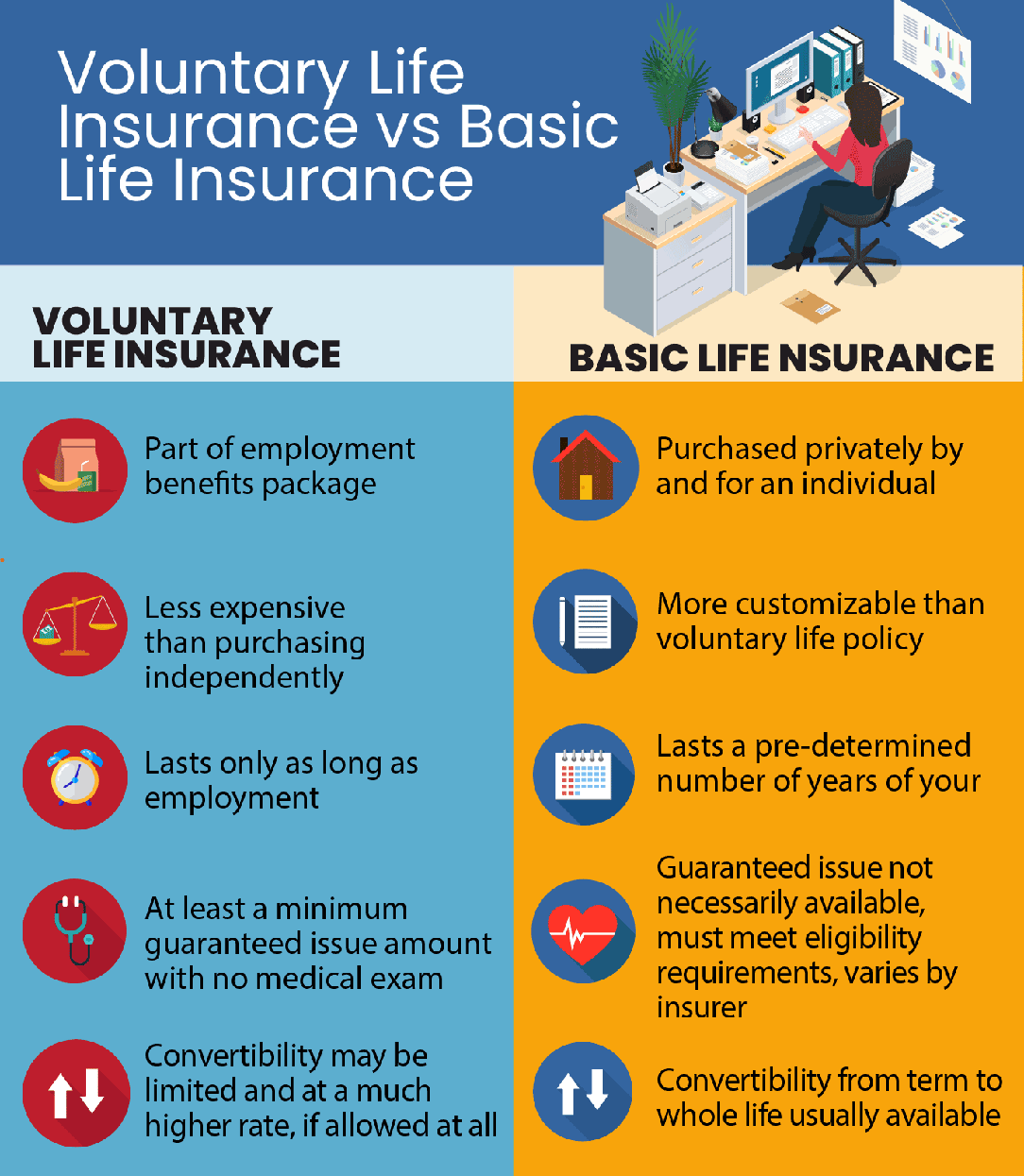

What’s the difference between basic life insurance and voluntary life insurance?

Voluntary life insurance is an affordable form of term life insurance provided through employers. Unlike employer-paid life insurance policies, which typically cover an amount equivalent to one or two times your base salary, voluntary life insurance options offer additional coverage. This includes options like voluntary supplemental life insurance and voluntary whole life insurance, enhancing your voluntary life benefit.

Voluntary employee life insurance is offered to some employees as part of their employment package. This is one of the types of life insurance offered at a low cost or free. The life insurance package covers a set amount of coverage. Some companies do offer supplemental coverage to expand your policy.

Voluntary life insurance, which includes options such as a voluntary spouse life and AD&D plan and child voluntary life insurance, along with a voluntary employee life plan, are term policies typically provided through your employer.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

What is voluntary life insurance?

Voluntary term life insurance is a low-cost type of term life insurance offered through employers.

Insurance experts suggest that most individuals should have between five to seven times their annual income covered by insurance, and in some cases, even more. This can be assessed using a voluntary life insurance calculator to determine the appropriate amount of voluntary group life insurance needed to ensure comprehensive voluntary life insurance coverage.

What is basic life insurance?

Basic life insurance, also called standard life insurance, refers to regular, individual term policies purchased independently.

Should you have voluntary life insurance?

There are benefits to buying voluntary life insurance.

- This type of life insurance has limited underwriting required. This allows for people with health conditions or lifestyles that might otherwise disqualify them to qualify for life insurance.

- The rates are lower by 10 to 20 percent, and that makes these life insurance policies affordable for those who might not otherwise purchase them.

- Many companies also offer the employee the opportunity to purchase a policy for their spouse and children if desired.

Employee voluntary term life insurance may sometimes be convertible if employment ends, although this process can be costly. typically, it involves underwriting or additional proof of insurability. for specific rates, refer to the Gerber life insurance rate chart.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Why should I buy basic life insurance?

Basic life insurance is offered to employees as part of their employment package. This type of insurance is offered at a low cost or free. The life insurance package covers a set amount of coverage.

Some companies do offer supplemental coverage to expand your policy. When people think of benefits that their companies will offer they usually think of insurance or medical benefits and retirement plans. There are additional benefits that you could be offered, like the HCA’s CorePlus total rewards package. It includes many additional benefits, like adoption assistance.

CorePlus, child, voluntary life — don’t worry. We are still talking about life insurance.

Some basic life insurance policies will have no medical exam insurance plans available.

Medical records will be requested and underwriting will occur. Rates will be higher than fully underwritten policies, and the death benefits are typically lower. Basic life insurance rates are higher than when the same policy is purchased through a group plan, also called a voluntary plan. People must pay for the policy on their own.

What is the difference between voluntary and supplemental life?

Now let’s talk about the difference between voluntary and supplemental life insurance.

Supplemental life insurance is any kind of group insurance that you decide to purchase on top of the insurance that your employer provides you. This includes riders.

Below are a couple of examples of optional riders that could be applied to your coverage. This information is provided by the State Financial Department of New York.

- Disability Income – This rider provides a monthly income while you are totally disabled, You will be eligible after an initial waiting period. The monthly disability income benefit is limited to a percentage of the death benefit.

- Cost of Living Rider – This rider enables you to purchase more insurance each year to help offset increasing insurance needs due to inflation. The amount that can be purchased is based on increases in the cost of living index. This coverage is usually available at low rates.

- Spouse Rider – A common question about life insurance is, What is spouse life insurance? There technically is not a policy called by this name. This question refers to a policy purchased for your spouse or the purchase of a spouse rider. This rider will provide level term coverage on the insured party’s spouse.

- Accidental Death Benefit – accidental death & dismemberment (AD&D) insurance provides additional insurance if the death of the insured occurs by accident. These benefits can provide for two or three times the face amount of the policy for specific types of accidents. The accidental death must occur before a specified age. Sickness does not count as accidental.

Read “What are riders in insurance?” to learn more. There is also an accidental death and dismemberment rider, which can get confusing.

You may have been researching and asked yourself “What is life insurance vs. accidental death & dismemberment (AD&D) insurance?” That is simply a voluntary life insurance policy with the additional accidental death and dismemberment rider attached.

The key takeaway when it comes to voluntary life insurance vs. AD&D is that AD&D insurance is not in every policy, individual or voluntary. Employee AD&D benefits are additional so remember that you will not likely have this coverage unless you add it. Accidental death and dismemberment insurance will come into effect if the insurance party suffered an unintentional dismemberment or death.

Dismemberment can include losing the function of body parts, like going blind. Accidental death only comes into effect in the event of the loss of life and AD&D insurance is a benefit to consider if you have a high-risk job.

Read more: Life Insurance for People Living With Disabilities

What factors will affect my life insurance rates for voluntary or basic life insurance?

Many factors will affect your life insurance premiums.

The older you get, the higher your life insurance rates will be when you buy a policy. Life insurance rates by age & gender vary. Rates increase with age.

Your life insurance rates will be higher or lower due to gender.

Women have a longer life expectancy than men, so men have higher rates. Read “Women vs. Men: Term Life Insurance Rates” to learn more.

Some habits are considered high-risk because they increase your mortality rate. These habits include:

- Smoking or chewing tobacco

- Reckless driving

- Excessive drinking

- Skydiving

Read more: How To Get Life Insurance With Chewing Tobacco Use

Some companies will allow you to have non-smoker rates if you’ve quit and not smoke for a period of their choosing. Reckless driving has a link to higher mortality and serious risk of bodily injury or harm. Life insurance companies will often want to look at your driving record to see if you’re a reckless driver.

High-risk habits such as smoking cigarettes and reckless driving aren’t the only habits the life insurance company will want to know about.

Marijuana and life insurance are correlated; marijuana/cannabis smokers are also at risk of higher rates.

Your current health and medical history are very important to the insurance company. Any condition that could increase your likelihood of death will increase your premiums. These conditions include heart disease, high blood pressure, or even obesity.

How do I get the best rates for voluntary and basic life insurance?

To get the best rates, you need to compare life insurance companies. You can find information about the cheapest life insurance companies online.

When comparing coverage, make sure to look for policies that will cover what you and your family will need. Ask the insurance company what riders they offer and if you need them. Riders are additional coverage options that are added to your policy. They normally aren’t required, so make sure to add any if you think you’ll need them.

Shop around for the best rates.

Ask the life insurance company if they offer discounts or bundles. Not all bundles are cheaper than buying insurance independently, so compare prices with bundles and without to see which makes the most sense fiscally. You become a higher risk as you get older, so you’ll get a better rate if you buy insurance at a younger age.

Life insurance companies will assess all your lifestyle and health factors to determine how much of a risk they will have to take to insure you. Any factor that will lower your life expectancy rate or heighten your mortality rate will make you more of a risk to the company. Tips for lowering your life insurance rates are:

- Get healthy

- Lose weight

- Stop smoking

- Limit high-risk behavior

- Change occupations if you have a high-risk job

Comparing each life insurance company’s rankings, reputation, rates, and coverage options can be a daunting task. This is why we offer a free life insurance quote tool so you don’t have to do all the work. Read “How can I save money when buying life insurance?” to learn more.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

How much basic life insurance do I need and what can I do with it?

Most people have no idea how much life insurance to buy. We have a term life insurance calculator to determine how much life insurance coverage you’ll want to purchase.

While learning about life insurance can be time-consuming, there are online resources and books to search for information about voluntary life insurance.

The main thing to remember when figuring out how much coverage you need to purchase is to get enough coverage to replace your income, and for as many years as you need. If you are a single father with two grown kids and you have no debt, then you probably won’t feel the need for a $300,000 life insurance policy.

If you are a single father with dependent children who are 3 and 7, then you’ll probably want to get life coverage that’s equal to your salary and enough to provide for your dependents until the youngest is 18. When you pass, the death benefit will be paid out to the beneficiary of the policy (voluntary term life). Dependent life insurance can be additionally bought and it will offer coverage if your spouse or any of your dependents dies.

Say you make $50,000 a year and have no debt. That’s $50,000 multiplied by 15, the number of years until your youngest child will be 18. That’s $750,000 you’d want in coverage.

What are the benefits of basic life insurance?

There are many benefits to having basic life insurance. Life insurance can help pay for:

- Funeral/Burial expenses

- Medical bills

- Debts

- Supplement income

Money from life insurance can be used on medical bills and debts that have accrued. It can provide supplemental income and even future needs that aren’t foreseeable. Basic life insurance can also cover funeral and burial expenses.

Burial & Funeral Expense

In 2016, the median cost of a funeral, along with burial and viewing, was $7,360. The median cost of the funeral, with burial and viewing, and a vault is $8,508. These figures don’t include the cost of monuments, cemetery costs, flowers, obituary, or other miscellaneous costs.

Casket prices increased by 230 percent from December 1986 to September 2017.

TransAmerica Average Monthly Burial & Final Expense Rates – $10,000 Coverage

| Policyholder Age & Gender | Average Monthly Burial & Final Expense Rates |

|---|---|

| 40-Year-Old Female | $20.43 |

| 40-Year-Old Male | $24.02 |

| 45-Year-Old Female | $22.65 |

| 45-Year-Old Male | $27.16 |

| 50-Year-Old Female | $25.32 |

| 50-Year-Old Male | $30.73 |

| 55-Year-Old Female | $29.19 |

| 55-Year-Old Male | $36.00 |

| 60-Year-Old Female | $33.72 |

| 60-Year-Old Male | $43.81 |

| 65-Year-Old Female | $41.62 |

| 65-Year-Old Male | $56.53 |

| 70-Year-Old Female | $53.99 |

| 70-Year-Old Male | $74.66 |

| 75-Year-Old Female | $72.89 |

| 75-Year-Old Male | $100.03 |

| 80-Year-Old Female | $104.11 |

| 80-Year-Old Male | $140.22 |

| 85-Year-Old Female | $148.62 |

| 85-Year-Old Male | $200.43 |

The chart above is an example of burial and funeral expense rates, from TransAmerica, for $10,000 coverage. These rates are for non-smokers.

How does the coronavirus (COVID-19) Pandemic affect basic life insurance?

Does life insurance cover coronavirus? Since the coronavirus pandemic, life insurance companies have decided to adjust some of their application and approval policies. Companies aren’t accepting anyone with this pre-existing medical condition.

If you’ve contracted COVID-19 and aren’t eligible for life insurance coverage now, rest and quarantine and you should be able to reapply again later.

Many life insurance companies have halted or temporarily suspended applications for older people. Life insurance companies have also decided that some conditions are riskier to insure now than they were before COVID-19. Diabetes and asthma are two of the conditions that are becoming increasingly harder or more expensive to buy during the pandemic.

What are the top life insurance companies by market share?

There are multiple ways to find out the best life insurance companies.

Many credit rating services let you compare companies against each other and read reviews from their clients. The rankings of a life insurance company are important because there are over 800 life insurance companies in the United States. You need to know which ones are reputable and will be there when your family needs them.

The market share of a company is found by dividing total sales, or revenues, of the company by the industry’s total sales over a fiscal period.

Top 10 Life Insurance Companies by Market Share (2016–2018)

| Companies | Market Share 2018 | Market Share 2017 | Market Share 2016 |

|---|---|---|---|

| Northwestern Mutual | 6.42% | 6.38% | 6.48% |

| Metropolitan Group | 6.00% | 7.37% | 7.65% |

| New York Life | 5.68% | 5.70% | 5.61% |

| Prudential of America | 5.57% | 5.48% | 5.49% |

| Lincoln National | 5.36% | 4.55% | 4.44% |

| MassMutual | 4.19% | 4.37% | 4.27% |

| Aegon / TransAmerica | 2.94% | 2.89% | 2.96% |

| John Hancock | 2.83% | 2.80% | 2.93% |

| State Farm | 2.83% | 2.76% | 2.82% |

| Minnesota Mutual | 2.7% | 2.52% | 2.51% |

The company with the highest market share in 2018 is Northwestern Mutual with a share of 6 percent. In previous years, the Metropolitan Group had the highest market share, but Northwestern Mutual took the lead in 2018.

Read More:

Want to see some sample life insurance rates?

Comparing rates from different companies is an easy way to research which companies have the most affordable rates. This table shows rates for non-smokers.

Average Annual Life Insurance Rates for Non-Smokers

| Non-Smoker Marital Status, Age, & Gender | Average Annual Rates | New York Life | Prudential Financial | Lincoln National | MassMutual | Aegon / TransAmerica | John Hancock | State Farm |

|---|---|---|---|---|---|---|---|---|

| Single 25-Year-Old Female | $164.50 | $158.00 | $195.00 | $187.00 | $132.00 | $164.00 | $172.50 | $143.00 |

| Married 35-Year-Old Female | $170.47 | $164.00 | $196.00 | $191.00 | $137.00 | $161.00 | $178.30 | $166.00 |

| Single 25-Year-Old Male | $183.61 | $152.00 | $237.00 | $231.00 | $147.00 | $176.00 | $178.30 | $164.00 |

| Married 35-Year-Old Male | $190.40 | $160.00 | $248.00 | $238.00 | $151.00 | $171.00 | $189.80 | $175.00 |

| Married 45-Year-Old Female | $247.50 | $262.00 | $314.00 | $239.00 | $209.00 | $229.00 | $241.50 | $238.00 |

| Married 45-Year-Old Male | $274.59 | $245.00 | $378.00 | $283.00 | $230.00 | $255.00 | $292.10 | $239.00 |

| Married 55-Year-Old Female | $417.01 | $414.00 | $496.00 | $435.00 | $373.00 | $453.00 | $407.10 | $341.00 |

| Married 55-Year-Old Male | $543.23 | $696.00 | $584.00 | $615.00 | $451.00 | $527.00 | $533.60 | $396.00 |

| Single 65-Year-Old Female | $898.76 | $924.00 | $941.00 | $903.00 | $763.00 | $1,139.00 | $937.30 | $684.00 |

| Single 65-Year-Old Male | $1,308.00 | $1,416.00 | $1,412.00 | $1,577.00 | $1,049.00 | $1,367.00 | $1,380.00 | $955.00 |

Massachusetts Mutual, New York Life, and State Farm have the lowest life insurance rates for non-smokers. All these company rates seem comparable to the average rates. This table shows rates for smokers. (For more information, read our “Massachusetts Life Insurance“).

Average Annual Life Insurance Rates by Marital Status, Age, and Gender – Smokers

| Smoker Age & Gender | Average Annual Rates | New York Life | Prudential Financial | Lincoln National | MassMutual | Aegon / TransAmerica | John Hancock | State Farm |

|---|---|---|---|---|---|---|---|---|

| 25-Year-Old Female | $248.90 | $210.00 | $267.00 | $229.00 | $200.00 | $290.00 | $326.30 | $220.00 |

| 35-Year-Old Female | $289.34 | $252.00 | $321.00 | $251.00 | $235.00 | $345.00 | $353.40 | $268.00 |

| 25-Year-Old Male | $328.31 | $346.00 | $344.00 | $310.00 | $230.00 | $373.00 | $440.20 | $255.00 |

| 35-Year-Old Male | $366.70 | $416.00 | $412.00 | $326.00 | $281.00 | $390.00 | $461.90 | $280.00 |

| 45-Year-Old Female | $494.59 | $464.00 | $592.00 | $520.00 | $387.00 | $565.00 | $523.10 | $411.00 |

| 45-Year-Old Male | $648.16 | $739.00 | $729.00 | $642.00 | $460.00 | $719.00 | $777.10 | $471.00 |

| 55-Year-Old Female | $999.43 | $864.00 | $1,101.00 | $1,193.00 | $770.00 | $1,365.00 | $949.00 | $763.00 |

| 55-Year-Old Male | $1,386.70 | $1,428.00 | $1,408.00 | $1,665.00 | $990.00 | $1,761.00 | $1,536.90 | $918.00 |

| 65-Year-Old Female | $2,267.36 | $1,884.00 | $1,846.00 | $3,079.00 | $1,391.00 | $3,507.00 | $2,184.50 | $1,980.00 |

| 65-Year-Old Male | $3,333.99 | $2,868.00 | $2,932.00 | $4,671.00 | $2,066.00 | $4,451.00 | $4,091.90 | $2,258.00 |

All of State Farm’s rates are lower than the average rates for smokers. Lincoln National and Massachusetts Mutual also had low rates in comparison to the average life insurance rates.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Case Studies: Voluntary Life Insurance vs. Basic Life Insurance

Case Study 1: John’s Voluntary Life Insurance

John, a 35-year-old professional, works for a large corporation that offers voluntary life insurance as part of its employee benefits package. After considering his financial obligations and the needs of his family, John decides to enroll in the voluntary life insurance program.

He purchases additional coverage beyond the basic amount provided by his employer to ensure his loved ones are financially protected in case of his untimely death. The low-cost nature of voluntary life insurance makes it an attractive option for John to secure additional coverage without breaking his budget.

Case Study 2: Sarah’s Basic Life Insurance

Sarah, a 45-year-old single mother, has a stable job with a mid-sized company that offers basic life insurance coverage to its employees. Recognizing the importance of financial security for her children, Sarah takes advantage of the basic life insurance provided by her employer.

The coverage offered is a set amount based on her salary, which gives her peace of mind knowing that her children will be taken care of in the event of her death. While the coverage is limited, the fact that it is provided at no direct cost to Sarah makes it a valuable benefit for her and her family.

Case Study 3: Mark’s Combination Approach

Mark, a 50-year-old professional, understands the importance of having comprehensive life insurance coverage. He works for a company that offers both voluntary and basic life insurance options. To ensure adequate protection, Mark chooses a combination approach.

He enrolls in the basic life insurance provided by his employer to have a baseline coverage amount. Additionally, he purchases voluntary life insurance to supplement the basic coverage and tailor it to his specific needs.

The Bottom Line: What is voluntary life insurance Vs. Basic life insurance?

Should you get voluntary life insurance? Should you get basic life insurance? After reading this guide, we hope you are more ready than ever to make this decision.

Voluntary life insurance plans and Basic Life Insurance are both options you can obtain through your employer. While opting for life insurance through your employer often comes with benefits such as lower premiums, it also has its drawbacks. In contrast, individual life insurance provides a wider range of options, though it typically comes with higher premiums. For managing these options, voluntary life insurance software can be helpful in comparing and selecting the best plan.

Now that you’ve learned about voluntary life insurance vs. basic life insurance, click our FREE life insurance quote tool to compare quotes for voluntary and basic life insurance and find the best rates. Get started now.

Frequently Asked Questions: What Is Voluntary Life Insurance vs. Basic Life Insurance

Here are answers to frequently asked questions about voluntary life insurance vs. basic life insurance.

#1 – Does voluntary life insurance have cash value?

It is possible to get cash value from voluntary life insurance but it is rare. Most voluntary life insurance policies offer term life insurance quotes. Term life policies do not accrue cash value. Life insurance companies who offer whole life insurance as a voluntary life insurance option may be eligible for a cash value.

#2 – Can you drop voluntary life insurance at any time?

If you want to cancel your voluntary life insurance then you should speak to your insurance company. They should be able to assist you and more than likely cancel the policy for you. Many life insurance companies offer online customer service options on their website so you can call the life insurance company or contact them online.

#3 – Should I get life insurance through work?

That depends on your needs. While insurance through work is easy to get and can be cheaper, it may not offer enough coverage for you and your family. Remember, you usually lose your voluntary life insurance if you leave your job.

#4 – What is the best age to get life insurance?

If you are not sure at what age you should buy life insurance then that’s okay. There is no perfect age to purchase life insurance. Since rates get locked in when you purchase your policy, it makes more sense to buy your coverage sooner than later.

It is most important to buy life insurance when your loss of income would affect those you support. Life insurance coverage also helps pay your end-of-life expenses, life burial expenses. Read our article “Why Your 30s are the Best Time to Buy Term Life Insurance” to learn more.

#5 – What happens to term insurance if you don’t die?

At the end of your term life, your coverage will end. Before your policy ends, your insurance company should allow you to convert the policy to a permanent, or whole life, policy. It may be cheaper to buy a new term life policy than converting your current one.

At this time, you should find out how much it will cost to convert your existing policy and compare it to your company’s current term life policies. Then, compare those rates to other company term life rates.

References:

- https://www.mib.com/risk_selection_mib.html

- https://www.bls.gov/opub/ted/2017/the-rising-cost-of-dying-1986-2017.htm

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Frequently Asked Questions

What is voluntary life insurance?

Voluntary life insurance is a type of life insurance coverage that is offered through an employer or organization but is optional for employees or members to purchase. It allows individuals to choose and pay for additional life insurance coverage beyond the basic coverage provided by their employer.

What is basic life insurance?

Basic life insurance, also known as employer-sponsored life insurance, is a policy that is provided by an employer or organization as part of the employee benefits package. It typically offers a set amount of life insurance coverage, often based on the employee’s salary or a flat amount.

What are the key differences between voluntary life insurance and basic life insurance?

The main difference between voluntary life insurance and basic life insurance is that voluntary coverage is optional and chosen by the individual, while basic coverage is typically provided automatically by the employer. Voluntary life insurance allows individuals to customize their coverage and purchase additional protection beyond the basic amount.

Which one is better: voluntary life insurance or basic life insurance?

The better option between voluntary life insurance and basic life insurance depends on individual circumstances and needs. Basic life insurance provides some level of coverage without any direct cost to the employee, making it a valuable benefit. However, voluntary life insurance allows individuals to increase their coverage to meet specific financial obligations or family protection goals.

What factors should be considered when deciding between voluntary and basic life insurance?

Several factors should be considered when deciding between voluntary and basic life insurance, including personal financial needs, current coverage amounts, dependents’ financial security, budget, and individual risk tolerance. It is important to assess your specific situation and consider factors like outstanding debts, mortgage, children’s education, and income replacement needs.

Can you have both voluntary and basic life insurance coverage?

Yes, it is possible to have both voluntary and basic life insurance coverage. Many employers offer the option for employees to purchase additional coverage through a voluntary life insurance program on top of the basic coverage provided. This allows individuals to have a higher total amount of life insurance protection.

What is the difference between basic and voluntary life insurance?

Basic life insurance is typically provided by an employer and offers a standard level of coverage at no cost to the employee. Voluntary life insurance is an optional benefit that employees can purchase at their own expense to increase their coverage. It often provides additional protection and can be customized based on individual needs.

What is voluntary employee life insurance?

Voluntary employee life insurance is a type of life insurance that employees can opt into through their employer. It is not automatically provided but can be purchased by employees who wish to have additional coverage beyond what is offered through basic life insurance.

What is AD&D insurance?

Accidental Death and Dismemberment (AD&D) insurance provides benefits in the event of accidental death or severe injury, such as loss of limbs or sight. It is often offered as a supplement to basic life insurance and covers specific types of accidents.

What is basic life insurance through employer?

Basic life insurance through an employer is a standard benefit provided to employees at no cost. It typically offers a set amount of coverage that can be used in the event of the employee’s death, and may be offered as part of a broader benefits package.

What is employee voluntary life insurance?

Employee voluntary life insurance is an optional benefit that employees can choose to purchase through their employer. It allows employees to buy additional coverage beyond the basic life insurance provided, often with the option to cover family members as well.

What is supplemental life insurance?

Supplemental life insurance is additional coverage that an individual can purchase to enhance the basic life insurance they already have. It provides extra financial protection and can be customized to fit individual needs.

What is the difference between basic and supplemental life insurance?

Basic life insurance is typically offered by employers and provides a standard level of coverage. In contrast, supplemental life insurance is extra coverage that individuals can purchase to enhance their overall protection, usually at their own cost. This highlights the difference between basic vs. supplemental life insurance, where the former is standard and employer-provided, while the latter is optional and self-funded.

What is the difference between voluntary life insurance and AD&D?

Voluntary life insurance provides benefits in the event of the policyholder’s death from any cause, while AD&D insurance specifically covers accidental death and dismemberment. Voluntary life insurance offers broader protection, whereas AD&D insurance is more specialized.

What is the difference between whole life and term life insurance?

Whole life insurance provides coverage for the entire lifetime of the insured, with a savings component that builds cash value over time. Term life insurance provides coverage for a specified period (term), and does not build cash value. It is generally more affordable but only pays out if the insured dies within the term.

What is voluntary AD&D?

Voluntary AD&D insurance is an optional benefit that employees can purchase to provide additional coverage in case of accidental death or severe injury. It is typically offered alongside other types of life insurance and allows for increased protection.

What is voluntary child life insurance?

Voluntary child life insurance is a type of coverage that parents can purchase to provide financial protection in the event of their child’s death. It is usually offered as an add-on to an existing life insurance policy.

What is voluntary dependent life insurance?

Voluntary dependent life insurance is a type of coverage that can be purchased to provide financial protection for dependents, such as a spouse or children, in the event of their death. It is often available as an add-on to an employee’s basic life insurance policy.

What is voluntary employee AD&D?

Voluntary employee AD&D insurance is an optional benefit that employees can choose to buy to provide additional coverage for accidental death and dismemberment. It offers extra protection beyond the basic life insurance provided by the employer.

What is voluntary group term life insurance?

Voluntary group term life insurance is a type of life insurance that employees can purchase through their employer. It offers coverage for a specified term and is typically available at group rates, which may be lower than individual rates.

What is voluntary life insurance coverage?

Voluntary life insurance coverage refers to the amount of life insurance that an employee can purchase voluntarily through their employer. It provides additional protection beyond the basic life insurance offered and can be customized based on individual needs.

How does basic life and AD&D work?

Basic life insurance provides a set amount of coverage in the event of the insured’s death, while AD&D insurance offers additional benefits if the death or injury occurs due to an accident. Together, they provide a comprehensive safety net for various scenarios.

How does voluntary life insurance work?

Voluntary life insurance allows employees to purchase additional life insurance coverage beyond what is provided by their employer. The employee pays for this coverage, which can be tailored to meet individual needs and often includes options for family members.

How much is voluntary life insurance?

The cost of voluntary life insurance varies depending on factors such as the amount of coverage purchased, the age and health of the insured, and the insurance provider. Typically, premiums are deducted from the employee’s paycheck.

How much voluntary life and AD&D insurance do I need?

The amount of voluntary life and AD&D insurance needed depends on individual financial circumstances and goals. It is important to consider factors such as income, debt, and dependents when determining the appropriate coverage levels.

How much voluntary life insurance do I need?

The amount of voluntary life insurance needed is based on individual needs and financial obligations. Factors to consider include current and future income needs, debts, and dependents’ financial needs.

What is the difference between an insured and an insurer?

The insured is the individual or entity covered by an insurance policy, while the insurer is the company or organization that provides the insurance coverage and pays out claims.

Is basic life insurance term or whole?

Basic life insurance provided by employers is typically term insurance, which offers coverage for a specified period. It does not include a cash value component, unlike whole life insurance.

Is basic life insurance worth it?

Basic life insurance can be worth it as it provides essential coverage at no cost to the employee. However, it may not be sufficient for all needs, and additional coverage might be necessary depending on individual circumstances.

Is life insurance different from health insurance?

Yes, life insurance provides financial protection in the event of death, while health insurance covers medical expenses and healthcare costs. They serve different purposes and offer different types of protection.

Is optional life insurance worth it?

Optional life insurance can be worth it if it provides additional coverage that meets your needs. It offers flexibility and can be tailored to specific requirements, such as covering family members or increasing coverage amounts.

Is voluntary employee life insurance worth it?

Voluntary employee life insurance can be worth it if it provides additional coverage that fits your financial goals and needs. It allows you to customize your coverage and often at a lower cost due to group rates.

What does voluntary life insurance cover?

Voluntary life insurance typically covers death benefits for the insured, with options to add coverage for dependents. It provides financial protection to beneficiaries in the event of the insured’s death.

What’s the difference between AD&D and life insurance?

AD&D insurance specifically covers accidental death and dismemberment, while life insurance provides coverage for death from any cause. AD&D is a specialized form of insurance that offers additional benefits in case of accidents.

What’s voluntary life insurance?

Voluntary life insurance is an optional benefit that employees can purchase through their employer to provide additional life insurance coverage beyond the basic policy provided.

When does life insurance not pay?

Life insurance may not pay in cases where the cause of death is excluded from the policy, such as suicide within a certain period after purchasing the policy, or if premiums are not paid. It’s important to review the policy details to understand any exclusions or limitations.

What is the difference between voluntary and involuntary loss of coverage?

Voluntary loss of coverage occurs when an individual chooses to cancel or not renew their insurance policy, typically due to personal preference or financial reasons. Involuntary loss of coverage happens when insurance is terminated by the provider without the individual’s choice, often due to non-payment of premiums, changes in policy terms, or eligibility issues.

What is the difference between voluntary and non-voluntary insurance?

Voluntary insurance is offered by employers or organizations where employees or members can choose to enroll, often with the option to pay premiums through payroll deductions. Non-voluntary insurance, on the other hand, is typically mandatory, meaning that coverage is provided as part of a benefits package or required by law, and individuals do not have the option to opt out.

How does group term life insurance compare to voluntary life insurance?

Group term life insurance is a type of coverage provided to a group of people, often through an employer or organization, with the premiums typically paid by the employer and coverage amount generally fixed. Voluntary life insurance allows individuals to purchase additional coverage beyond what is provided by a group policy, usually at their own expense, and may offer more flexible options and higher coverage limits.

What is the difference between basic life insurance and optional life insurance?

Basic life insurance is typically provided by an employer as a standard benefit with a fixed coverage amount at no cost or a minimal cost to the employee. Optional life insurance, also known as supplemental or voluntary life insurance, is additional coverage that employees can choose to purchase beyond the basic policy, usually at their own expense, with the option to select higher coverage amounts and additional features.

How does group life insurance differ from individual life insurance?

Group life insurance is a policy offered to a group of people, often through an employer or organization, with the premium generally paid by the employer. Coverage is typically uniform for all members and may be less expensive. Individual life insurance is purchased privately by an individual, offering personalized coverage options and benefits tailored to the policyholder’s needs, often at a higher cost.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Life Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Licensed Life Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.